Insurance agents love to pitch whole life insurance.

This is sometimes a controversial topic, but the truth is that insurance agents make massive commissions on permanent life insurance when compared to term policies. Because of this, it’s not uncommon to see agents find creative ways to work permanent life insurance into a financial plan.

The truth is that most people simply don’t need permanent insurance, and are far better served with a term policy. Whole life insurance is costly, and offers very poor return potential. This post will cover what whole life insurance is, and why most people are better off with lower cost alternatives.

How Life Insurance Works

In order to understand whole life insurance, we really need to understand term life insurance first. With term life insurance policies, you’re paying an insurance company a monthly premium in exchange for old fashioned, plain vanilla insurance on your life. If you die while the policy is in force, the insurance company will pay your beneficiaries a death benefit.

Since it’s a term policy, it’s only good for a certain amount of time. Most term policies are written for 10, 20, or 30 years, and have level premiums throughout the life of the policy.

By and large, term policies are the best way to insure your life. They’re inexpensive and straightforward. Plus, the whole reason most people insure their lives is to protect against the chance that they die before becoming financially independent. Once they become financially independent there’s rarely a need for life insurance. You have enough assets to pay for your lifestyle, which can be distributed to your heirs after you go.

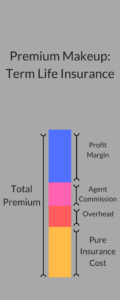

Pure Insurance Cost

The cost of term life insurance depends on a few factors:

- The cost of insuring your life

- The insurance company’s costs

- The insurance company’s margin

First, there is a cost to insuring your life. This is based on the amount of death benefit you’d like in the policy, and the likelihood that you’ll die.

For example, let’s say you’re a healthy, active, 40 year-old man. You have a wife and kids, and decide you need a 10-year level term policy.

The insurance company could calculate (based on hundreds of thousands of data points) the probability that you’ll die sometime in the next 10 years, while the policy is valid. The pure cost of insuring your life would be that probability multiplied by the death benefit.

So, let’s say there’s a 1% chance that you’ll die in the next ten years. If you’d like a $500,000 death benefit, the pure cost of the insurance would be $500,000 * 1% = $5,000.

Want a $1,000,000 death benefit? The pure cost of that policy would be $1,000,000 * 1% = $10,000. Split it up monthly over the ten year term, and the pure cost of insuring your life would be $83 per month.

The cost of your premiums would be $83 each month, plus the insurance company’s costs (including the salesman’s commission) and profit margin.

How Whole Life Insurance Works

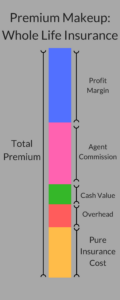

Whole life insurance doesn’t have a term – it’s known as permanent insurance. You pay a premium that covers the cost of insuring your life, company overheard, and profit margin, but it also includes a cash value. That means that permanent insurance policies have account values that grow every time you pay the premium.

The cash value will also grow over time on its own. Most whole life policies guarantee a minimum annual return, and share projections (which are often overly optimistic) of greater returns above the guaranteed minimum.

The investment returns will vary based on the insurance company’s own investment performance. Remember, they’re taking your premium dollars and investing them in their own portfolio. Over time your cash value grows on a tax-deferred basis. You can borrow from it if you like, or withdraw it entirely and surrender the policy.

*Disclaimer, I don’t know what the exact proportions are. Even if I did, they vary from company to company. My point here is that agent commissions and profit margins are far higher for whole life than they are for term life policies.

Why I Dislike Whole Life Insurance…..and You Should Too

My problem with whole life insurance is two-fold:

- The fees and commissions in whole life policies are very high

- The returns on your cash value are far lower than you’d get investing elsewhere….mostly because of the fees & commissions

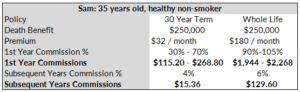

As you probably know, insurance is sold through sales agents across the country. Different companies will have slightly different commission structures, but by and large they all compensate their sales agents using a similar commission schedule.

A hefty portion of the first year’s premium is paid to the agent in the first year a policy is in force. If the policy is surrendered within the first year or two, the agent may have to repay this initial commission. In subsequent years the agent is paid a smaller, trailing percentage of the policy premiums.

According to The Balance, agents are paid 30%-70% of the first year’s premium on term policies, and 90%-105% on whole life policies.

For example, let’s look at Sam, a healthy, non-smoking 35 year old guy. He wants $250,000 in life insurance. Here’s what it’d look like from the agent’s perspective:

Which leads me to point #2: the high fees cut significantly into the returns from a whole life policy.

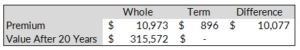

Here’s an actual quote I saw recently for life insurance on a healthy 30-year old male. It came from one of the biggest life insurance underwriters in the country, and included a $1,000,000 death benefit:

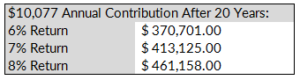

The annual premium for a whole life policy was $10,973, vs. $896 for a 20 year level term policy. The whole life policy projected a cash value of $315,572 after 20 years of consistent premiums.

Usually, these projections are overly optimistic. But let’s give the whole life policy the benefit of the doubt. What would happen if we took the $10,077 difference and invested it in a brokerage account instead?

Even at very modest returns of 6% per year, the term policy easily outweighs the projected cash value in the whole life policy: $370,701 vs. $315,572. And that’s using an often unrealistic projection from the insurance company.

Of course, the cash value in the whole life policy grows tax deferred. Any gains or dividends would be taxable in a brokerage account.

Also, even though buying term and investing the difference will leave you with a bigger balance, you’ll be left without insurance once the policy expires. You can always reapply, but life insurance at age 50 is far more costly than it is at age 30. But even so, I’d argue that most people simply don’t need life at age 50 if they’re diligent savers.

Most people have an aspiration of financial independence & retirement at some point in their future. By age 50, most will be well on their way. Once a 20 year term policy lapses, the financial impact of dying is far lower. And if you think that’s not the case for you, you can always opt for a 30 year term instead of 20.

Other Types of Permanent Life Insurance

I’ve spent most of this blog post taking the liberty of expressing my dislike of whole life insurance. But to be honest, this feeling extends to most other forms of permanent life insurance too. Some of the features of other permanent life insurance might look attractive, but the additional costs & commissions usually outweigh the benefits. Here are the other main forms of permanent life insurance:

Variable Life

With whole life insurance, part of your premium goes toward the cash value of the policy. The cash value earns dividends, and grows over time. In a variable life policy, you have the opportunity to invest the cash value in a series of sub-accounts instead of relying on the insurance company’s dividends. Just like mutual funds, these sub-accounts have varying investment strategies and levels of risk & return. The insurance side of product is the same as whole life.

Universal Life

Universal life insurance is similar to whole life, but gives you more flexibility over the premium payments. With whole life policies your premiums will be level throughout the life of the policy. With universal policies, you have the option to pay higher or lower premiums whenever you want (within policy limitations). The difference is used adjust either the policy’s cash value or death benefit. For example, you might choose to not pay a premium one month, and as a result the death benefit could be adjusted downward.

Variable Universal Life

As you can guess, variable universal life is a combination of the two. You have flexibility over the timing & payment of premiums, and can invest any cash value that accumulates in various sub-accounts.

The Few Circumstances Whole Life Might Actually Make Sense

There are two main circumstances that permanent life insurance might actually be a good fit. The first is if you’ll never become financially independent.

If you never plan to become financially independent you’ll never accumulate the assets required to fund your living expenses. You’d be relying on employment income and be forced to work as long you could. And once you no longer could work, you’d need to rely on a friend or family member (or the government) to live. In this circumstance permanent insurance might be a nice way to compensate them for their efforts – especially since you wouldn’t have any assets to bequeath to them. Being permanent insurance, there’s no possibility your beneficiaries wouldn’t receive the death benefit.

The second reason has to do with estate planning. Many families who are subject to state or federal estate taxation have trouble raising the cash to pay the tax once a family member dies.

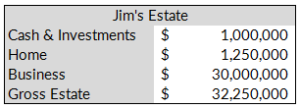

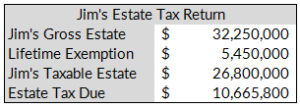

For example, let’s say that Jim has $1,000,000 in cash and investments and a home worth $1.25 million. Jim started a software business 30 years ago, which is now worth $30 million. When he dies, his estate will be subject to the estate tax:

In fact, he’ll be subject to a LOT of estate tax. Currently you’re given a lifetime estate exemption of $5.45 million when it comes to estate taxation. Any amount above that is subject to the tax. Since Jim’s estate is $26.8 million above this threshold, he’ll have a big tax bill once he dies:

Jim’s family would owe over $10 million in estate taxes, but Jim’s estate only has $1 million in cash and investments. If he can’t find another source of cash the family might be forced to liquidate the business.

This is where permanent life insurance might be helpful. A whole or universal life policy could be purchased with the intention of raising enough cash to pay estate taxes when Jim dies. Usually such policies are placed in an irrevocable life insurance trust (or ILIT), making the death benefit free of estate taxation. And since it’d be possible for Jim to outlive a term policy & be unable to re-qualify for underwriting, a permanent policy could be a good idea.

These are both compelling reasons to buy permanent life insurance, but in American today they’re pretty few and far between. Most people aspire to financial independence, and only the wealthiest Americans will have estates worth more than the current lifetime exemption of $5.45 million.

The Moral of the Story

Insurance is usually a zero sum game: what’s good for an insurance company is generally bad for you. Insurance companies make huge profits from whole life policies, which I believe often comes at the expense of policyholders. Agents are compensated accordingly. They’re paid giant first year commissions for selling the policies, which makes it easier for them to justify such a recommendation.

There is definitely a place for whole life insurance in the marketplace. But by and large most people will be better served with term insurance.