June Recap and July Outlook

After a barely positive May, June saw the bear market return across indices. We ended up with the worst first half performance since 1970. A mid-month surprise 75 basis point rate hike at the June FOMC meeting, followed by Fed Chairman Powell’s testimony to Congress in which he indicated aggressive rate increases at the July and September meetings, convinced markets that inflation is the priority for the Fed.

Chairman Powell indicated that the current level of inflation – a historic 8.6% – will require a short-term rate of at least 3% to get to a neutral level. With the Fed funds rate currently at 1.50%-1.75%, that means several more rate increases this year.

Are we headed for a recession? Are we already there? Or is the Fed’s plan to slow the economy and bring the labor markets into balance beginning to work?

- The Atlanta Fed has created a model of GDP that attempts to forecast the key economic indicator, removing the lag of the official measure from the Bureau of Economic Analysis. The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 is -2.1 percent on July 1, down from -1.0 percent on June 30

- The official GDP number for the first quarter was a decline of 1.6%. If the GDPNow forecasts proves accurate for the second quarter, that would fit technical definition of a recession – two quarters of economic contraction

- The June Manufacturing PMI® registered 53 percent, down 3.1 percentage points from the reading of 56.1 percent in May. This figure indicates expansion in the overall economy for the 25th month in a row after a contraction in April and May 2020. This is the lowest Manufacturing PMI® reading since June 2020, when it registered 52.4 percent

- The U.S. Bureau of Economic Analysis (BEA) released the Consumer Spending estimate on June 30. Personal consumption expenditures (PCE) increased $32.7 billion, which equates to 0.2 percent – but inflation-adjusted spending dropped 0.4%

- The Department of Labor reported that in the week ending June 25, the advance figure for seasonally adjusted initial unemployment claims was 231,000, a decrease of 2,000 from the previous week’s revised level

What Does All of That Data Add Up To?

The official GDP number doesn’t come out until July 28th, and a lot can change in a month. Upcoming data releases on labor markets and inflation will guide what the Fed does at the July FOMC meeting, and more data will hopefully remove some of the uncertainty, particularly if inflation trends back down, even a little bit.

Chairman Powell has been clear that the “Fed put,” in which the Fed will back off on rate “We fully understand and appreciate the pain people are going through dealing with higher inflation, that we have the tools to address that and the resolve to use them, and that we are committed to and will succeed in getting inflation down to 2%. The process is highly likely to involve some pain, but the worse pain would be from failing to address this high inflation and allowing it to become persistent.”

The pain Powell is talking about isn’t just stock market pain – labor markets will contract, which means wage gains may not persist and unemployment will increase.

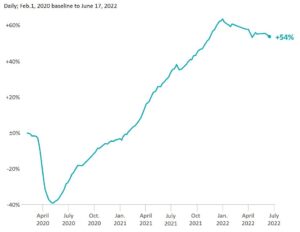

Chart of the Month: Labor Markets May Be Loosening

Bringing labor markets into balance is a key objective for lowering inflation.

Change in Indeed Job Postings

Source: Data: Indeed; Chart Axios Visuals

Equity Markets

- The S&P 500’s year-to-date return was -20.6%, the worst first half since 1970

- The Dow Jones Industrial Average dropped 15.3% year-to-date for the worst first half since 1962

- The Nasdaq decline of 29.5% was worst first half on record

Source: All performance as of June 30, 2022

Bond Markets

The 10-year U.S. Treasury ended the month at 2.98%. Intra month, the key rate reached 3.49%. The 3-month U.S. Treasury ended June at 1.77%.

The Smart Investor

There isn’t enough data to know if the Fed will be successful in engineering a soft landing, or if we do enter a recession, how long it will last. Controlling the things you can is important.

Review spending and consider putting off big expenses. Top up emergency funds, and shift from spending to saving. We still have six months left in the year, so don’t neglect 401(k) savings or education savings.

Stock prices have fallen, so it may be time to take advantage of tax-saving strategies. Tax-loss harvesting can offset gains elsewhere. If you’ve been considering a Roth conversion – now may be an ideal time. Lower stock values mean lower taxes, and any growth on these assets in a Roth account will be tax-free.

Keep your long-term plan in mind. Managing emotions is a balance of taking a realistic view but keeping your goals in front of you. Don’t make impetuous moves, and focus on the things you can control.

The information on this site was produced by a third party and is provided “AS IS” without warranties of any kind either express or implied. Three Oaks Wealth does not warrant that the information on this site will be free from error. Information contained on this site should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security.