It’s easy to forget, with everything happening in Washington D.C. in the last week, that we have a new stimulus package. After sitting on the bill for about a week, President Trump signed the Consolidated Appropriations Act into law in the late hours of December 27th.

It was a massive bill, with many sections other coronavirus related stimulus. I haven’t read the entire Act, and hope that I never do. I have read the sections related to stimulus checks, the paycheck protection program and a few others though, as they relate directly to many of our clients.

This post will cover what you need to know about those sections: whether you’re entitled to a stimulus check and/or PPP loan, when you might receive one, and other relevant details.

Stimulus Checks

The section of the bill generating the most questions across the country is probably the new round of stimulus checks. As it stands, eligible taxpayers will receive $600 in the form of an electronic deposit or mailed check.

This may not stand long though. With democrats winning both seats in the Georgia senate runoff, Joe Biden has substantial leverage in implementing his agenda. Several outlets are reporting that he is seeking far more substantial fiscal stimulus measures, including an increase from $600 stimulus checks to $2,000 per person.

As always, we don’t know exactly how the legislative process will play out. Here’s what’s been passed so far:

Who Will Receive a Check?

Like the last round of stimulus checks, this round will be based on your most recent tax return data. If your adjusted gross income fall below certain thresholds, you’ll be getting a check:

- $75,000 for single filers

- $150,000 for married people filing jointly

- $115,000 for head of household filers

In the CARES Act, checks were issued based on the tax information they had on file for you. And since they were issued between April 15th and October 15th (the deadline for returns on extension), the checks were based on 2019 data for some people, and 2018 data for others.

This round is similar, in that the IRS will use the most recent info they have on file for you when determining whether you’ll receive a check. But since we’re beyond the 2019 extensions deadline, 2019 data will be used for just about everyone who filed a return last year.

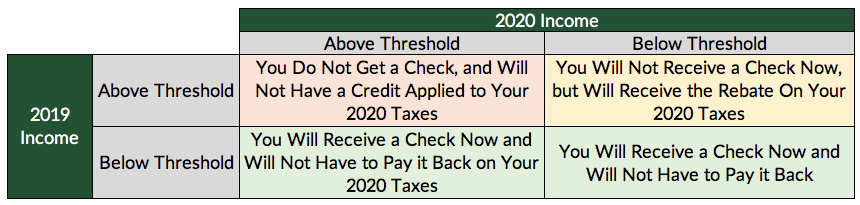

The checks will be considered a “refundable credit” for 2020. Which means that while your 2019 tax data will determine whether you receive a check in the first place, it’ll be accounted for on your 2020 taxes.

This has a couple other affects, as many people who qualified in 2019 may not qualify in 2020, and vice versa. For example, let’s say made too much money in 2019 to receive a stimulus check. But once COVID set in last April, you lost your job and haven’t come back to work yet.

Since the checks are technically a credit for 2020, you’ll receive the appropriate amount through a rebate when you file your taxes for the year – even though you may not get a check in the mail now. This will either work to reduce the amount you owe the IRS, or come back to you in the form of a refund.

And for those who qualify based on their 2019 numbers but don’t in 2020, this is where the “refundable” portion comes into play. You’ll receive a check now, but don’t need to pay it back when you file your taxes.

Here’s a chart for the graphically minded:

How Much Will You Receive?

The first round of stimulus checks included $1200 per adult and $500 per eligible child as the base amount. This round is $600 per person – adults and eligible kids both. Kids are considered eligible if they can be claimed for the Child Tax Credit.

For example, this means that a married couple with three kids filing jointly could be eligible for a check of 5 * $600 = $3,000. In the first round it would have been ($1200 * 2) + ($500 * 3) = $3,900.

This is just the base amount though. Your check may be reduced if your adjusted gross income falls above the thresholds listed above. For every $100 above the threshold, your check will be reduced by $5.

Using the same example, let’s say the married couple with three kids had an adjusted gross income of $160,000 in 2019. They’d be $10,000 over the threshold. Their check would be reduced by $10,000 / $100 = 100 * $5 = $500. Their check would total $2,500 instead of $3,000.

When Will the Checks Arrive?

Soon. The IRS said on 1/8/21 that more than 100 million have already gone out. If you filed a tax return for 2019 you should expect to receive one by January 15th if you qualify. Some checks will be sent by mail, but the IRS will direct deposit as many as possible. If they have your banking information on file, I’d expect the funds to be sent electronically.

Paycheck Protection Program Round Two

The Paycheck Protection Program was probably the portion generating the second most questions around the country. And certainly the most for business owners. The new round of the program accomplishes a couple things. Most importantly it make more funds available to extend loans to eligible small businesses. Meaning that if your business still qualifies you can apply for a loan once the window opens again – even if you took out a loan in the first round last year.

It also makes some notable changes to the program that are effective retroactively. This means that if you have unused funds left over from round one, the new rules may apply to them. Here’s the breakdown:

Eligibility

In the first round of the PPP last year, any business with less than 500 employees that could confirm in good faith that it needed the funds could qualify for a PPP loan. Given the urgency, the bar was not high for businesses to obtain a loan. That’s changed. For the new round of PPP businesses cannot have more than 300 employees, and must have seen year over year quarterly revenue fall by at least 25%. Any quarter from 2020 can make you eligible, as long as you can prove that your business’s revenue from that quarter fell at least 25% from the same quarter in 2019.

Additionally, businesses with substantial ownership residing in China are ineligible, as are all publicly traded and lobbying companies. Businesses with funds left over from the first round of PPP last year are also ineligible. So while you can absolutely take out loans in both rounds, you must exhaust the funds from last year first.

Loan Amounts

Like the first round, businesses are eligible for PPP loans of up to 2.5x monthly average payrolls. Payrolls can include retirement and some other benefits, like group life and health insurance too. The same limit of $100,000 per employee remains. Any compensation about that amount does not contribute to loan amounts.

Restaurants and hotels can receive larger loans. Any business in the accommodations or food service industry can borrow up to 3.5x their average monthly payrolls, as opposed to the baseline 2.5x. Business in this industry can also have up to 500 employees and still be eligible, too.

Forgiveness

The details on forgiveness are a little more lenient than they were in round one last year. First off, the Act stipulates that expenses paid for with forgiven loans are indeed NOT counted as taxable income, which is exactly the opposite of the treasury’s guidance last year. This is good news for borrowers.

And whereas borrowers must still spend at least 60% of the loan proceeds on payrolls, the other 40% may be spent on a much longer list of eligible items. In addition to rent and utilities, borrowers may also use funds on operating costs, supplier costs, property damages, and worker protection costs.

What’s more, borrowers have the discretion to choose either an 8-week or 24-week covered period. This is the period in which the funds must be spent, and payrolls & staffing numbers must remain consistent. During the first round early borrowers were forced to use an 8-week period, while later borrowers could choose either.

For all intents and purposes most businesses will want to choose the 24-week period, as it simply gives you more time to spend the funds appropriately. But for those businesses needing to staff up just for the purposes of qualifying for forgiveness, the 8-week period may be a better choice.

The procedure for having loans forgiven will be largely the same for loans greater than $150,000. For loans under $150,000, the Act forces the Small Business Administration to create a streamlined forgiveness application. That cannot be longer than one page, including all supporting documentation. This is a good thing for borrowers, but will unfortunately result in some degree of fraud.

Timing

The Act also compels the SBA to implement these changes rather quickly. The window for the new round of PPP will be open soon, if it’s not already by the time you read this post. So if your business qualifies and is in need of funds, I’d contact your banker now.

Payroll Tax Deferrals

You might recall that back in August, President Trump signed an executive order that allowed employers to defer payroll taxes through the end of the year. Employers were not required to participate. If they did, both employees and employers could skip paying Social Security and Medicare taxes through the end of the year, and then make up the payments in Q1 of 2021. This would save employees and employers both 7.65% of taxable wages. (Remember that employees and employers both pay 6.2% of wages toward Social Security – on the first $137,700 of wages, and 1.45% of wages toward Medicare, with no limit. 6.2% + 1.45% = 7.65%).

The federal government began participating immediately after the order was signed. Which created quite a headache for federal employees who didn’t want or need to participate. When employers choose to participate in this program, employees do not have a choice to opt out. Which means that federal employees will need to pay back the payroll taxes that were deferred in 2020 sometime later this year. Which is a bit of a headache.

President Trump made it clear that he wanted to forgive the deferrals after signing the order, but lacked the authority to do so. Whereas the repayments were initially due between 1/1/21 and 4/30/21, the new stimulus bill extends the deadline to 12/31/21. Meaning that employees working at business participating in the program last year now have some more time to repay anything that was deferred.

Other Items

As I mentioned above, this is a MASSIVE piece of legislation, and I am pretty confident that none of the legislators who voted on it read the bill in its entirety. (It was over 5,000 pages long, and the vote took place less than 24 hours after the draft was finalized).

While most of the readers of this blog will be wondering about the stimulus checks, PPP, and payroll tax forgiveness described above, here are a couple other relevant highlights:

- Business meals are now deductible again, as long as they’re at a “restaurant”.

- Unused funds you have in an FSA (flex spending account) can be rolled from 2020 into 2021, and again from 2021 to 2022. Ordinarily they cannot. This is helpful, but employers still need to opt in before you can take advantage.

- The $300 per week in federal unemployment assistance will start up again, and last for 11 weeks.

There were some non-financial sections that stood out to me too. For example, one section requires federal agencies to produce an unclassified report on what they know about UFOs. What a fitting way to wrap up 2020! I honestly can’t wait to read the report when it comes out, though.

As is always the case with this type of legislation, there are new rules that will require new guidance. There will probably be some changes to interpretations and other nuances that could be different than the way I’ve written this post. But this is what we have for now.

Stay tuned for more as guidance is released!