Today’s post is another on the topic of financial independence. We’ve had several of these recently, but since that’s the focus of this blog I guess that’s not surprising.

Rather than discuss the fundamental components of financial planning like insurance or investing, today’s focus is entrepreneurship. Specifically, how entrepreneurship can be a wonderful way to align your career with your lifestyle and become financially independent on your own terms.

Forewarning: today’s post is another that falls on the philosophical side of the spectrum. I normally don’t write too many of these posts, and realize there’s already been several to start the year. Read on if you’re OK indulging my abstract (and possibly poor quality) musings.

The Life of an Entrepreneur

When you read the word entrepreneurship, I’m guessing you have a few predisposed thoughts that enter your brain. It’s probably some kind of picture, idea, or very possibly a stereotype of what you think entrepreneurship is all about. For most people this image probably has something to do with a new idea, passion, long hours, hard work, and potentially great reward.

This image is actually pretty accurate, at least for most business owners I know. Starting a business venture is extremely stressful, and there’s always the looming chance of failure. Entrepreneurs scratch and claw in order to mold an innovation or new idea into a marketable product or service. Then they’re challenged with convincing some group of people that the product is valuable and will make their lives better. If anything goes wrong along the way, the business is doomed.

In short, it’s not an easy path.

The Spoils

For entrepreneurs who find a way to be successful, the reward can be great. Monetarily, it’s huge – there’s virtually no limit to the amount of money you can make. This includes profits & annual income extracted from your business and the value of the business itself. There really is no ceiling. In the context of financial independence this opens up a whole lot off opportunity.

The Traditional Route

Consider a more traditional career path:

- Enter the workforce in your 20s

- Learn your job, your company, and your industry

- Pick up some skills

- Move up the ladder over time, either via promotion or job offers from competitors

- Hit your peak & hope to remain at that level (and pay grade) for the rest of your career

I’m making some pretty big generalizations here, but you get the point. The typical career path is pretty linear.

From a lifestyle perspective, good savers will spend a little less than they earn. As they move up the ladder and their income increases, they’ll expand their lifestyle accordingly. Maybe move into a bigger house, buy a new car a little more frequently, or travel.

Again, I’m making some big assumptions here. My point is that in a typical career path there’s a little money left each paycheck that goes into savings (or a retirement or investment account). With every paycheck a little more is added to the pile, and over time it grows enough to make you financially independent.

The path is somewhat long and slow, but there’s a very high chance that you’ll succeed (as long as you don’t make any big mistakes along the way). Traditionally, most people reach this point sometime in their 60s.

The Entrepreneurial Route

What if, instead, we looked at financial independence from another angle?

Your objective might still be to build savings and a nest egg. But when you’re an entrepreneur you can structure your business around how much money you want or need to make each year.

Here’s an example. Let’s say you make $100,000 per year in a “normal” job. You contribute $15,000 each year to your 401(k), pay living expenses, and have $10,000 left over. Each year your net worth is growing by $25,000, plus any investment gains. The only ways to increase your pace toward financial independence are to:

- Save more by cutting your expenses & lifestyle

- Take more investment risk, hoping your savings will grow faster

- Get a raise, bonus, or different job to increase your income

In the entrepreneurial route you have far more discretion. Want to pick up the pace and earn $150,000 instead of $100,000? You have more options at your disposal. To name just a few:

- Raise prices

- Sell more

- Automate

- Hire staff & delegate

- Develop complementary goods or services

You have infinitely more options as an entrepreneur. Once you get past the initial grind of building a steady business around a new idea, you can blaze whatever trail to financial independence that you like. You’re not bound to a consistent, “little bit each month” pace.

Overlooked Rewards

To me there are important rewards to entrepreneurship that go beyond financial, as well. The reward that often goes unnoticed is the ability to make a living by sharing your personal values with the world.

Regardless of the industry or type of business, entrepreneurs develop and offer products that they truly believe will improve peoples’ lives. Why? Because they developed it themselves! It takes relentless work and perseverance to take an idea from concept to product to successful business. If you don’t believe in the benefits of what you’re doing, the venture is probably doomed from the start.

It’s this alignment of personal values with a business’s ethos that makes entrepreneurship so rewarding. Everything that your business is can be aligned with your view of the world. Your products, services, and complete operation can be calibrated with whatever is important to you. This could be sustainability, politics, or anything else. You’re not conforming to someone else’s framework, you’re molding your own. You get to operate your business the way you think is right, and there’s no one who can tell you otherwise.

Lifestyle Design

This idea applies to your lifestyle too. No one is telling you you’re required to work 40 hours per week from 9am to 5pm? You’re no longer bound to a limited amount of vacation per year. You can do whatever you want!

Of course, building a business isn’t possible without putting in the hours. But when and where those hours occur are completely up to you. You can work in the early mornings in order to coach your kid’s sports team, or only between 10 and 2 because of other obligations. Not only can you align your business with your personal values, you can align it with the lifestyle that’s best for you.

Risks of Entrepreneurship

Unlimited financial reward and the freedom to structure your career around your lifestyle are certainly killer perks. So why doesn’t everyone ditch their day job to start a new business?

Because it’s extremely risky.

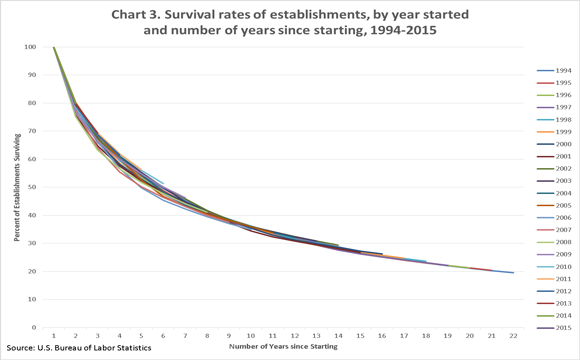

Many people claim that 90% – 95% of new businesses fail within the first five years. The Bureau of Labor Statistics claims that 50% of new businesses with employees are typically still standing after five years of being in business. Either way you view it, the failure rate is extremely high.

And if a high failure rate isn’t enough, many people need to step out on a ledge in order to start.

Some entrepreneurs have to quit their day jobs before getting started. Many businesses require huge amounts of capital investment too, which come from your bank account, retirement savings, or financing from a lender. If your idea doesn’t pan out, you could be left not only without employment income, but also with debt and depleted savings.

Is Entrepreneurship for You?

When we invest in for-profit ventures, there is always a trade off between risk and return. Entrepreneurship is no different: it presents a high risk opportunity not just for financial gain, but also to structure your life around your values.

The path isn’t easy. But if you’re comfortable taking risks and want total control over your path to financial independence, you might just consider starting a business yourself.