For business owners starting to think about the next generation, the phrases”estate tax” or “transfer tax” almost seem like curse words. The bad news is that when you build an estate of a certain size, the IRS wants to get in your pockets regardless of what, when, or how you transfer your assets to beneficiaries. The good news is that there are plenty of strategies available to help you minimize these taxes. The grantor retained annuity trust is one of them, and will be the topic of today’s post. We’ll cover what they are, why they’re beneficial, and how you might go about using one.

Gift Tax Review

Ok – before we dive into the details, let’s review what taxes typically apply when you gift an asset to someone else.

First off, you’re allowed to give away $14,000 per year, per person tax free. If you’re married, you and your spouse are both allowed $14,000 per person per year, or $28,000 total. So, if you and your spouse want to gift each of your kids $28,000 for their birthday every year, you could do so tax free. (It’d be one heck of a birthday present, too).

You also have a lifetime gift exclusion. This is the amount that you can give away, either while you’re alive or after you die, without incurring any federal estate or gift taxes. Anything that exceeds the $14,000 annual limit (or doesn’t qualify) works against your lifetime exclusion. The lifetime gift exclusion in 2017 is $5.49 million, which inches higher with inflation over time. Here again you can combine your lifetime exclusion with your spouse, for a total of $10.98 million.

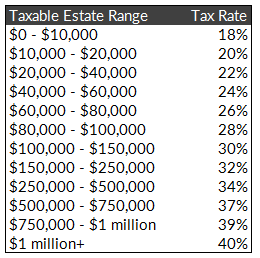

So let’s say that one year you and your spouse decide to gift your oldest child $128,000. The first $28,000 would be covered under your annual allowance and excluded from tax. The remaining $100,000 would work against your lifetime exclusion. Neither you nor your child would owe tax on the gift, but you’d have worked your lifetime exclusion from $10.98 million down to $10.88 million. If your future gifts (either while you’re alive or after death) exceed $10.88 million, they’ll be subject to the federal gift/estate tax:

Grantor Retained Annuity Trust: The Benefits

Because the lifetime exclusion is $5.49 million, very few families in the U.S. actually pay federal estate tax. This is a different story for business owners, though.

Your interest in your business, of course, is included in your taxable estate after you die. And if your estate exceeds the lifetime gift exclusion, federal estate taxes will be taking a nice chunk away from your beneficiaries.

This is where a grantor retained annuity trust, or GRAT, might come in handy. Grantor retained annuity trusts allow you to gift assets to an irrevocable trust, but continue collecting income from the assets for a specified period.

This is pretty handy for owners of rapidly growing businesses, since the arrangement lets you gift assets based on their value today, before they’ve appreciated. Plus, you still collect income and control of the asset until the term is up.

Here’s an Example:

Let’s say that you’re 50 years old, married, and have two children in their early 20’s. You own a rapidly growing industrial products business that’s currently worth $7.5 million. Your kids work in the business with you, and you’d like them to take over operations once you retire.

Let’s also say that the value of your stake in the company will grow over the next 20 years at 8% annually. That means that when you’re 60, your stake would be worth $16.19 million, and when you’re 70 it’d be worth $34.96 million.

If your ultimate goal is to transfer your share to your children, you have a few basic options:

1) Gift the business to your kids today, before the business appreciates

Since you’re married, you and your spouse have a total lifetime gift exclusion of $10.98 million. So by gifting the business to your kids today, you’d completely avoid gift taxation. You’d only use up $7.5 million of the $10.98 you have to work with. On the downside, you’d also be giving up your primary income source.

2) Gift the business to your kids later, after the business appreciates

The other options are to gift the business to your kids at some point in the future. This lets you collect business income and retain control for a longer period of time. But, once the business (plus the rest of your estate) is worth more than the lifetime exclusion amount, you’ll start owing estate and/or gift taxes. In this example if you’d waited until age 60 to make the gift, it’d be worth $16.19 million. You’d owe gift taxes on $16.19 – $10.98 = $5.21 million, plus anything else you leave to your kids after you die. This would total over $2 million in transfer taxes.

3) Fund a grantor retained annuity trust

Instead, you could fund a grantor retained annuity trust with your stake in your business. You could draw income from the trust during its term, say 10 years, to help fund your lifestyle. Plus, you’d be gifting the asset at today’s value – which conveniently falls below the lifetime gift exclusion. You’re essentially freezing the amount of the gift at it’s value today. It’s the best of both worlds.

The Mechanics of GRATs

A grantor retained annuity trust is an irrevocable trust. That means that any assets you gift to the trust are it’s to keep. You can structure the trust (and should) so that you’re entitled to a certain amount of income each year, but cannot reverse your decision later if you change your mind.

In all trusts, the grantor is the party that funds the assets to the trust. That’s you. GRATs are called grantor retained annuity trusts because after funding the trust, you retain income in the form of an annuity for a certain period of time. When that term is up, the assets can either be passed on to your beneficiaries immediately or managed by a trustee to be gifted at a later date.

The assets used to fund the trust (presumably the stake in your business) will count against your lifetime gift exclusion. But since you’ll receive an income stream during the trust term, that gift is discounted by the present value of those cash flows:

Taxable Gift = Current Value of Asset – Present Value of Annuity Income

The discount rate applied to the annuity income comes from IRS guidance in Section 7520.

For example, let’s say you gift a $5 million stake in your business to a grantor retained annuity trust in June of 2017. The term of the trust is 10 years, and during that time you will collect annuity payments of 6% per year.

This means you’ll collect annual income of $300,000 from the trust for 10 years. Using the June 2017 rate of 2.4% from Section 7520, the present value of that income stream would be $2,639,239. So, the taxable gift to the GRAT would be $5,000,000 – $2,639,239 = $2,360,761.

That’s the amount that would count against your lifetime gift exclusion. Your remaining exclusion would then be $10,980,000 – $2,360,761 = $8,619,239.

Interest Rate Considerations

The value of the grantor’s annuity income depends heavily on the interest rate published in Section 7520. The higher the interest rate, the more heavily discounted the income stream is, and the lower the present value of the gift.

This has a big impact on the current value of the gift and subsequent tax implications. Remember, the assets used to fund the trust are reduced by the grantor’s retained annuity to arrive at the gift’s total value. So if interest rates are higher, the value of the future annuity income is lower, and the gift amount is higher.

Here’s what I mean. If you plan to gift a $15 million business to your kids, without the annuity you’d owe gift taxes on $15 – $10.98 = $4.02 million. Let’s say that you create a GRAT with a 4% annuity and 10 year term in order to take advantage of annuity stream’s valuation discount and to avoid future appreciation. So, for the next 10 years, you’ll receive $600,000 ($15 million * 4%) per year from the trust.

If the section 7520 interest rate is 10%, the current value of the annuity would be $3,686,740. This amount would be subtracted from your gift of $15 million, meaning your net gift would be $15,000,000 – $3,686,740 = $11,313,260. You’d use up your entire lifetime exclusion of $10.98 million, and owe gift tax on the remaining $333,000 ($11,313,260 – $10,980,000).

But if the section 7520 rate were 3% instead of 10%, the current value of the annuity would be $5,118,121. That means that your gift would only be $15,000,000 – $5,118,121 = $9,881,879. At lower interest rates your income annuity is discounted less and worth more today. Thanks to lower interest rates, your gift would fall below the lifetime exclusion amount and allow you to avoid gift tax entirely.

It’s for this reason that GRATs are generally more beneficial in low interest rate environments, like we’re in today. It also brings up an important point: for a grantor retained annuity trust to be successful, the gifted asset needs to grow at least as rapidly as the Section 7520 interest rate. If it doesn’t, you’re better off hanging onto your business outside the trust, since the taxable value would be lower outside the trust than inside.

Income Tax Considerations

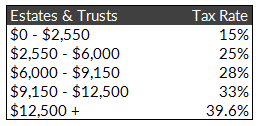

Another benefit of the grantor retained annuity trust has to do with the taxation of the trust’s income. Since the grantor (you) retains the right and benefits of the annuity income during the trust’s term, that income is taxable to you at your personal rates.

This is very beneficial. Trusts are subject to the same federal tax rates that we are as individuals, but at very compressed brackets:

For example, at $100,000 of income a married couple would find themselves in the 25% bracket and owe $16,478 in federal income tax. A trust, however jumps to the 39.6% bracket after only $12,500 in income. $100,000 of income to a trust works out to $37,883 in annual income tax.

Zero’ed Out GRATs

As you probably noticed in the example above, the larger the annuity stream and retained interest, the smaller the taxable gift. Some GRATs are even structured so that the present value of the annuity stream equals the asset’s current value. This is known as a “zero’ed out GRAT”. Since the retained annuity matches the value of the gift, there is no tax due or charge against your lifetime gift exclusion.

Drawbacks of a Grantor Retained Annuity Trust

Grantor retained annuity trusts aren’t for everyone. Their major drawback is what happens if you die before the term of the trust is up: a portion of the trust’s value falls back into your estate. Obviously this negates the value of the strategy, so the term must be chosen wisely.

When creating a grantor retained annuity trust, it’s usually preferable to set a term that’s shorter than your life expectancy. Another strategy is to use a “laddered” approach, where you set up several trusts with varying durations. This approach is a little more expensive, of course, since creating a GRAT comes with some legal fees.

Life insurance is a convenient tool to use with GRATs as well. If the grantor dies prematurely, the gifted assets might be subjected to additional tax since some will revert back to the grantor’s estate. Life insurance can be purchased to help offset this risk and provide extra cash in the event of premature death. Typically life insurance policies are held in irrevocable life insurance trusts, or ILITs.

Are GRATs Really that Easy?

OK, OK, the title of this post claims that a grantor retained annuity trust is an easy way for business owners to reduce wealth transfer taxes.

GRATs can be very effective at reducing estate taxes, but I’ll agree that they may not be that easy. Trust law differs from state to state, and there are many nuances surrounding the best way to manage estate taxes where you live.

A grantor retained annuity trust can be a very effective tool, but at the end of the day a discussion with an experienced professional is the best course of action. In fact, if your estate does exceed the lifetime exclusion amount, a team of professionals is probably more appropriate. Experienced financial planners, attorneys, and CPAs should all be included on your team of advisors when so much is at stake.