If you’ve been following the California legislative process at all, or if you own a business that employs people in California, you may have heard of the CalSavers Retirement Savings Program. In 2016, Governor Jerry Brown signed Bill 1234, requiring development of a workplace retirement savings program for private sector workers without access to one. The resulting program is known as CalSavers.

Basically, the program forces employers with more than 5 employees to defer a portion of their employees’ paychecks into a state run Roth IRA. These contributions are invested in default target date retirement funds, unless the employee directs their investments otherwise. Employees may also opt out entirely, if they choose.

The benefit of such a program is easy access to a retirement savings account. Employees could contribute to one on their own, of course, but that would require opening an account at a brokerage firm & making investment decisions. CalSavers greases the wheels by providing a “done for you” program that employees are defaulted into.

The positive spin here is that the program will certainly result in more retirement savings for many thousands of employees. The negative side of the story comes from the business community. Businesses without retirement plans will be forced to take the time to open a plan, enroll their employees, and deposit their contributions.

CalSavers isn’t at all unprecedented. At this point 21 states have enacted similar legislation. The law is taking a good amount of “heat” though. Several industry groups are suing the state treasurer in an attempt to derail the rule. Some plaintiffs don’t care for the state government telling them what to do, while others in the financial industry probably see the program as a competitive threat.

Whatever your take on the matter, businesses will be required to comply beginning in June of 2020 as the law stands today. This post will provide a quick overview of the program, including its benefits and shortcomings.

What the CalSavers Retirement Program Is

As I mentioned above, the genesis of the program is Bill 1234, signed into law in 2016. Businesses with 5 or more employees will now be required to offer some type of retirement plan to their employees. If the business decides not to use a traditional type of plan (SIMPLE IRA, 401(k), SEP-IRA, etc.), they can either sign up for CalSavers or pay a fine.

Upon signing up, businesses will need to enroll their employees through the state’s portal. A notice is then sent to the employees, and after a 30-day waiting period a portion of their paycheck is deferred into the program’s Roth IRA. Employees can opt out if they wish. If they don’t opt out, 5% of their compensation will be deposited directly into the CalSavers account. The deferral percentage goes up 1% each year, until topping out at 8%.

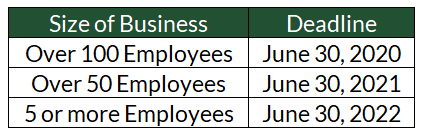

From the employer’s perspective there are pros and cons. The downside of any program like this is that businesses with five or more employees will be forced to participate by the following deadlines:

Enrolling in the program will take a little time, and there’s no doubt employers will be fielding questions from their employees. And probably more than a few that they’re not qualified to answer.

On the other hand, the program comes at no cost to employers. Employees pay the operating costs, and businesses are not required to make matching or other types of contributions.

What I Like About CalSavers

It’s a step in the right direction, and one I’m not surprised California has taken. Aimed at curbing the nationwide retirement dilemma we’re facing, most of the programs California and other states have launched compel businesses to offer some type of retirement savings vehicle.

In general I’m favor of offering some type of state operated retirement savings program for small businesses. Many businesses with fewer than 10-15 employees haven’t established a retirement plan. Some business owners don’t see the value in offering a program. Some don’t have the time to set one up. Some don’t have the budget. Others just haven’t gotten around to it yet.

CalSavers is a convenient option for small businesses in this situation. You set up the program (whether you want to or not), you enroll your employees, and that’s it. Aside from contributions each payroll period, which only take a minute, you have no other responsibilities. No ongoing fees. No fiduciary responsibilities or oversight. You’re all set.

This will be really convenient for many small businesses in the state. Other retirement plan options for small businesses are typically SEP-IRAs, SIMPLE IRAs, or 401k plans. All three of these options take a little time and money to set up and operate. Plus, ownership is typically compelled to contribute funds on behalf of their employees (like matching your employees’ contributions, for example). CalSavers is easier, less costly, and less time intensive for businesses to operate. And you won’t need to contribute funds on behalf of your employees. Your only responsibility is depositing their payroll deferral during your normal payroll cycle.

What I Don’t Like About CalSavers

The biggest problem I see with CalSavers is the type of account that employees’ contributions are deposited into: a Roth IRA. Don’t get me wrong – I LOVE Roth IRAs. The issue here is the combination of Roth IRA income restrictions and CalSavers’ automatic enrollment feature.

The benefits of Roth IRAs are so great that the IRS doesn’t allow you to contribute to them if you make too much money. In 2019, married couples filing jointly may contribute up to $6,000 to a Roth IRA per year if their modified adjusted gross income (MAGI) is less than $193,000. That contribution limit is reduced if their MAGI is between $193,000 and $203,000. Married couples with MAGI above $203,000 may not contribute to Roth IRAs at all. For single people the phaseout range is $122,000 to $137,000 in MAGI.

So what happens if your MAGI exceeds these thresholds, but you contribute to a Roth IRA anyway? You can rectify the mistake before you file your taxes by withdrawing your excess contributions, plus earnings & interest. But if you forget, or don’t notice, you’ll owe a 6% excise penalty on the contributions every year until you fix the mistake.

The way CalSavers is set up, businesses using the program will automatically enroll ALL of their employees in the program, whether they want to participate or not. It’s then up to the employee to opt out. If they don’t opt out within the 30-day window, 5% of their paychecks will automatically be contributed to the CalSavers Roth IRA.

This means that it will be up to the employee to:

- Realize that a portion of their earnings will be contributed to a Roth IRA

- Know what their modified adjusted gross income is

- Know that Roth IRAs have an income restriction

- Determine whether they’re eligible to contribute to a Roth IRA

- Adjust their participation accordingly

Now, how many participants will realistically fall above the MAGI threshold? Likely not too many. But for those who do fit the description, I’m guessing that few will recognize the problem. Which will ultimately result in the 6% excise penalty.

The Verdict

While I like that CalSavers provides an easy and inexpensive way for employers to offer retirement savings plan to their employees, there are some shortcomings. I’m not a big fan of the government forcing me to direct my employees’ comp into a state run savings program, for one. (Personal taste, I guess). The fees that participants (employees) will absorb are also a little high. But from my perspective, the biggest problem I see is the auto-enrollment feature alongside a Roth IRA. Unless I’m missing something, I’d expect a lot of excess contribution penalties in the next few years.