There’s been more than a few news headlines recently claiming that we’re on the verge of an economic recession. For many business owners and investors the word recession is a lot like Voldemort. It’s so evil and scary that you’re not even supposed to say it. “Recession” evokes fears of falling stock prices, unemployment, and scarcity.

So what exactly is a recession? And should we treat them with the same respect that Harry Potter treats Lord Voldemort?

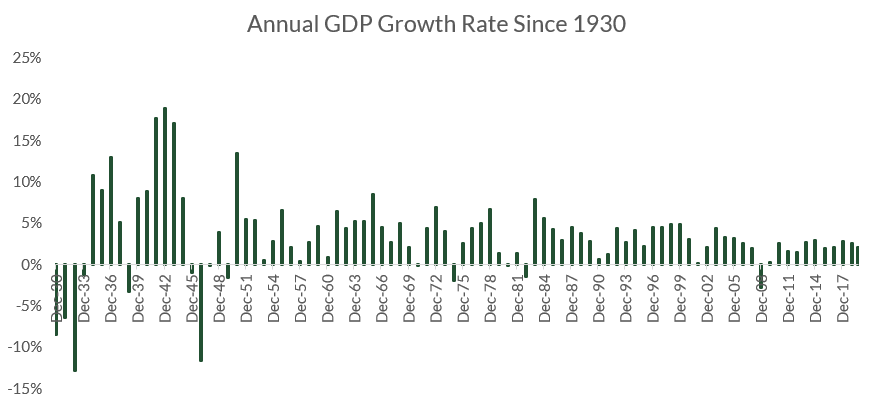

Recessions are technically two or more consecutive quarters where national gross domestic product contracts. Gross domestic product (GDP) is sum of all the goods and services a country produces. It’s the broadest and most common way to measure economic activity and the strength of the economy. Growing GDP is a good sign, falling GDP is a bad sign. This is what US GDP growth has looked like since 1930. Lots of major swings between 1930 and 1950, and relatively steady since about 1985. Note that by that time the US dollar was the world’s reserve currency, we were off the gold standard, and interest rates had started to stabilize after stagflation in the 1970s.

Now on to why you should care. The more goods and services a country produces, the better off its citizens are financially. There’s more wealth being created, more jobs available, and usually faster rising wages. For businesses this means that your customers have more stable employment and more discretionary income to buy your products.

In a recession GDP contracts. There’s less economic activity. From a business’s perspective your customers have fewer jobs, lower wages, and less discretionary income. Revenue dries up, and you may be forced to lay employees off yourself. Times are tough.

From an investor’s perspective, recessions are tough on asset prices. The value of your stock holdings, including index funds, depends on the market’s expectation of future cash flows & profitability. Recessions are tough on cash flow, tough on profitability, and tough on stock prices. Recessions often coincide with bear markets.

So where are we now? Are we actually nearing a recession, or is the rhetoric we’re hearing on the news just propaganda? I’m no economist, but I do have some background and stay informed as part of my day job. Here’s my take on whether we’re nearing a recession.

The Good: Unemployment is Low

Economist use all types of statistics to measure economic activity. Some of these measures are leading indicators, meaning that changes in them are useful in forecasting GDP. There’s not silver bullet, of course. (Remember, economics is called the dismal science).

Unemployment is one of these leading indicators. When more people file for unemployment, fewer goods and services are produced. There’s a strong correlation between increased unemployment and falling future GDP. Again, GDP doesn’t fall every single time unemployment ticks up, but there’s a relationship.

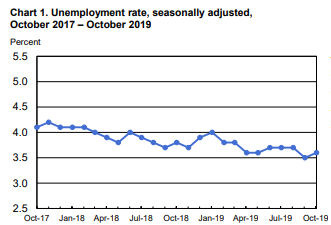

Unemployment is tracked by the Bureau of Labor Statistics (BLS). As of October, national unemployment is at 3.6%. This is about as low as unemployment gets, and indicates a very strong economy.

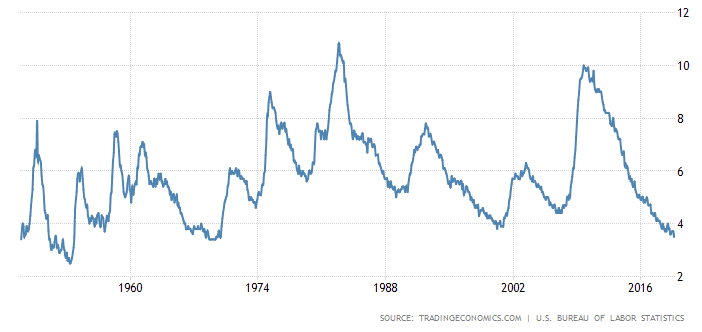

Notice in the chart that there’s a slight tick upward in the most recent reading. Yes, technically the uptick tells us that the unemployment rate has increased slightly. But these are still historically low rates. Look at the unemployment rate over a longer period of time. The time unemployment was substantially lower was during the post WWII boom era in the 1950’s.

The Bad: Trade With China Is….Tense

Without getting into the politics here, the trade war with China is a downward pressure on the economy. My rudimentary understanding here is that President Trump wants to pressure China into improving their trade practices. Since we import a huge amount of goods and services from China, tariffs make them more expensive. Costs go up for both consumers and businesses, leaving everyone with less available cash.

This also impacts business confidence. Given the uncertainty surrounding this issue, businesses tend to be reluctant to invest money in new projects. Decision makers tend to be more reserved when it comes to expansionary decisions. Maybe you’re not so inclined to launch that new product or business line. Perhaps buying that building isn’t the best idea if there’s a chance your costs will go up substantially.

I don’t have a clue how all this will play out. A lot of it will have to do with the 2020 election. But if the trade war with China continues expect more downward pressure on the economy. That’s not to say the good things about our economic engine won’t outweigh the pressure from tariffs. But regardless, higher taxes on imports is a headwind.

The Ugly: The Yield Curve Inverted in August

Back in August the 2/10 yield curve inverted for a few days. The yield curve expresses the market rate of interest for U.S. treasury securities at various maturity dates. Typically longer term interest rates exceed short term rates, meaning the yield curve slopes “upward.” In this environment investors are rewarded for locking up funds over longer periods of time. You get a higher interest rate investing in a 10-year bond than you do investing in a 2-year bond.

Whereas short term interest rates are set by the Federal Reserve through monetary policy, longer term rates are based on market expectations. Higher long term interest rates mean the markets are bullish on the economy. Lower short term rates mean the opposite.

Every now and then the yield curve “inverts”, and short term rates actually exceed long term rates. This is what happened for a few days back in August.

Inverted yield curves can be an ominous sign. Let’s refresh our memory on each of the last five recessions:

- 2008-2009: The “Great Recession”. Caused by the subprime crisis. This was the longest recession since the depression way back in 1929, lasting from December of 2007 to June of 2009.

- 2001: The “Dot Com Bust”. Unprofitable internet companies went bananas, until the investing public realized that profitability is indeed important in an equity investment. This recession lasted for eight months.

- 1990-1991: The “Savings and Loan Crisis”. Over 1,000 banking institutions went belly up, thanks in part to the stagflation in the 70’s and resulting high interest rates in the 80’s.

- 1980-1982: Inflation & Interest Rates. To combat the stagflation from the 1970s, the Fed Reserve hiked interest rates to previously unseen levels. If you were alive during this time you might remember banks offering 20% CDs.

- 1973-1975: Stagflation & the Gold Standard. The headline most people will remember is stagflation, because it begun the chain of events resulting in the inflation scares, high interest rates, and the S&L crisis of 1990. What’s often forgotten is that President Nixon simultaneously took the US off the gold standard and implemented wage price controls.

If you lived during the periods above, the dates and headlines are probably somewhat familiar to you. The position of the yield curve prior to these time frames is probably not.

The yield curve inverted prior to all five of these recessions. Inverted yield curves aren’t perfectly accurate predictors of recessions. (Not all recessions have followed an inverted yield curve). Economists don’t typically like to forecast recessions based on the yield curve alone, either. But they do have a pretty strong track record.

So Are We Nearing a Recession?

This is the part where I get to say I have no idea. Remember – this is the “dismal” part of the dismal science. And I’m not even an economist.

From my standpoint the numbers look pretty good right now though. Money is cheap, people are working, and everything is humming along pretty smoothly. There are a few headwinds, but overall I’d say the outlook over the next 12 months is pretty positive.

Beyond 12 months I am not as confident. The inverted yield curve tells me there’s a lot of pessimism out there, which can impact consumer spending and optimism over time. Plus, if inflation ever reenters the picture we will immediately be looking at higher interest rates. Either of these scenarios could spark a turn in the business cycle.

Whatever your belief, don’t let the possibility of recession impact your investment decisions. It may make sense to build up a war chest of cash for your business operations, but the best investment results are achieved by a long term and consistent strategy.