When someone mentions the word insurance, most of us think of one of three things:

- Aaron Rodgers doing a discount double check

- The GEICO Gecko using his British accent

- The coverage we carry on our cars, our home, our health, or our life

What most of us don’t think of is our long term disability coverage.

Since tangible assets like our cars and homes are easy to visualize, they’re often top of mind when it comes to insurance protection.

But what about the risk that we get sick or injured, and can’t work?

Long term disability insurance is meant to replace our income if this happens. And coincidentally, our ability to earn a living is probably our biggest and most overlooked asset.

Earnings Capacity

Let’s take a moment to think about your ability to earn a living. Just imagine for a moment what your lifetime earnings will look like.

Your lifetime earnings includes every single paycheck you earn throughout your entire career. It counts every single raise, every single promotion, and every single bonus.

When you add them all together you’ll get a massive number. It will be far bigger than the value of your home, your car, and probably your retirement nest egg.

Your ability to go out into the work force and earn this money is your earnings capacity.

Now Imagine It’s Gone

Many people consider the possibility that they die, and the impact that would have on their family. But what if you were hurt or sick and unable to work?

Your family would be left with monthly expenses like a mortgage, utilities, and grocery bills. They’d also be left without your steady paychecks to afford them.

Plus there’s a chance you might need additional help from a caretaker if you’re permanently disabled. The end result? Higher expenses, lower income.

It’s More Likely Than You Think

If you’re thinking “that’ll never happen to me,” the statistics would disagree with you.

The social security administration says that 1 in 4 of today’s 20 year-old’s will become disabled for some period of time before they retire.

And if you’re under 45, the chances that you become disabled are far, far greater than the chances that you die.

Let’s Think About This

- Our earnings capacity is our biggest and most important asset

- Becoming disabled is far more likely than we realize

- Losing our earnings capacity could cause our family severe hardship

What No One Is Telling You About Long Term Disability

The point of this post is not to scare you into running out and buying up as much coverage as you possibly can.

The point of this post is to highlight the fact that millions of Americans are under insured and in the dark when it comes to disability coverage.

Don’t let this be you.

- Understand the likelihood that you’ll become disabled

- Understand the damage it might cause

- Make an informed decision about your insurance coverage

How Much Disability Coverage Should You Carry?

There’s no one-size-fits-all approach to calculating the perfect amount of disability coverage.

Instead, compare your monthly expenses to your savings. If you’re comfortable paying your mortgage and grocery bills with savings for a long period of time, you can probably opt for a less comprehensive policy.

On the other hand, you have less flexibility if you’re living paycheck to paycheck. If this is you, try and scrape together some extra cash to fund a more robust policy.

Disability Policy Provisions

Disability coverage can come in many shapes and sizes – leaving you with plenty of options.

Policies can vary by benefit amounts, coverage lengths, waiting periods, and a number of different riders. Be sure to take these nuances into consideration when shopping for coverage:

Elimination Period

The elimination period is the time between when you submit a claim and when you start receiving benefits. Elimination periods range from 30 days on the low end to 2 years on the high end.

If you have enough cash in the bank, lengthening the elimination period is a good way to reduce your policy’s premiums. Also keep in mind that disability benefits are typically paid in arrears at the end of the month. So if you have an elimination period of 30 days, you’d be waiting until the end of the second month before your payments begin.

Length of Coverage

This is an area where you have some flexibility. It’s prudent to opt for a policy that pays you at least until you turn 65. You may not need benefits for the rest of your life, though. If your policy pays you 80% of your current income on a tax free basis, you’ll likely have enough to continue saving for retirement. In which case, you’ll only need to replace your income until you start drawing retirement benefits at age 65.

Future Increase Option

Most disability policies only cover your income at the time you take out the policy. Even though coverage is expressed as a percentage of your pay, most policies don’t cover future additional income you’ll get from promotions, raises, and career growth. A future increase option (FIO) is a rider that accounts for this future income.

Cost of Living Adjustments

This is a rider I suggest everyone strongly consider. Long term disability benefits are only based on your income when you took out the policy (unless you added the FIO rider). This means that if you ever have to rely on benefits for income, they will not increase with inflation. And as the cost of groceries, healthcare, and every day living increase over time, your benefits will not. Here’s an example:

Let’s say you’re 30 years old and make $100,000 per year. You have a disability policy that pays you 80% of your salary until you’re 65 if you become disabled and can’t work. Your monthly expenses are currently $4,000.

If you become disabled and need to rely on your insurance coverage, your policy will pay $80,000 per year. But by the time you turn 65 your monthly expenses will be close to $8,000, with 2% inflation each year.

The cost of living adjustment (COLA) rider boosts your benefit each year based on inflation. Most policies use the consumer price index (CPI) to measure inflation each year. When the cost of every day goods and services goes up, so do your benefit payments.

Noncancelable and Guaranteed Renewable

In my practice, one insurance question that comes up a lot is “can the insurance company raise my rates over time?”

The answer is that it depends on the renewability clause in your policy. A noncancelable and guaranteed renewable policy means that the insurance company is not allowed to change your premiums, benefits, or anything else about your policy without your permission. This is the strongest form of renewability in the insurance world.

Guaranteed renewable policies are a step more liberal. In a guaranteed renewable policy, your insurance company probably won’t change the terms of your policy, but they can. Most often insurance companies will only raise premiums once every few years in a guaranteed renewable policy. And when they do, they need permission from your state.

If steady premiums are important to you, try to find a policy that’s noncancelable and guaranteed renewable. If you opt for a guaranteed renewable policy, it always helps to check out the company’s history of rate increases. This will give some insight into how aggressive the company might be going forward.

Accident Only Policies

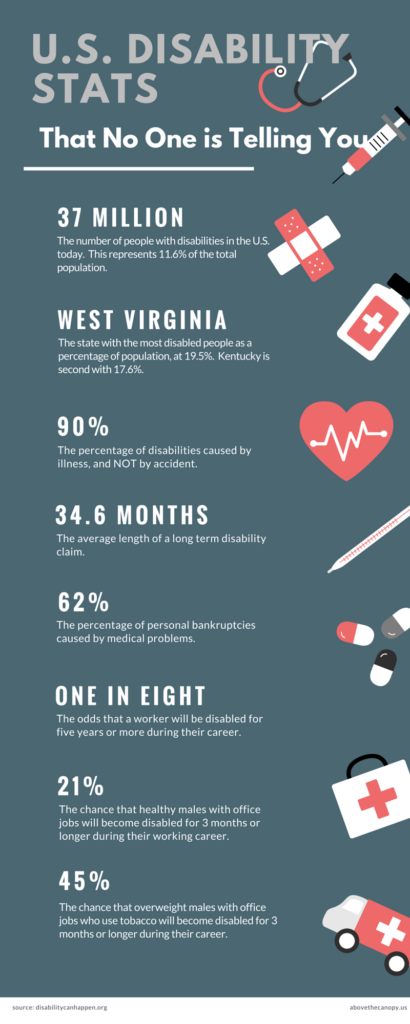

Finally, be aware that some policies cover accidents only – not illness. This might look appealing since they have lower premiums, but proceed with caution. As the graphic above shows, 90% of disability claims are the result of illness, not accident.

Short Term vs. Long Term Disability

Disability policies are classified as either short term or long term. Short term policies only pay benefits for a maximum of 2 years, and many pay for only 3-12 months.

Long term policies typically pay benefits for at least 2 years. Most policies typically pay until you turn 65 or for the rest of your life.

Many businesses carry disability coverage for their employees, but by and large it’s short term coverage only. It’s not uncommon for employees to be left on their own when it comes to long term disability.

Own Occupation vs. Any Occupation

The most important distinction in any disability coverage is the policy’s definition of disability.

Own occupation disability policies pay benefits if you’re unable to perform your own job. Any occupation disability policies pay benefits if you’re unable to perform any job.

For example, brain surgeons should always carry own occupation disability policies. If they’re in an accident and lose functionality in their hand, their career as a brain surgeon would probably be over.

An own occupation policy would pay benefits in this circumstance. An any occupation policy would not, since the surgeon could still go work in another profession.

As you can guess, own occupation policies are more expensive than any occupation policies since they’re more comprehensive.

Worker’s Comp vs. Disability Insurance

When employees are injured on the job, it’s often the employer’s responsibility to pay their medical bills and wages while they can’t work. Employers often purchase (and are sometimes required to purchase) worker’s compensation policies to cover this risk.

This is a big difference from disability insurance.

Disability insurance covers a percentage of your earnings if you can’t work due to illness or injury. It doesn’t matter whether an accident or degenerative disease caused your disability. Worker’s comp only pays if you’re hurt in an accident, and only if the accident occurred on the job.

Social Security Disability

Many people assume that social security will provide sufficient benefits if they become disabled.

Social security does have disability benefit provisions, but the benefits are pretty small. In 2016, the average monthly benefit is less than $1200 per month.

And you would still need to qualify, which is really difficult. Basically, to be approved for social security disability benefits you need to be completely disabled and not be able to work at any job. Your disability must also be expected to last at least one year or end in death.

On top of this, you’re required to have attained a certain number of social security credits during your working years. Typically you need 40 credits to qualify, which works out to 10 years of employment. The requirement for younger people is lower.

And even if you do qualify, there’s a 5 month waiting period before benefits start to pay out.

Long story short, it’s highly unlikely that social security will adequately replace your income if you become disabled.

Taxation of Disability Benefits

If you become disabled and make a claim to receive benefits, the monthly benefits may or may not be taxable as income.

Any time you pay the monthly premiums with after tax dollars, the benefits you receive are tax free. It could be that you pay premiums out of pocket with taxable income, or they’re deducted from your paycheck on an after tax basis.

Your employer may also pay disability premiums for you, which may not be counted as taxable income. Any time you don’t pay tax on the premiums, the benefits paid to you are considered taxable income.

Sometimes employers will pay for a portion of disability premiums and employees cover the remainder with after tax dollars. When this happens the benefits are partially taxable, based on the percentage of after tax vs. tax free premium payments.

Here’s an example:

Your employer offers long term disability coverage through a group plan. The plan promises to pay 40% of your salary if you become disabled and can’t work. Employees have the option to pay out of pocket to increase their individual coverage.

Let’s say that you decide to bump up your coverage to 70% of your current salary by paying out of pocket with after tax dollars.

If you need to draw on the policy down the road, 57% (40% / 70%) of your benefits will be taxable income. 43% (30% / 70%) will be tax free.

Insurance Company Ratings

Insurance companies do go bankrupt from time to time.

When you shop for a disability policies – and any kind of insurance for that matter – it’s important to take the financial stability of the issuer into account. If your insurance company doesn’t have the cash on hand to pay your claim, your benefits won’t get paid.

Fortunately, each state requires insurance companies to maintain a safe amount of cash on hand to pay claims.

Additionally, there are several ratings agencies that publish the financial stability of various insurance companies:

- A.M. Best

- Moody’s

- Standard & Poor’s (S&P)

Each of these three has slightly different ratings criteria. Before signing on the dotted line, it’s a good idea to reference at least one of these ratings.

Disability Insurance for Entrepreneurs

Being successful as an entrepreneur requires an unusual amount of self confidence and comfort taking risks.

Because of this it’s easy for entrepreneurs to feel infallible and ignore the need to insure their income.

Don’t let this be you.

Again, the point of this post isn’t to scare you into buying long term disability insurance. The point is to understand that becoming disabled is a lot more likely than you might realize.

- Understand the likelihood that you’ll become disabled

- Understand the damage it might cause

- Make an informed decision about your long term disability coverage

I hope you enjoyed the post. If so, please comment and share!