Planning for retirement takes careful preparation and a decent idea of what your budget will be once you stop working. This can be a pretty scary process with so many unknown variables. How much will groceries, travel, and utilities cost in 15-20 years? How long will you live, exactly? What if you get hurt or need help with everyday activities like getting dressed or paying the bills?

Arguably the biggest variable when we talk about retirement is the cost of healthcare. It’s no secret that the cost of coverage and prescription drugs is increasing at an uncomfortable pace. This post will cover the current research on what healthcare will cost in retirement, as well as the best way to put money aside for it now.

Medicare

If we’re trying to estimate exactly what healthcare will cost in retirement, we may as well start with Medicare. The vast majority of retirees who are eligible for Medicare choose to enroll, since it’s almost always the least expensive option given the government’s funding. But even if you qualify for and enroll in Medicare, there will be plenty of out of pocket costs. Here’s a breakdown of each of Medicare’s four parts:

Medicare Part A: Hospital Insurance

Part A of Medicare covers you for the costs of visits to the hospital or skilled nursing home facilities, home health, and hospice care. If you’re eligible for Social Security (by virtue of paying at least 40 quarters worth of payroll taxes), Part A will be offered to you for free. If not, you’ll pay a monthly premium.

Medicare Part B: Medical Insurance

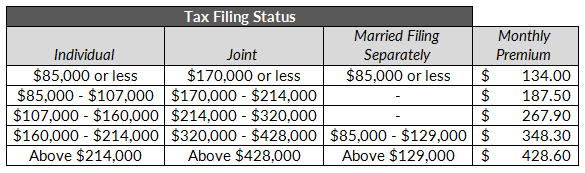

Part B covers you for services provided by doctors, like regular office visits, preventive care, lab tests, X-rays, and outpatient services. (Only the medically necessary services, of course). You pay a monthly premium for Part B, which is deducted directly from your Social Security check if you receive one. The amount of this premium will vary based on your modified adjusted gross income:

Medicare Part C: Medicare Advantage Plans

Part C isn’t actually coverage in and of itself. Part C is the section of the law that allows private insurance companies to provide Medicare benefits, known as Medicare Advantage Plans. Basically, these plans offer extra coverage that’s not offered in Parts A and B. Usually this includes dental, hearing, or vision, but varies based on the policy.

Medicare Advantage Plans are a pretty handy way to cover what Parts A and B of Medicare don’t. But while enrollment across the country is rising, still only 31% of those enrolled in Medicare opt for this type of extra coverage.

Costs for medicare advantage plans vary based on what you’re covered for, but will typically range between $0 and $200 per month. The national average premium in 2017 is $31.40 per month. Also, you’re required to enroll in both Parts A and B to be eligible.

Medicare Part D: Prescription Drug Coverage

Finally, Medicare Part D covers the cost of prescription drugs. It’s also provided by insurance companies that have contracts with the government (like Part C). And like all other insurance plans, premium costs will vary based on your coverage and where you live. The national average premium for 2017 is $34.

Total Cost

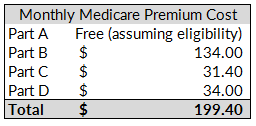

So let’s say that you qualify for Medicare Part A after having a successful career where you paid at least 10 years of payroll taxes. If you & your spouse make $170,000 or less as a couple after you retire (which covers the majority of Americans), you’ll be looking at a monthly premium of $134.00 for Part B coverage.

When we add in an average of $31.40 for a Medicare Advantage Plan, and another $34 for prescription drugs, this brings us to a total monthly premium of $199.40:

What Medicare Doesn’t Cover

$199.40 per month isn’t all that bad. But what about all the stuff that’s not covered?

- Eye exams

- Cosmetic surgery

- Routine foot care

- Hearing aids

- Most dental care & all dentures

- Acupuncture

- Long term care

Some of these areas can be covered by Medicare Advantage plans, depending on how much you want to spend. But even with the most comprehensive coverage there will be some gaps.

Current Research

This is where the research comes in handy. There are two studies out there that do a pretty good job estimating total out pocket cost beyond just Medicare premiums. One is done by Fidelity and the other by Healthview Services. Both these estimates are updated annually, and with their broad data sets are far more accurate than anything I could produce.

The Fidelity Study

Every year, Fidelity estimates the total amount a newly retired 65 year old couple can expect to spend on healthcare. To build their study, Fidelity assumes that a fictional couple lives exactly to their life expectancy (85 for men and 87 for women). They also assume that the couple is eligible for Medicare, signs up for Parts A, B, and D, and needs a few services not included by Medicare. They don’t include the cost of dental care, over the counter meds, or long term care.

The most recent study estimates that a 65 year old couple retiring in 2016 will need about $260,000 over the course of their retirement to pay for health care. $260,000! This works out to over $1,000 per month, which is $800 higher than the average premium cost alone.

The $260,000 estimate from 2016 was the highest number since they began the study in 2002. It’s also a 6% increase over their 2015 estimate. Fidelity did comment on this increase, sharing that they attribute the rise to “utilization of medical services and rapidly rising drug costs.”

It’s also worth noting that Fidelity looked at long term care costs too (which again are very rarely covered by Medicare, and were not included in the $260,000 figure). They expect 7 in 10 Americans to require long term care services at some point in their lives. And to insure against long care costs, the average 65 year old would need to shell out an extra $130,000 over the course of their retirement. This assumes that they’re in good health, purchase a policy with an $8,000 max monthly benefit, 3 years of benefits, and inflation adjustment of 3% per year.

The Healthview Study

Healthview Services also took a stab at what retirees should expect to pay in healthcare costs. Healthview Services actually builds healthcare cost-projection software, and was founded by a group of physicians and financial & healthcare executives.

Healthview’s study used a very similar hypothetical example, and got a strikingly similar output. They assumed that a 65 year old couple retiring today was eligible for free Medicare Part A coverage, and paid out of pocket for Parts B and D coverage. They also assumed that the couple opted for a supplemental policy via Part C.

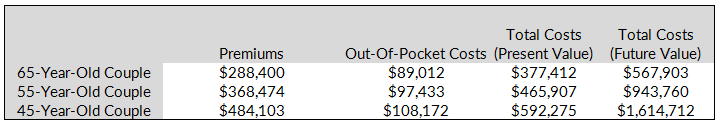

Total cost estimate for our 65 year old couple? $266,589. Again this doesn’t include a bunch of important things, like dental or vision. If we include dental, vision, co-pays, and all other out of pocket costs, the total estimate rises to $394,954.

What’s also interesting here is that Healthview also ran projections on what future 65 year old couples might expect to pay when they retire. For example, they think a 55 year old couple today (who expects to retire in 10 years) will need to pay a total of over the course of their retirement $463,849.

Another interesting point about Healthview’s study is that they utilize actual data from over 50 million healthcare cases. This is what people are actually paying for their healthcare, which makes their estimate seem pretty legitimate on it’s surface.

What You Can Do About It

Any way you measure it, health care will require a significant chunk of change in retirement. So what’s the best way to prepare for it?

Well, you can always take your doctor’s advice: exercise more frequently and eat better. The healthier you are, the less serious and frequent your health concerns, and the less expensive your care will be.

I wouldn’t use that as a retirement plan though. Really, the best way to prepare for the cost of healthcare is to integrate it into a comprehensive financial plan and save for it over time.

Health Savings Accounts (HSAs)

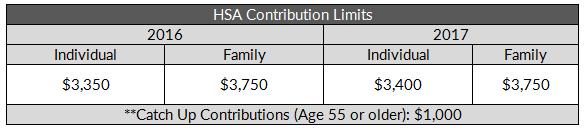

Health savings accounts (HSAs) are one of the best “deals” available to retirement savers today. If you’re enrolled in a high deductible health plan, the government allows you to contribute to one. Currently this means that your plan must have a deductible of at least $1,300 for an individual, or $2,600 for a family.

HSAs work a lot like IRAs – only better. You put money into the account on a tax free basis. Your contributions grow tax free. Then down the road your withdrawals come out tax free too, as long as they’re used for qualified medical purposes. Its a triple tax advantage!

Most custodians of health savings accounts offer a selection of mutual funds you can invest your contributions in. This isn’t true of every custodian though, and some will require a minimum balance before you can do so.

On top of all this, once you turn 65 you can withdraw funds for non medical purposes without penalty. Your withdrawals are subject to income tax if they’re done for non medical purposes, but realistically this lets them function exactly like an IRA. Just keep in mind that your non medical withdrawals before you turn 65 will be subject to income tax plus a 20% penalty.

Of course, while the tax benefits of a health savings account are great, you’ll need to keep fees in check. HSAs are a relatively new type of account, and currently there aren’t a whole lot of service providers who offer them. Since there’s not much competition you’ll most likely pay more to open and maintain an HSA than you would an IRA. But even so, the tax advantages make them a wonderful way to save for future healthcare costs.

Any way you cut it, the cost of healthcare will be a huge burden on retirees for years to come. There are a couple convenient ways you can build your savings and prepare. Whatever your preference, the best way to prepare is to build a comprehensive plan that accounts for and integrates the increasing cost of care.