The concept of acquiring rental properties as a means to build passive income has become exceptionally popular recently. In fact, it’s difficult to peruse the internet for content on personal finance without bumping into videos/podcasts/blogs/courses on how to build passive income through real estate investing.

My take on real estate investing is that it can indeed be a wonderful complement to your investment portfolio. But the conditions need to be just right. And given how quickly housing prices have risen since the depths of the financial crisis in 2009, the circumstances today are rarely compelling.

As you can imagine, this is a conversation I have with clients frequently. Some have an existing property we need to evaluate. Others fall in love with the idea of putting in sweat equity now & building an empire of properties that kick off income over time. This sounds nice in theory, but in my experience rarely pencils out. (At least of the opportunities I’ve seen recently in California & Oregon).

This post will explore how to evaluate real estate investing opportunities. We’ll cover cash flow, return on investment, and go through a real life scenario of a property I pulled from Zillow.com.

It’s All About ROE: Return on Equity

Buying real estate comes with a lot of uncertainty. There’s no way to know exactly how much you’ll need to put into a piece of property, what the maintenance will be, what the neighborhood will look like in a few years, or whether you’ll find stable tenants. It takes a leap of faith. It’s risky and it’s speculative.

The best way to minimize this uncertainty is to focus on the hard numbers that you do know. There are a ton of different methods to evaluate the merits of an investment property, but they all center on the same idea: what are you actually getting in return for your invested time & energy?

A few common metrics you’ll run into are “net rental yield” and “cap rate“. Whatever you want to call them, in my mind there are only two data points that really matter: cash flow and return on equity (ROE). Let’s walk through both.

Cash Flow

I always prefer to start with cash flow, since it’s an input we’ll need to determine ROE. The first step here is to project the following over the first few years:

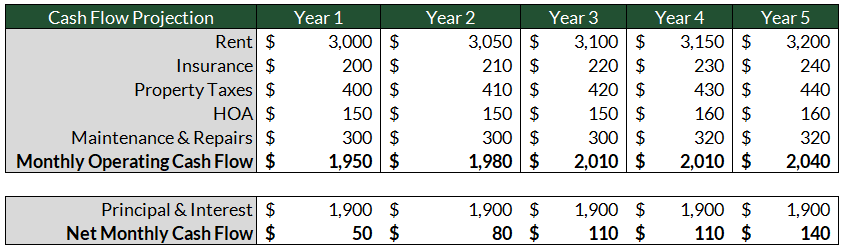

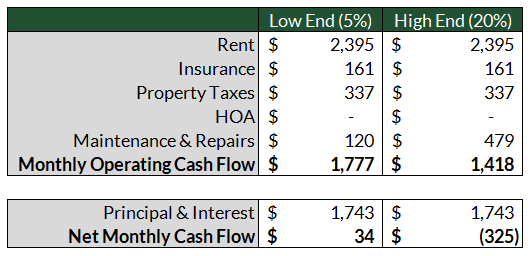

Many people prefer to evaluate the operating costs of a property separately from the mortgage & financing costs.

When doing so, subtracting insurance/taxes/dues/maintenance/utilities/etc. from rent will give you “operating cash flow”.

Deducting principal & interest from operating cash flow will give you “net cash flow”. Here’s an example (I omitted vacancies):

Again, different people use different terms for these figures, but all are essentially the same. What does the cash flow look like, and what are you getting on your invested money?

Optimally, any real estate investment will at LEAST be cash flow neutral. If an opportunity is cash flow negative (meaning you need to go out of pocket each month to cover expenses) proceed with caution. Unexpected maintenance costs or vacancies can be quick death spirals to fire sales and losses.

Return on Equity

Once you have a handle on cash flow you can evaluate the ROE of a real estate investment. To do this you’ll need to add a couple additional data points and make a few additional assumptions.

The first thing you’ll want to do is produce an amortization table for your financing. This will tell you how much you’ll pay in mortgage interest each year, and what the mortgage balance is expected to be in future years.

You’ll also need to make an assumption on price appreciation each year. Many of my clients assume their real estate investments will appreciate at 3%-4% per year. This is pretty aggressive. According to the S&P/Case-Shiller home price index, the average annual home appreciation rate has been 2.58% since 1987.

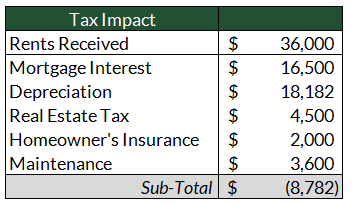

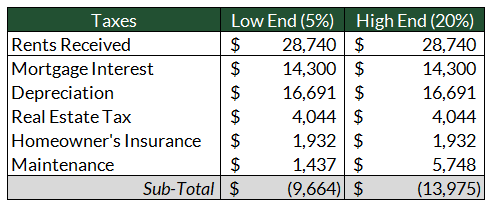

Finally, you’ll want to evaluate the tax impact of the property. To do so you’ll need to project the annual rental income and expenses that will be reported on schedule E of your tax return. Here’s an example:

This is where many people I speak with get tripped up. The tax advantages of owning rental properties are helpful, but perhaps not as helpful as many investors realize.

The example I used above assumes $3,000 per month in rental income, and includes mortgage interest and depreciation as expenses. When you add those expenses to the taxes, insurance, and maintenance costs, the property produces a tax loss.

Just as income from rental properties is considered “passive” for tax purposes, losses are considered passive too. That means that you can use it to offset other passive income, but cannot use it as a deduction to active income like earnings from a job. (Unless you’re a real estate professional or your modified adjusted gross income is under $150,000).

So, unless you have other passive income that the tax loss offsets, the tax advantages are not terribly helpful. Yes, you’d be collecting $50 per month in tax free cash flow in year one, but that’s a pretty small component of your overall return.

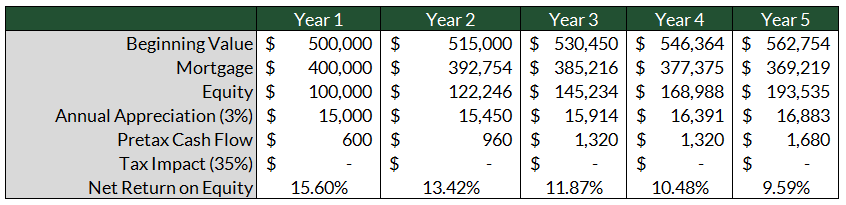

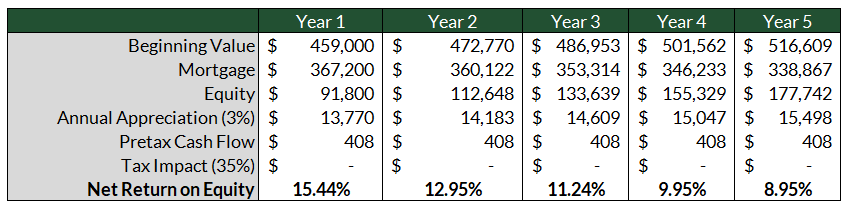

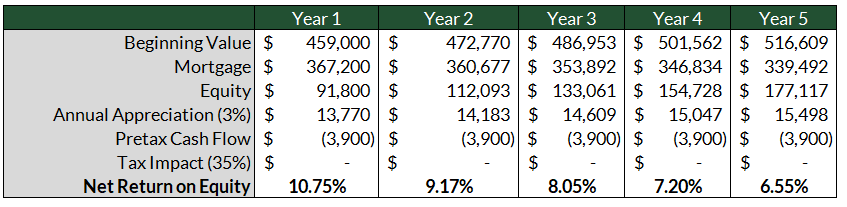

To arrive at your return on equity, divide the return (annual appreciation plus after tax cash flow) by your equity (property value minus mortgage balance). Here’s an example:

Couple things to keep in mind here. The first is that I’ve begun with a 3% annual appreciation rate, which as I mentioned is pretty aggressive. The second is that the ROE in year one looks very attractive, but falls in year two and thereafter.

This is typically how real estate investing works. Your ROE is high in the first years after a new investment because your property is so leveraged. Here, you’re putting down $100,000 in order to buy a $500,000 property. As your equity in the property rises as you pay the mortgage down each year, the denominator in ROE goes up. Annual appreciation and cash flow cannot keep the same pace, so ROE naturally goes down over time.

Third, you’ll notice that there is no tax impact on the cash flow. This is because the tax impact is negative based on our projection. If the property produced taxable income, you’d want to multiply that income by your marginal state & federal tax rates to arrive at after tax ROE.

Compare the Alternatives

Understanding the return (or potential return) on a piece of real estate is no doubt helpful. But if you’re using this information to make a purchase decision, ROE doesn’t do you much good without comparing it to available alternatives.

For example, you might have a big pile of cash that you’ve been building for the sole purpose of scratching your real estate investing itch. If that’s you, it makes sense to compare your ROE projection to two numbers:

- The risk free rate, measured as the yield on government bonds with terms matching your anticipated holding period. (If you plan to hold the property for a very long time, use the 30-year U.S. government bond yield. If you plan to sell the property in 5, use the 5-year yield, etc.) Here’s a link to the daily treasury yield curve rates.

- The expected return of a boring old portfolio of stock and bond index funds. I’d start with 7-8%.

On the high end of the spectrum, if your projected net ROE is greater than 7-8%, you may have found an excellent real estate opportunity! The example above appears to fit into this category (I created it this way intentionally). But as I mentioned at the beginning of the post, of opportunities I’ve seen recently this situation is the exception.

On the opposite end, if your projected net ROE is lower than the risk free rate….you should probably pass on the opportunity. Why would you want to invest money in a property that you project will have less return, and you know will have more risk than traditional investments?

For the “tweeners”, where your projected net ROE is greater than the risk free rate but less than what you can expect in a stock & bond portfolio, proceed with caution. Many people I speak with try to talk themselves into real estate opportunities because of the perceived diversification benefits. Yes, real estate is not terribly correlated to stocks and bonds. But it’s also far less passive than many people realize. Not only can you usually get better returns investing in stocks & bonds – you don’t have the replace their water heaters when they break.

Evaluating Property You Already Own

Along the same lines, make sure you evaluate the tax impact if you’re trying to decide how to handle a property you already own. It might not feel good to realize that the ROE on your rental is only 3-4%. But all things considered, keeping the property might be the best path for you.

Most investors depreciate real estate investments every year, directly reducing taxes due on their rental income. This helps offset taxes due on the cash coming in, but can sting if you ever decide to sell. Whereas capital gains are taxed at reduced rates if you hold a property for longer than one year, any and all depreciation must be “recaptured” as income first.

Here’s an Example

Let’s say you buy a rental property for $250,000. You depreciate the property evenly over the standard 27.5 year life. This means you’ll have an annual deduction against rental income on your Schedule E of $250,000 / 27.5 = $9,091.

Let’s also say that the property value increases 3% per year, and you hold it for five years before selling it for $289,800. Over those five years, you claimed $9,091 of depreciation each year. Your tax due on the sale would consist of:

- Long Term Capital Gains: $289,800 – $250,000 = $39,819

- Recaptured Depreciation: $9,091 * 5 = $45,455

The long term capital gains are taxed at reduced rates, but the recaptured depreciation would be taxed at higher levels as income.

Real Life Example

Let’s run through a real life example to put all this together. Perusing Zillow.com, I’ve picked out a house for sale in Sacramento, not terribly far from where I live. I filtered for:

- Price: $300,000 – $500,000

- Bedrooms: 3+

- Bathrooms: 2+

- Housing type: only houses and townhomes

This particular property was sold in 2016 for $411,000, and then put back on the market in 2018 for $480,000. It didn’t sell, and after several price drops is now back on the market for $459,000. It’s in a very nice area of town, right on the Sacramento River.

Cash Flow

As you may know, Zillow provides estimates of just about all the inputs you’d want to know: what it could rent for, property taxes, insurance, HOA…the whole bit. I’m confident these numbers aren’t 100% accurate, but they’re close enough for our purposes. Here’s what Zillow tells us:

- Rent estimate: $2,395 / mo

- Insurance: $161 / mo

- Property taxes: $337 / mo

- HOA: $0

- Mortgage interest & principal: $1,743 / mo (assuming 20% down on a 30-year fixed rate mortgage at 3.95%)

The more challenging inputs to forecast are maintenance costs and vacancies. For this exercise let’s assume that you’re able to successfully rent the property full-time for $2,395 per month, with no vacancies.

As for maintenance expenses, I typically see annual expenses run anywhere between 5% and 20% of rent. Yes, this is wide margin. But the amount you need to put into a property varies greatly by the circumstances. Who will be paying for utilities? What about landscaping? What happens if unexpected improvements are needed? These nuances matter significantly, and will affect the return you see on the property.

Case in point, see how the two ends of the spectrum affect net monthly cash flow. The low end of maintenance costs leave you pretty close to cash flow neutral on a monthly basis. Higher end costs will put you cash flow negative.

Tax Impact

For tax impact, I’ve taken all the monthly figures above and multiplied them by 12 to produce annual figures. I’ve also amortized out the first year’s mortgage interest.

In either case (low end vs. high end maintenance costs), the property will produce a tax loss. But unless your MAGI is below the thresholds described above (or you have other passive income this loss would offset), you won’t be able to use the loss as a deduction.

Return on Equity: Low Maintenance Costs

Now let’s evaluate return on equity. To do so I’ve modeled out property value, mortgage value, equity, appreciation, and cash flow over the first five years. I’ve also assumed that there is no tax impact since this property will probably produce a passive loss.

Looks pretty attractive, right? 8.95% or better in each of the first five years is a return I’d be very happy with.

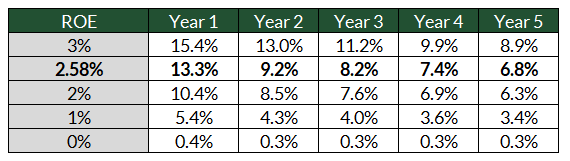

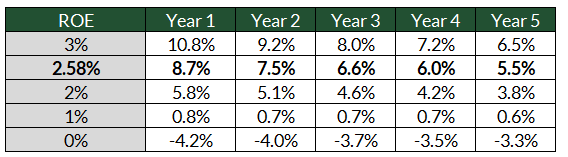

Don’t call your realtor just yet, though. Notice here that I’ve started with a 3% annual appreciation rate. As I mentioned above, this is pretty aggressive. The ROI you’ll see from a rental property depends highly on the investment’s annual appreciation.

What happens if the property only rises at 1% or 2% per year? What about the long run average of 2.58%? Here are the numbers for each of those scenarios:

Putting all this together, the property looks pretty attractive….IF we can keep maintenance costs down. But for this to happen many things need to go right.

Return on Equity: High Maintenance Costs

Now let’s rerun the analysis & assume the maintenance costs are on the high end of the spectrum. When we do the picture changes….substantially. Here’s the ROE assuming 3% annual appreciation:

Still pretty attractive, but only in the first couple years. And if the property doesn’t appreciate as much as we’d like, the ROE falls into the “danger zone”:

As you can see, falling to just the long term average appreciation rate makes the ROE on this property only attractive in the first two years.

Would I Buy This Property?

No. Not as a rental, at least. If you were able to bargain the price down $10,000 – $20,000 it would start to look more appealing. But again, many things would need to go right. You’d need to:

- Ensure that your maintenance costs fall on the low end of the spectrum

- Manage the property yourself (not pay additional overhead for management services)

- Find tenants willing to pay all the utilities & landscaping

- Keep the property rented

- Avoid major improvements

Not only do the above factors need to be in your favor, but this particular property comes with some significant risks. It’s right on the Sacramento River for one, which is a huge flood zone. You can pick up insurance coverage, but it’s not cheap.

I’d also be wary of picking up rental properties in the current housing market. House prices have been extremely strong since the middle of 2009, and if the economy sours it’s likely that house prices will too. And as we can see from the scenarios above, below average price appreciation would….not be helpful.

Final Notes

- Price appreciation is the biggest component of the return you’ll see in a rental property. Property generally increases in value within 2% of the national inflation rate. So if we see 2.5% inflation, property prices will generally increase somewhere between 0.5% and 4.5%. The long run average is 2.58%, which is very close to the long term average inflation rate.

- Always check comparables in the area when considering real estate investments, and bargain wherever you can. Talking a buyer down a few thousand dollars, or talking tenants into covering utilites goes a long way toward your ROI.

- Always check occupancy rates in the area. Nothing kills rental property ROI faster than vacancies.

- Always run scenarios – including the worst case. If your real estate opportunity depends on razor thin maintenance costs or a rapidly rising housing market, you’ll probably want to look elsewhere.