If you’re a parent, I’m guessing that at some point you’ve freaked out thought about the cost of your child’s future college tuition. College costs are rising about 7% per year here in the U.S., and don’t look to be slowing down any time soon. Most conventional advice we hear about ways to afford college costs has to do with starting to save early, or scouring the earth for potential scholarships. What many of us forget is that we already have saving opportunities build into our tax code, in the form of a college tuition tax credit.

How A College Tuition Tax Credit Helps

It’s easy to confuse a tax credit with a tax deduction. Remember, a tax credit is applied directly against the amount of tax you need to pay. A deduction reduces the amount of your income subject to tax in the first place. A tax credit is always more valuable than a deduction.

Here’s an example:

Let’s say you’re single and have an adjusted gross income of $100,000. You’d find yourself in the 28% tax bracket, and owe $21,037 in federal income tax this year.

If you took a deduction of $10,000, you’d reduce your adjusted gross income from $100,000 to $90,000. At $90,000 you’d fall into the 25% tax bracket, and owe $18,271 in federal income taxes.

If the $10,000 were a tax credit instead of a deduction, you’d still report $100,000 in adjusted gross income. The credit would work directly against your tax due, and you’d owe $11,037 instead of $21,037.

College Tuition Tax Credit: What’s Available

So what college tuition tax credits are out there? There are two written into the tax code:

If you’re covering qualified expenses for yourself or a dependent you claim on your tax return, you might be able to claim one. The qualification standards differ slightly, which we’ll cover below. Among other parameters, both credits rely on modified adjusted gross income limits; if you make too much money you won’t be able to claim either. You also won’t be able to claim a credit if you’re married & file separately.

To calculate your MAGI, take your adjusted gross income and add the following amounts:

- Foreign earned income exclusion

- Foreign housing exclusion

- Foreign housing deduction

- Exclusion of income by bona fide residents of Puerto Rico or American Samoa

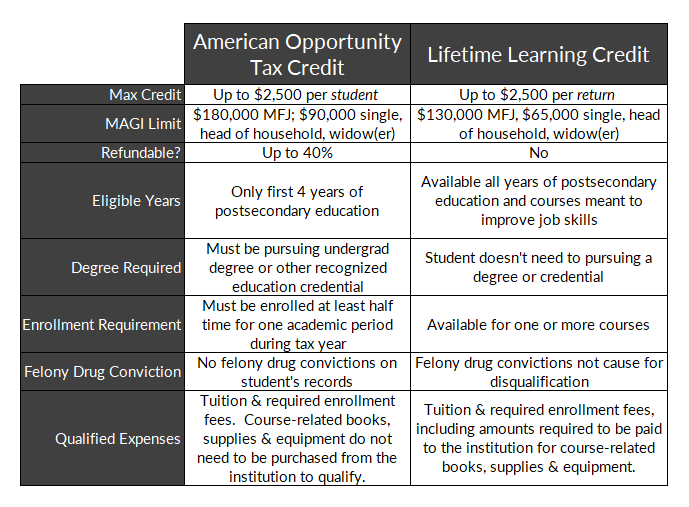

American Opportunity Tax Credit

If you pay qualified education expenses on behalf of yourself or one of your dependents, the AOTC offers a tax credit of up to $2500. Qualified education expenses include:

- Tuition

- Enrollment Fees

- Books, Supplies & Equipment

Room & board, transportation, and medical expenses are not eligible expenses.

Additionally, the student needs to be pursuing an undergraduate degree or a “recognized education credential.” They need to be enrolled at least half time during the tax year, and may not have any felony drug convictions on their record.

If you qualify, you can receive a credit of 100% of the first $2,000 paid in qualified education expenses, and 25% on the next $2,000. So if you pay $4,000 or more for your kid’s education, you’ll get $2,500 back in the form of a tax credit. What’s also nice is that if the credit reduces the tax you owe below $0, up to 40% of the credit can even trigger a refund.

You’re only allowed to take the credit for four years – the first four years of your child’s postsecondary education.

Income Limit

The income limit for the AOTC is $80,000 if you’re single, or $160,000 if you’re married & file jointly. You can also claim a partial credit if you’re single and fall between $80,000 and $90,000 in income.

Lifetime Learning Credit

The lifetime learning credit has broader eligibility, and offers a tax credit of up to $2,000. Unlike the AOTC, there’s no limit to the number of years you can claim the LLC, either. So, if you’re a parent of a college student on the 5-year plan (or longer), you could claim the AOTC for the first four years and the Lifetime Learning Credit (LLC) for the fifth.

Also unlike the AOTC, the student doesn’t need to be enrolled half time for you to qualify. You can claim the credit for an unlimited number of years, and students with felony drug convictions are not disqualified.

The amount of the LLC is 20% of the first $10,000 of qualified expenses, up to a maximum of $2,000 per dependent. It’s not refundable either, so if it causes your tax due to fall below $0 it won’t trigger a refund.

Income Limit

The income limits for the LLC are lower than for the AOTC. To claim the full LLC you’ll need a modified adjusted gross income of $55,000 or less if you’re single, $111,000 if you’re married filing jointly. You can claim a reduced amount if your MAGI is $55,000 – $65,000 (single), or $111,000 – $131,000 (married filing jointly).

Which Credit Should You Take?

Generally the rule of thumb is to take the American Opportunity Tax Credit if you qualify. It offers a larger credit, and you don’t need to spend as much in order to take it. You’re not allowed to save years of eligibility for the AOTC either, so you might as well strike while the iron’s hot.

Claiming the Credit

To claim either credit you’ll need to file IRS form 8863 – one for each eligible student you’re claiming a credit for. Most schools will distribute tuition statements to students by January 31, via form 1098-T. Most of the information you’ll need to include on form 8863 can be found on 1098-T. But, make sure the information on 1098-T is correct. Colleges & universities have to process a ton of them, and mistakes happen from time to time.