Roth IRAs have become one of the most popular ways to build retirement savings over the years. In fact, they’re so popular that thousands of people clamor every tax season to convert their traditional IRAs to Roth IRAs.

This conversion is one of the most popular financial planning moves, since it can reduce your tax burden and eliminates required minimum distributions (RMDs).

More recently, a new form of Roth account has emerged: Roth 401k plans. Roth 401k plans are essentially the same alternative to traditional 401k plans that Roth IRAs are to traditional IRAs. Contributions are made after tax, and gains and withdrawals are tax free.

And with Roth 401k plans on the scene, many sponsors are starting to allow their participants to convert their traditional, pretax 401k balances into Roth, after tax balances. This transition is known as a Roth 401k conversion.

Roth 401k conversions are not unlike Roth IRA conversions. The transition will create taxable income, but your assets will never leave your employer’s 401k plan.

Here’s how one might work:

- Johnny has a $100,000 saved up in his employer’s 401k plan. He didn’t pay any income tax on his contributions, and they will continue to grow tax free until he starts taking withdrawals.

- When he starts taking withdrawals after age 59 1/2, he’ll owe income tax on every dollar he takes out of his account.

- If Johnny were to convert his 401k contribution to Roth contributions, he would owe income tax on the entire $100,000 this year. His account would continue to grow tax free as it would have otherwise.

- But, when he begins taking withdrawals down the road, they won’t be taxable income to Johnny. Essentially, he would be paying his tax burden now instead of later.

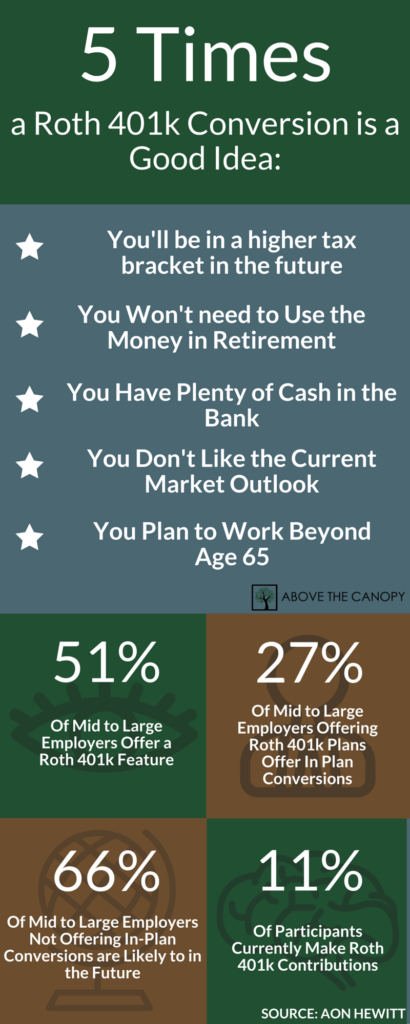

Conversions can be appealing. You pay taxes on the account now, rather than in the future when you might be in a higher bracket. But the decision is not always so cut and dry. And since this is a question I get in my practice from time to time, I thought it’d help to share 5 circumstances where a Roth 401k conversion is a good idea.

5 Times a Roth 401k Conversion is a Good Idea:

1) You’ll be in a higher tax bracket in the future

It’s not hard to find online resources about whether a Roth IRA conversion is a good fit for you. Here’s some info from Charles Schwab, and some more from Jeff Rose.

If you check out both the links above, you’ll notice they both suggest that you estimate your future tax bracket to help you decide whether a Roth IRA conversion is a good idea.

Remember the difference between a traditional and Roth IRA here:

- In a traditional IRA, your make tax deductible contributions. Those contributions grow tax free, and your withdrawals at retirement age are added to your taxable income. In other words less tax now, more tax later.

- In a Roth IRA, your contributions are not tax deductible. Instead, they grow tax free within the account and your withdrawals at retirement age are tax free. In other words more tax now, less tax later.

If you’re deciding whether to convert your traditional IRA to a Roth IRA, you’ll probably want to consider your tax liabilities. If you think you’ll be paying higher taxes in the future, you might want to pay taxes now by moving forward with the conversion. This could be because you think you’ll be in a higher bracket in the future, or you think that you’ll be taxed more in general.

Of course, if you’re in the middle of your career and in your peak earnings years, the opposite might be true. You might plan on being in a lower tax bracket in your retirement years than you are now. In this case, you’d be better off deferring taxes now, and paying them later by keeping your money in the traditional IRA.

A Roth 401k conversion isn’t all that different from a tax perspective. If you think you’ll be in a higher tax bracket down the road, it might sense to go ahead with the conversion.

Roth 401k Conversions Are Not the Same as Roth IRA Conversions

There is a key difference between a Roth 401k conversion and a Roth IRA conversion though. With a Roth IRA conversion you can back out of your decision any time before your taxes are due.

This can be a very handy for tax savvy investors. Let’s use Johnny again from our previous example (Johnny’s getting a lot of attention today).

In addition to his 401k at work, let’s assume that Johnny has $100,000 in a traditional IRA. In November, he decides he’s going to convert the entire balance to a Roth IRA.

If Johnny is in the 25% tax bracket, he’d owe $25,000 on the conversion. Let’s also assume that the stock market takes a tumble in March before Johnny’s taxes are due.

He can actually recharacterize the conversion and back out of his decision. If his account falls 20% after the market correction, this would make a lot of sense. Rather than owing $25,000 (25% of $100,000), he could postpone the conversion until the following year when his account has a lower balance. If his account stayed level after the 20% drop, this would be a tax bill of $20,000 (25% of $80,000).

This is a handy move for Roth IRA conversions, but isn’t allowed in Roth 401k conversions.

2) You Won’t Need to Use the Money in Retirement

One of the pesky drawbacks of traditional IRAs and 401k plans are the required minimum distributions, or RMDs. Since the IRS doesn’t want us to leave money in tax advantaged retirement accounts forever, they’ll make you take withdrawals once you turn 70 1/2.

Essentially, you’ll take the account balance on the December 31 of each year, and divide by your life expectancy. This is the amount you’ll need to take out of the account each year and pay tax on.

With Roth accounts, you’ve already paid the tax – either on your initial contribution or when you converted the account. Since you’ve already paid the tax due, and the IRS isn’t sitting around waiting for their money, they don’t impose RMDs on Roth IRAs.

The IRS does require RMDs on Roth 401k plans however, unless you’re still employed at the company sponsoring the retirement plan. Fortunately there’s an easy workaround, since it’s simple to roll over your Roth 401k assets into a Roth IRA. This can be done easily at any brokerage firm, without complications, taxes due, or fees.

This is a huge advantage of Roth 401k features. Without RMDs, you can keep your retirement dollars in a Roth IRA and continue to let them grow tax free.

If you don’t need your 401k money to live off of in retirement, a Roth conversion might be a good idea. It will leave you more flexibility in the future and save you from forced, taxable withdrawals.

3) You Have Plenty of Cash in the Bank

The biggest drawback of Roth 401k conversions might be the immediate tax implications. Any amount converted will be added to your adjusted gross income for the year.

You’ll also want to pay this bill out of pocket. Paying the tax due directly from your newly converted 401k balance is considered a distribution subject to penalty. Not only would you be paying tax, but the IRS would tack on an additional 10% penalty. Long story short, you’ll only want to move forward with a Roth 401k conversion if you have enough cash to pay the taxes out of pocket.

4) You Don’t Like the Current Market Outlook

Since a Roth 401k conversion will require a large cash outlay, it might be a good time to convert if you think the markets are entering a period of poor returns.

*Disclaimer* I am NOT a fan of trying to time the markets and predict when stocks or bonds might be headed higher or lower. But despite my personal philosophy, many people feel very uncomfortable when they’re invested in the markets at certain times.

If this is you, and you have some cash sitting on the sidelines that you don’t feel comfortable investing, why not put it toward a Roth 401k conversion? If you can’t find any decent investment opportunities, it might make a lot of sense to get your tax burden out of the way.

5) You Plan to Work Beyond Age 65

Working beyond the traditional retirement age can also make a Roth 401k conversion a good fit. If you do plan to continue working, you’ll have taxable income for a longer period of time.

If you supplement your earnings with distributions from a traditional retirement account, your tax liability will be pushed even higher. But if instead your retirement savings were in a Roth account by virtue of an in-plan conversion, your withdrawals wouldn’t be taxable.

This is a helpful way to manage your tax liabilities throughout retirement, and is known as tax diversification.