Non-qualified stock options (NSOs) are a very popular way to compensate employees at publicly traded companies, and a wonderful benefit to receive. But the tax consequences, and how to handle them, can be confusing.

How you handle an NSO grant should depend on your personal financial situation: your objectives, your tax situation, your cash needs, the rest of your portfolio, etc. Managing your NSOs thoughtfully can lead to a huge tax savings over time. Managing them haphazardly can lead to an unwanted (and unneeded) bill to the IRS.

This post will cover how NSOs are taxed, and a few questions you should ask yourself before deciding how to handle them.

The Basics of Non-Qualified Stock Options

Stock options give holders the right to buy or sell a certain security at a certain price for a certain period of time. You can buy and sell stock options on thousands of publicly traded stocks through a typical brokerage account.

They’re used by many companies as compensation devices as well. “Non-qualified” stock options (NSOs) are often given to employees of public businesses, and can help keep employee interests aligned with the company’s. They can also be helpful for long term retention, as they tend to vest over time.

Here are a few basic terms you’ll need to know.

Strike Price: This is the price at which you have the right to purchase shares. This is often discounted from the current market price.

Fair Market Value: Fair market value (FMV) reflects the value of a company’s shares at any given time. This is easy to ascertain for large, publicly traded companies since their equity value is constantly being traded over exchanges. FMV for a given day is simply the average of the high and low selling prices on a particular trading day. For privately held businesses, FMV is typically determined by a formal appraisal or business valuation.

Vesting: Vesting is the concept of your options becoming “active”. Often companies will issue stock options that vest over time. This incentivizes employees to stick around and continue building the value of the company. A common vesting schedule might be 25% over four years. This means that if you’re issued 1,000 options, 250 will be available for you to exercise one year after the grant date. Another 250 would vest after two years, and so on.

Grant Date: This is the date the company gives you the options initially. Vesting “clocks” start ticking on the grant date.

Expiration Date: This is the date the options expire. Note that sometimes expiration is triggered upon resignation or termination of employment. Usually you’ll have 90 days after leaving to exercise your options, but this isn’t always the case.

The Bargain Element

If you receive NSOs at work, the first time you’ll be taxed on them is when you exercise. You’re not taxed when the options are given to you. You’re not taxed when they vest.

When you decide to exercise, the difference between the fair market value of the shares and your strike price will be taxable as income. This is known as the bargain element. Your employer will include this in your W-2 income for the year.

Example:

Let’s say that your employer gave you 1,000 non-qualified stock options a few years ago that just vested. The strike price (exercise price) is $10, and equity shares of your company currently trade over an exchange at $25. The bargain element works out to $15 per share: $25 – $10. By exercising the 1,000 options, you’d be adding $15 * 1,000 = $15,000 to your W-2 income for the year.

Capital Gains

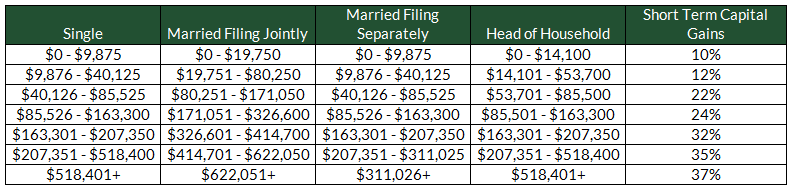

After exercising non-qualified stock options you’ll be in possession of the shares in question. You may keep the shares or sell them as you wish. The amount you’re taxed on these sales depends on how long you hold the shares. Sales of shares held less than 365 days are considered short term capital gains, and taxed at your ordinary income rate. Here are the current levels:

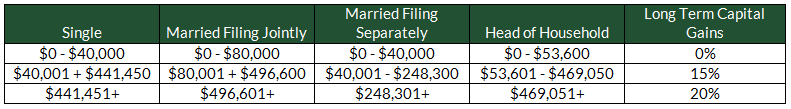

Once you hold the shares for one year or longer after exercise, any sales will be considered a long term capital gain. Long term gains are taxed at lower rates than short term gains, making a one-year holding period (or longer) a common planning objective.

Example:

Continuing the previous example, let’s say that you exercised your 1,000 options at a strike of $10 per share. The fair market value of the shares at exercise was $25 per share, meaning that you’ll have $15,000 ($25 – $10 * 1,000) added to your taxable income.

Let’s say the price of the shares pop six months later, and rise to $50 per share. If you decided to sell the 1,000 then you’d have only held them for six months, meaning the short term capital gains rates would apply. Assuming you’re in the 32% bracket, this would result in a tax bill of $8,000: (($50 – $25) * 1,000) * 32%.

But should you sell? Hanging onto the shares for another six months would qualify the gain for long term capital gains treatment. Which means you’d be taxed at 15% instead of 32%. This would result in a tax bill of $3,750 instead of $8,000: (($50 – $25) * 1000) * 15%.

Of course, the stock price could fall back to earth in the next six months. But given the tax savings, waiting another six months before selling should at least be considered.

NSO Planning Implications

Here are a couple common questions we get from people who’ve just received NSOs, as well as a couple questions we recommend you ask yourself before taking action:

Do You Have the Cash?

Before exercising ANYTHING, make sure you understand the tax ramifications and whether you plan to pony up the cash for the shares. If you don’t want to use cash out of pocket to exercise your options at the strike price, you’ll probably want to consider a cashless exercise. In a cashless exercise you’ll exercise and immediately sell additional shares, using the cash raised to pay the strike price for others.

Using our example above, if you’re exercising options on 100 shares of your company stock at a fair market value and $25 and strike price of $10, you’ll need to come up with $10 * 100 = $1000. If you exercised additional options to raise that cash, you’d need to exercise & sell another $1000 / ($25 – $10) = 67 shares.

The downside of cashless exercise is that it results in accelerated taxation. If your intention is to exercise 100 shares of company stock at a fair market value of $25 and strike price of $10, you’d be triggering ($25 – $10) * 100 = $1500 of w-2 income. But if you wanted to use a cashless exercise to avoid coming up with the $1000 cash, you’d need to trigger taxation on an additional 67. Meaning that your taxable income would jump from $1500 to $2505 (($25 – $10( * (100 + 67)). Just for avoiding the nuisance of going out of pocket to buy the initial 100 shares.

When Is the Best Time To Sell?

This is a tough question. If you’re trying to delay paying any tax whatsoever, you’ll likely want to delay exercising for as long as possible and then sell immediately once you do. That way the appreciation of the shares won’t be taxed until you sell them, and will count as w-2 income once you do.

The alternative is to exercise the shares earlier and hang on to them for a while (ideally at least a year). The benefit here is that more of the appreciation can become eligible for long term capital gains rates if held for longer than one year. The only amount taxed as w-2 income, at higher rates, is the bargain element between the fair market value and strike price at exercise. The drawback, of course, is that you have to pay tax on that w-2 in the year of exercise.

Should You Make an 83(b) Election?

Making an “83(b)” election is a popular strategy that allows you trigger a taxable event before your NSOs actually vest. This can be beneficial if you believe your company’s stock price is poised to jump before taxable income is triggered at vesting. Although it means you’ll need to pay tax sooner, the amount of w-2 income triggered could potentially be far lower.

The 83(b) election itself relates to a section of the tax code that allows for this type of maneuver. Note though that while the tax code allows NSO plans to offer these elections to participants, NSO plans don’t necessarily have to. It’s a choice made by individual plans, described in its plan document.. This means you need to check with your plan to determine whether it’s available if you think you’d be a good candidate.

Are You Planning on Leaving the Company?

Once you leave your company, either voluntarily or otherwise, you typically have 90 days to exercise your vested options. After that date NSOs typically expire. This is a worst possible scenario. As important as it is to manage tax liability, taking advantage of your options’ bargain element still comes first. If that means tallying up a big tax bill right after you leave your employer, so be it. I’d much rather make a buck and pay tax on it than let the options expire worthless.

That being the case, a common NSO strategy is to exercise vested options consistently over time. That opens the door on long term capital gains rates, and keeps your unexercised options at a minimum.