“I paid out the ears in taxes this year. How can I reduce my tax burden?”

This is a question I’m hearing a lot from business owners recently. And while it may not sound flashy, the best way to reduce taxes is to incorporate some smart planning into your decision making. More often than not, business owners simply don’t have the time to research and apply the opportunities offered in the tax code.

So to make your life a little easier, today’s post will cover an often unused tax saving opportunity: the Section 105 medical reimbursement plan.

An Overview of Section 105 Health Reimbursement Plans

A section 105 health reimbursement plan is a tax-efficient way to repay your employees for their health care costs. Rather than purchasing group coverage that your qualifying employees can opt into, you allow them to find their own coverage and then reimburse them for qualified expenses. This can include premiums, deductibles, or a wide variety of other out of pocket costs. (Side note, there are section 105 plans that combine traditional group coverage with reimbursement for qualified out of pocket costs, but that’s a subject for a future post).

Whereas this would not have been a popular way to offer benefits a decade ago, it’s more palatable now that individual health insurance is widely available through the state and federal marketplaces.

The main benefits of section 105 plans are the tax advantages. Most small businesses deduct the cost of health insurance premiums for their employees, and possibly for themselves. But when it comes to their own out of pocket health care costs, business owners normally pay for them with taxable dollars. These expenses can be deductible at the personal level, but only when they exceed 10% of your adjusted gross income.

With a Section 105 plan you can deduct your entire family’s medical expenses with without being subject to the 10% AGI floor. Even better, it’s a deduction from income tax at the state and federal levels, AND a deduction from payroll taxes. For some business owners this can be a savings of thousands of dollars per year.

The tax benefits don’t apply to all types of business entities, though. S-Corps don’t get to deduct reimbursements through section 105 plans from state or federal income tax. And if you own a sole prop, a partnership, or an LLC you aren’t considered an employee. That means you can’t be reimbursed by a plan, and would need to employ your spouse in order to reap the benefits.

How a Section 105 Medical Reimbursement Plan Works

Since a Section 105 plan is considered qualified, you’ll need to adopt a plan document in order to use one. This establishes what the plan does, what your responsibilities as the employer are, and how it will be managed. Your plan document then needs to be distributed to qualified employees.

Next, you’ll need to determine how much the plan will reimburse employees for qualified expenses during the coverage period. The coverage period is usually annually, but can be modified for your needs. Keep in mind here that you can’t discriminate between employees, by nature of being a qualified plan. That means you can’t offer more reimbursement to your spouse than to other employees. You set the annual limit for all qualified employees, and agree to reimburse them for qualified expenses up to that amount.

Then, as employees pay the premiums & other costs for their health care, they submit the expenses for reimbursement. The business reimburses employees up to the coverage limits, which is a 100% deductible expense. If employees don’t use their total allotment during the coverage period, the remaining amount is then typically carried over to the next period.

Here’s an Example:

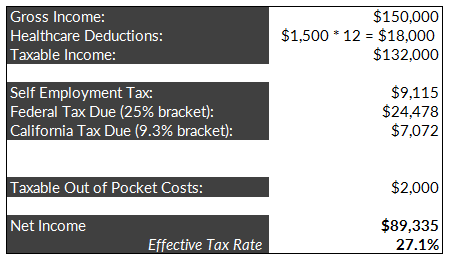

Let’s say you own an LLC in California and don’t have any employees. You gross $150,000 per year, and pay $1,500 per month in healthcare premiums. Your plan covers you, your wife, and your two kids.

Let’s also say you usually pay about $2,000 per year out of pocket, as your kids are aspiring knuckleheads. Let’s ignore California state disability taxes too (they won’t make a difference in this example).

Your net income after taxes and health care costs would be $89,335:

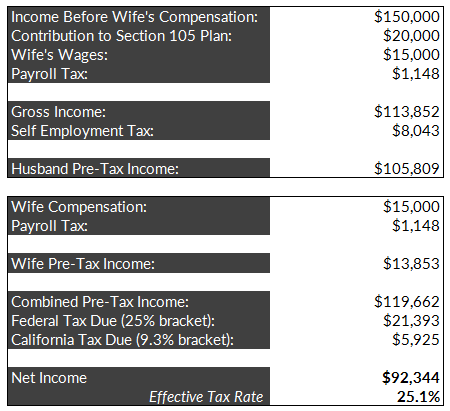

If you decided to establish a section 105 medical reimbursement plan, you still couldn’t take advantage of the tax benefits because you’re not considered an employee. But what if you decided to hire your wife? You could reimburse her, for her entire family’s health care expenses, which you’re a part of, of course.

To do so, you’d first need to establish her compensation arrangement. Assuming her employment isn’t fabricated this shouldn’t be a problem. This is an area that the IRS scrutinizes, so it’d be important that she actually work for a reasonable compensation.

Let’s say she keeps your books, handles order processing, arranges your travel schedule, and keeps your calendar. Her compensation would consist of:

- W-2 wages of $15,000

- Reimbursement for medical costs of $20,000

Summing the two, her total cash compensation is $35,000. If you utilized a Section 105 plan, you could reimburse your wife for your entire family’s health costs. This expense would be fully deductible, and in this example boost your combined after tax income by about $3,000:

So, by using the Section 105 plan you’re free to deduct all your family’s healthcare expenses from your FICA taxes in addition to state and federal income taxes. All you’d need to do is employ your spouse (legitimately), and set up the plan.

Other Considerations

There are a few other considerations when considering a Section 105 plan. First, in order to qualify for the tax benefits neither you nor your spouse can be eligible for a workplace sponsored health plan.

Second, as I mentioned your spouse must be a bona fide employee. You’ll also need to consider any other employees you might have. Since Section 105 plans are considered “qualified” in the eyes of the IRS, you can’t offer more health benefits to your spouse than you do to other employees. That would be discriminatory, which is a big no-no for qualified plans.

Finally, your business entity matters too. The example above works with a sole proprietorship, a partnership, or an LLC . It doesn’t work well with S-Corps, though. With S-Corps, 2% or greater owners are allowed to deduct FICA taxes in Section 105 plans. They aren’t allowed to deduct state or federal income taxes, though, which more than negates the appeal. Family members, including spouses and dependents, are treated the same as owners, too.

C-Corps are able to reap the full deduction privileges, though. And since owners are already considered employees in C-Corps, there’s no need to hire your spouse to qualify.

Spousal Employment

Like we covered above, the IRS scrutinizes spousal employment pretty closely. Many business owners across the country like to put their spouses “on the books” to take advantage of tax benefits, even if they don’t do any actual work.

For this reason, it’s important to clearly establish the employer-employee relationship with your spouse. If the IRS comes knocking, they’ll want you to prove that your spouse is actually a regular employee. To do so, keep the following documents on hand & up to date:

- A record of regular and fair wages

- W-2

- W-4

- I-9

- Other employee tax reporting forms required by the IRS

- Log of hours worked

- Written employment agreement

Qualified Medical Expenses

Section 105 medical reimbursement plans do have limitations on qualified expenses. They’re listed here in Section 213 of the tax code. Fortunately, the definition is pretty broad. As a general rule you can use reimbursement any expense used for the diagnosis, cure, mitigation, treatment, or prevention of a disease. This includes, but isn’t limited to:

- Health insurance premiums

- Deductibles

- Physician fees

- Prescription costs

- Dental care fees

- Vision care fees

- Chiropractor fees

- Psychiatric Care fees

- Hospital fees

- Laboratory fees

- Orthodontia fees

- Medical supplies

Administering a Section 105 Plan

Some businesses prefer to administer Section 105 plans themselves, but for most it makes more sense to hire an expert. Since you’ll need to abide by ERISA, HIPAA, and IRS regulations, there’s a whole lot to keep track of. At the very least, look into software that will help you stay compliant. The law tends to change pretty frequently, and failure to abide by them can be costly and jeopardize the plan’s tax benefits.

All in all, a Section 105 medical reimbursement plan is a great way to save money on taxes when used in the right circumstance. Just remember that your spouse’s employment must be legitimate, and operating a plan is no small task. If you’re not sure you’re up to it, you could probably benefit from the help of an experienced professional. If the cost of professional help to administer the plan is less than your tax savings, any for-profit business owner would be foolish not to explore the idea further.