Many of us feel an innate need to make contributions to tax advantaged retirement plans every year. When it comes to personal finance, much of what we read, hear, and see in the media centers on plowing money into your 401k every single year, no matter what.

In general it’s great advice. Save early and often, and take advantaged of tax deferred compound income. And if you’re lucky, your employer might match your contributions or make a profit sharing contribution. If we’re going to build up enough savings to sustain our lifestyle through retirement, this makes perfect sense.

Every once in a while I’ll speak with an entrepreneur who is really working hard to build their business, but they can’t quite scratch together enough cash to fund their retirement plan for the year. They’re putting all their effort into their company and things are still just a bit tight financially. They feel like they should be contributing to the 401k they set up for themselves and their employees, but they can’t quite pull the funds together to do so.

For many business owners I speak with, the fact that they can’t fund their 401k for the year makes them feel inadequate. Like they’re not good at their job. Like they’re unsuccessful.

I wanted to write a post on this topic because entrepreneurs who feel this way are missing the forest from the trees. Regardless of whether you contribute to a retirement plan in a certain year, it’s far more important to sustain & grow your business. Because if you can find a way to grow your business each year, the increased value in your ownership stake will dwarf what you could ever contribute to 401k!

It’s OK to Skip a Few 401(k) Contributions

Aswath Damodaran is a professor at NYU who teaches corporate finance, investing, and business valuation. He publishes estimates of EBITDA multiple benchmarks for use by his students, and anyone else who’s interested. EBITDA is an accounting measure that stands for “earnings before interest, taxes, depreciation, or amortization”. It’s a decent proxy for free cash flow, and is often used in quick and dirty business valuations.

For example, let’s say your business does $350,000 in revenue one year. If your costs & operating expenses totaled $250,000, you’d be left with EBITDA of $100,000. Here are Professor Damodaran’s valuation estimates for 2018. The list of multiples ranges from 5-6x EBITDA on the low end to nearly 20x on the high end. Meaning, it’s very possible that a business with $100,000 in recurring annual EBITDA is worth at least $500,000 ($100,000 * 5).

Now, when I mean quick and dirty, this example is very quick, and very dirty. Business valuation is a field of its own, and not something I claim to be half way competent in. There are a ton of factors that go into what a business is worth, and EBITDA certainly doesn’t paint the whole picture. Nevertheless, the takeaway is important: if you can build a business with recurring annual revenue, that will persist even if you’re not around to drive sales, there’s a good chance you’re creating far more wealth than what you would maxing out your 401k contributions.

A Quick Example

My nerd side won’t let me continue writing this post until I run the numbers on what that break even point is. Let’s use this example: you max out out retirement plan contributions at work with $19,000 in employee deferrals. Let’s also say that your employer provides a matching contribution of $5,000, making your total contributions $24,000 per year. You decide to start a business, foregoing these deferrals and matching contributions (at least for now). Between state and federal income taxes you’re in the 30% marginal tax bracket.

Counting the tax advantage of having your savings in the 401k, you’d be foregoing $24,000 / (1 – 0.3) = $34,286 per year. Even if your business were in an industry commanding a terribly low EBITDA multiple (like coal mining or oil exploration, according to Dr. Damodaran), you’d only need to add $34,286 / 5 = $6,857 per year in recurring annual EBITDA to break even. Yes, you have some ground to make up after leaving a steady job to start a company – meaning that you’d need to build enough revenue to pay yourself a salary before allocating new revenue to EBITDA. This might be $100,000 more than your operating costs. But if you can get there, most viable businesses won’t have much problem bringing in another $7,000 in free cash flow once they’re up and running.

Wealth Creation Over Longer Periods of Time

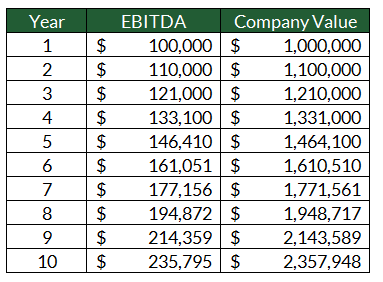

There are more than a few flaws in the example above, and that’s OK. My point here is to demonstrate that creating recurring revenue, recurring cash flow, and recurring profits through entrepreneurship is a tremendous way to build wealth. Let’s run with the example above over a longer period of time. This time, let’s say that you have the same $350,000 in revenue and $250,000 in costs (including your own salary of $100,000). Let’s also assume that you’re able to grow your EBITDA of $100,000 by 10% each year over a 15 year period. With an EBITDA multiple of 10, here’s how the value of your company would grow:

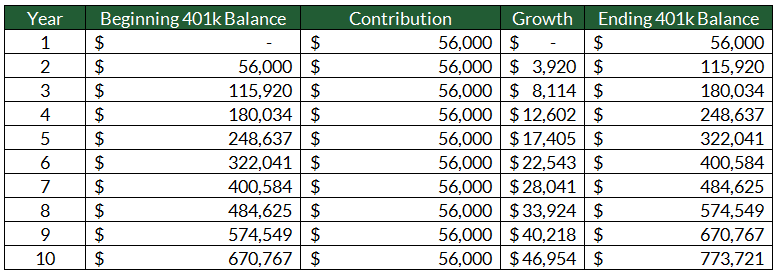

Growth can be challenging, but 10% per year is a very reasonable number. And the resulting company value after ten years is drastically higher than what could expect by maxing out a 401k. Making $56,000 annual contributions (the max this year) that grow at 7% per year only gets you to $773,721 after ten years!

Yes, I’m ignoring the tax advantage of making the deductible contribution here. The point is it’s OK to miss a few 401k contributions because you’re focused on building your company. If you do so consistently, the enterprise value you’re building will be far, far greater than what you could ever build in a tax advantaged retirement plan.