You’ve seen the stats. Long term care is expensive, and we’re all likely to need it at some point in our lives. The cost of spending time in a nursing home or assisted living facility adds up quickly, which is why many retirees choose to insure against it through a long term care insurance policy.

Problem is, since there’s a high likelihood of requiring long term care, insurance is an expensive proposition in its own right. Plus, there’s no guarantee that the premium costs of a policy today don’t rise in the future. Genworth, one of the biggest underwriters in the long term care insurance, received approval in the Q1 of 2019 to raise premiums an average of 58%. (Insurance companies must receive approval on a state to state basis). That’s also after the company raised costs an average of 45% in 2018, and 28% in both 2017 and 2016. Ouch.

Are you better off crossing your fingers and hoping you don’t need expensive care for a long period of time? Or is it better to cover this risk through an insurance policy that will cost you an arm and a leg anyway?

This post will cover the essentials of long term care insurance, including exactly how to decide whether picking up a policy is a good decision for you and your family.

Long Term Care: The Stats

So here’s the big question. What are the chances you’ll ever need long term care? According to longtermcare.gov, about 70% of people turning 65 will need long term care services at some point in their lives. With the average annual cost of a nursing home totaling around $100,000 these days (depending on where you live), this can be a scary proposition.

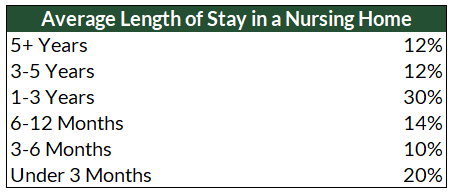

The stats can be misleading, though. Many people who need long term care services only need them for short periods of time. And since most long term care policies have elimination periods (the waiting period before the policy starts paying out) of around 90 days, many people won’t even need care long enough for their coverage to kick in.

The Case For Buying Long Term Care Insurance

It’s probably no surprise that an extended stay at a long term care facility could easily wipe out most of your net worth. At $100,000 per year, a 3 year stay for a couple would add up to: $100,000 * 3 * 2 = $600,000.

For this reason buying long term care insurance can make a lot of sense. If you’ve been diligent about saving for retirement, future long term care needs could completely deplete your savings.

For example, let’s say you’ve saved up $1.25 million throughout your career. Based on the stats above, there’s a 12% chance that you’ll need long term care for 3-5 years, and a 12% chance you’ll need it for 5+ years. That means there’s a 24% chance you’ll need care for at least three years – which would cost you at minimum $300,000. That’s almost a quarter of your retirement savings, and not something many people would want to gamble.

By purchasing an insurance policy, you could transfer this risk to an insurance company in exchange for a monthly or annual premium. Essentially, you’d be trading the possibility of a big bill from a nursing home or other LTC facility for the definite cost of the insurance premiums.

The Case Against Buying Long Term Care Insurance

You shouldn’t buy LTC insurance just because long term care can be expensive, though. Since there’s a relatively good chance you’ll need long term care at some point in your life, insurance policies are mighty expensive too.

A recent quote I saw for a very healthy couple of 55 and 57 ran $5,681 in annual premiums. The maximum annual benefit was $90,000, the total max benefit was $270,000 (providing a benefit period of 3 years), and it had an elimination period of 90 days. There was also a 3% inflation rider, meaning the annual & max benefits would increase 3% per year as LTC costs increase.

Here’s a Real Life Example:

Let’s say this couple purchased the policy, and paid the premiums dutifully every year. If they lived to 85 and 87 (slightly longer than their life expectancies), they’d be paying premiums for 30 years. Assuming their premiums don’t increase, this would be a total out of pocket cost of $5,681 * 30 = $170,430.

How much care does $170,430 provide? At $100,000 per year, a little longer than 20 months. This is the breakeven point, at which it doesn’t matter whether the couple purchases the insurance or not. After adding the standard 90 day elimination before benefits kick in, one of the two would need care for at least two years for the policy to pay off. If neither needed care, or if they needed care for a total of less than two years, they’d be better off saving the premium dollars and not obtaining a policy.

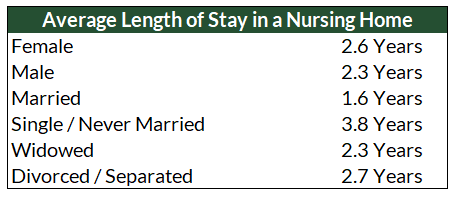

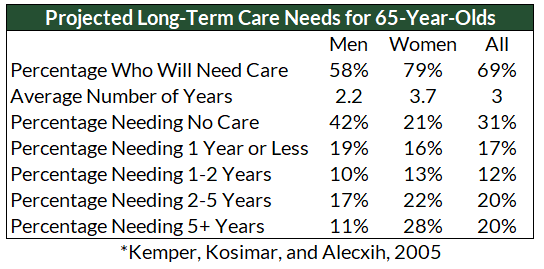

So what’s the probability that one of them will need care for longer than two years? The statistics from the American Association of Long Term Care Insurance above lump the average nursing home stay into a 1-3 period. But a 2005 study by Kemper, Kosimar, and Alecxih is a little more granular. It may be a little older, but the data is still useful:

Based on this data (assuming it’s still semi-accurate) we can actually calculate the probability of meeting our breakeven point. I’ll save you the math, but basically the numbers come down to:

The probability that either spouse will need care for longer than 2 years, plus the probability that both spouses need care for 1-2 years.

Any other possibility won’t meet our breakeven point. That includes the possibility that either or both spouses do not need care, or need care for less than two years in total. If either of these situations comes true, the couple total care will fall under our breakeven point of two years.

To make a long story short, there’s a 56.3% probability that purchasing a long term care policy would pay off.

This example makes many assumptions though, including that premium costs never increase. This is highly unrealistic. As I mentioned above, we’re already seeing long term care insurers hike premium costs substantially, as far more policyholders are drawing on their policies than the underwriters initially expected.

Plus, the example above uses a premium for a very healthy non-smoking couple with zero medical problems. It’s likely that most 55 year old couples would need to pay more for coverage based on their health record, thus increasing the breakeven point. That said, the 56.3% probability for a 65 year old couple above is lower than what it’d be for a 55 year old couple as well.

What’s the Worst That Can Happen?

Knowing the probability that a long term care policy might pay off is helpful, but that’s not typically why we buy insurance. We buy insurance to protect us against catastrophic events. If requiring extended long term care services is going to jeopardize your financial independence, you may want to consider a policy. Regardless of the probability it will pay off.

So what’s the worst that can happen? If you find yourself in a position where you need long term care but don’t have coverage, you’ll need to pay the expense out of pocket. Yes, you’d be forced to spend through your savings, but the expense won’t put you out on the street. Medicaid offers long term care coverage, which you qualify for once you spend through a certain amount of assets. The rules protect families somewhat, in that you won’t have to sell your home & force your spouse to find another place to live. But you will have to show that you’ve spent through the majority of your assets before Medicaid will assist.

So Who is LTC Insurance Best Suited For?

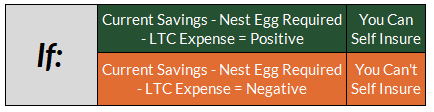

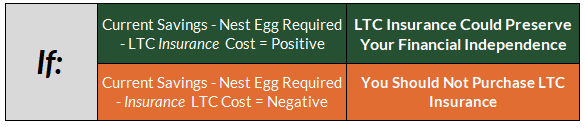

LTC policies are best suited for people who are not wealthy enough to pay for services out of pocket, but have enough saved to afford a policy. To determine whether you can self insure, you’ll need to determine whether a three year stay in a long term care facility would jeopardize your financial independence.

Most LTC insurance policies have maximum benefits periods of three years. So, even if you opt for coverage, if you need care for longer than three years you’ll probably be paying for it out of pocket. Based on the stats, this is about 24% of people who stay in a nursing home.

For example, let’s say a John and Sally live a lifestyle that costs $80,000 per year. Using some back of the envelope math, if they wanted to be somewhat conservative they might use a 3.5% annual withdrawal rate from their portfolio. This means they’d need to build a nest egg of: $80,000 / 3.5% = $2,285,714 in order to retire comfortably.

So, if John and Sally had a nest egg of $3,000,000, they could self insure. They need $2.29 million to afford their lifestyle, and another $600,000 in potential LTC costs (about three years of coverage for both of them), for a total need of $2.89 million. Their savings exceeds their needs:

If you’re among the majority of Americans and can’t self-insure you’ll need to determine whether to buy a policy. And again, if the cost of the policy itself jeopardizes your financial independence, LTC insurance won’t do you any good. You’d be trading the possibility that LTC costs would cripple your finances for the certainty that LTC insurance premiums would.

Let’s say that the annual premium for an LTC policy for John & Sally would run $7,500. If they’re 60, they’d probably be paying premiums for around 30 years until they’re 90. Using some more back of the envelope math (that doesn’t account for the time value of money or premium increases), the total cost would be 30 * $7,500 = $225,000.

If this cost is enough to bring their total savings below the amount they need to live, LTC insurance won’t do them any good. For example, let’s say that John & Sally figure they need $1.25 million to live on in retirement. If they’d saved exactly $1.25 million, the cost of the LTC insurance would mean they’d need to adjust their lifestyle & reduce spending in order to afford the coverage. They still might decide to purchase the insurance. But by doing so, they’d be trading the possibility that a big expense would force a lifestyle adjustment for the certainty that they need to make changes now.

You May Want to Consider Long Term Care Coverage If

So should you purchase a policy? Based on the stats, LTC policies make sense anyone who’s financial situation would be jeopardized by a three year stay in a nursing home. Coverage could be a good idea if:

- You want to leave an estate after you die

- You don’t have enough assets to self-insure

- You have enough retirement income to cover your living expenses and the cost of a policy

If the premiums will put you in a tight situation themselves, don’t get it. But if you have enough retirement income to afford a policy, it could help ensure you’ll have some assets to leave to your estate after you die.

The Best Time to Buy Long Term Care Coverage

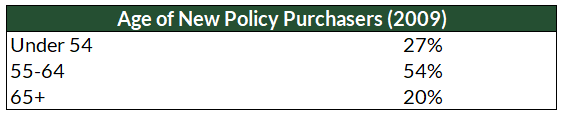

The general consensus here is that if you do want to purchase long term care coverage, the best time to do so is in your mid-50s.

When you purchase coverage, the annual premiums are based on your age and health at that time. The rates are “locked in”, and won’t increase each year as you get older (and more likely to require long term care).

They’re not locked in forever, though. Insurance companies can raise premiums on existing policies, but must jump through several hoops to do so. First, they must raise rates for an entire “class” of policyholders. They can’t single you out and raise only your premium if your health deteriorates. The insurance company must also make their case and get approval from your state before raising premiums. All that aside, recent history hasn’t been friendly here. There’s no guarantee that premiums won’t jump substantially in the future, and I’ll remind you again that Genworth hiked premiums 28% in 2016 and 2017, 45% in 2018, and 58% in 2019. The worst case scenario here is obtaining a policy, paying premiums for a number of years, and then letting it lapse before drawing on it because the premiums rise to the point where you can no longer afford them.

On the other hand premiums will become more expensive each year you wait to obtain coverage, too. Insurance companies know that your health rarely improves once you reach your mid 50s. While you’re in your 50s, premiums on new policies increase 2-4% every year on your birthday. Once you reach your 60s, this rate jumps to 6-8% every year on your birthday.

All in all, I typically like to explore the cost & possibility of obtaining long term care coverage with my clients who need it. But at the end of the day I often try to steer them away from it. There’s no guarantee that insurance companies won’t continue raising premiums year in, year out, as more policyholders file for benefits. And with the benefit periods of nearly all policies limited to three years, it makes the product quite a gamble.

What do you think?

How did you decide whether to obtain long term care insurance?

Are you happy with the decision you made?

Comment below!