Investing is kind of like buying new shoes.

There are a thousands of options out there: running shoes, hiking shoes, dress shoes, and flip flops just to name a few. The right pair for you will depend on what you need them for, how big your foot is, and how much you want to spend.

There are thousands of options in the investment world too, from individual stocks and bonds, to mutual funds and ETFs, to managed accounts and automated platforms.

One question I hear a fair amount is, “with all the options out there, how do I know if my portfolio is right for me?”

Much like buying a new pair of shoes, the right portfolio for you matches your needs.

If you need new shoes to take your dog for a walk around the block twice a day, you probably won’t go out and buy ski boots. The same idea applies when investing.

4 Telltale Signs You’re in the Wrong Investments:

1) You Haven’t Assessed Your Risk Tolerance Recently

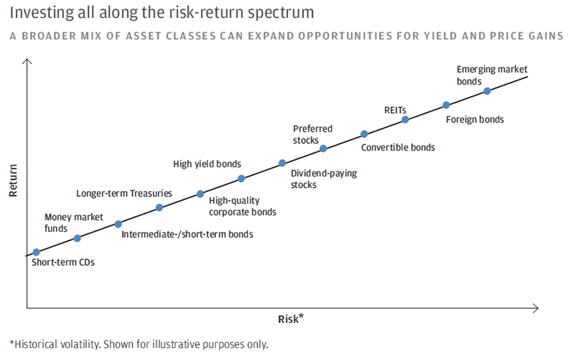

Any time you’re investing, there’s a tradeoff between risk and return.

Some investments might offer very high potential returns, but they’ll also come with a large risk of loss.

On the other end of the spectrum other investments will have a very low risk of loss, but also won’t offer much potential return.

Since all investments have a different tradeoff between risk and return, they create a spectrum when you put them all together.

When you combine the investments in your portfolio, the group as a whole will also fall somewhere along this spectrum.

The key to knowing whether your portfolio is right for you starts with understanding how much risk and return you’re aiming for.

When you’re in your 20s, at your first job, and investing for retirement for the first time, you probably have a pretty high tolerance for risk. Since you have so long until retirement, you can recover from a large loss in your portfolio.

As you age, your risk tolerance tends to go down. And when you’re a few years from retirement you no longer have the ability to tolerate losses in your portfolio like you once did.

If you don’t know what your risk tolerance is, it’s highly likely that your portfolio is not the best fit for your needs.

Vanguard has a handy tool to help you assess risk tolerance.

2) You’re Not Sure What You’re Investing For

What you’re investing for will have a big impact on your risk tolerance, since different goals have different time frames and costs.

You might want to retire in 15 years, but send your kid to college starting in 10. These are obviously different objectives. You’ll need different amounts of cash at different times to pay for them.

The right portfolio for you will be built to accommodate all your needs in one comprehensive mix of assets.

Like your risk tolerance, if you don’t know what you’re shooting for it’s pretty likely your portfolio isn’t the best fit.

3) The Asset Allocation of Your Portfolio is Unclear

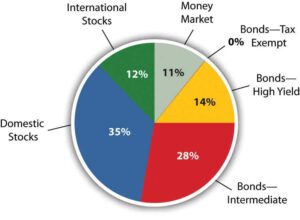

Let’s assume for a second that you know exactly what your investment objectives are and exactly how much risk you want to take with your portfolio. Your perfect investment mix will come down to asset allocation.

Investments are usually categorized by where they fall on the risk and return spectrum, as we addressed above.

Groups of investments that share similar risk and return tradeoffs along the spectrum are known as asset classes. The main three are stocks, bonds, and cash.

When we compile the investments in your portfolio, the group as a whole will fall somewhere on this spectrum just as your individual investments do.

The reason it’s so important to know the asset allocation of your portfolio is that asset allocation is the biggest predictor of portfolio returns.

Studies show that asset allocation explains over 90% of returns in a portfolio.

This means that the decision between investing in stocks vs. bonds is FAR more important than the decision of which stock or bond to invest in.

Calculating Asset Allocation

You might think that assessing your portfolio’s asset allocation is simple – and many times it can be.

Just add up the value of your stock funds and compare them to your bond funds, right? The wrinkle is that many funds these days invest in a mix of stocks and bonds as part of a specific strategy, like growth or income.

Without knowing the exact composition of each fund in your portfolio, the exercise can become complex and time consuming.

In the end, risk and return is a far reaching spectrum. The chances that your portfolio happens to land exactly on your ideal “sweet spot” are pretty low.

You’d probably have a better odds running into the stock room at Foot Locker, and grabbing the perfect shoe in the perfect size from a random box off the shelf.

4) You’re Unclear About the Fees You’re Paying

Simple math tells us that the higher the fees we pay in our portfolios, the lower our returns.

Fees can come from commissions, expense ratios, loads, or management fees paid to advisors. The right investments for you are those that check the boxes above at the lowest possible cost.

Keep in mind that there are millions of people around today who aren’t exactly sure how much they’re paying in investment fees.

The reason?

Investment account and mutual fund fees can become extremely confusing.

If this is you, don’t feel bad. There’s tons of information available online to help decipher your fee structure, and thousands of qualified and objective fee-only professionals you can speak with.

Notice a Theme?

By now I’m sure you’ve noticed a common theme here: to know whether your investments are right or wrong for you, you need to take stock of your personal situation.

All investment portfolios are right for someone out there. The key is finding the mix of assets that match your needs and objectives.

If the shoe fits, wear it!