For most of us in the US today who do not live in the middle of populous cities, driving a car from place to place is a way of life. Some of us share a car with a parent, spouse, or friend. Some of us choose to rent cars by the week, day, or even hour as we need them. Those of us who don’t are faced with a major financial decision every 3-15 years: should you lease your next car or buy it?

The car buying experience is not one that many people enjoy. Neither is leasing, for that matter. You generally start by doing some research online. You identify what you need from the car in terms of size, capacity, fuel economy, etc., and then look at different makes and models. Maybe you read some reviews on Consumer Reports or Kelley Blue Book to get a feel for quality, dependability, and price. Then, once you have an idea what kind of car you’re really looking for, you start to look at the economics.

How much do want to spend? New or used? Should you finance it or pay cash? And then the grand question: what about leasing a car?

Leasing a car would require less money down, which probably means you could be driving a nicer car. Yes, you’d have a mileage limit, but who knows what your life will be like in 3 years after a lease would end? Would you still want to be driving the same car anyway?

There are several moving parts surrounding the whole “lease vs. buy” decision. This post will discuss the economics of the decision, as well as the pros and cons of leasing vs. buying a car.

Buying a New Car With Cash

To review the economics of buying vs. leasing, I ran the numbers comparing a $40,000 new car purchase. I took a look at three different options:

- Buying the car with cash

- Financing it over a five year period

- Leasing it over a three year period

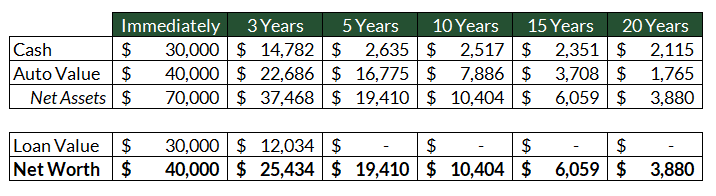

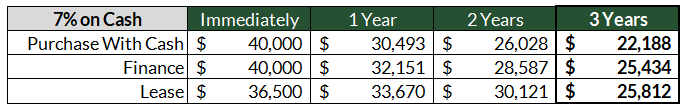

The charts you’ll see below compare cash available, car value, loan value, and net worth over several different time intervals. To start, I assumed that you have only $40,000 to spend. So, if you decided to buy the car with cash, you’d be the proud new owner of a $40,000 car, but have $0 left in your bank account.

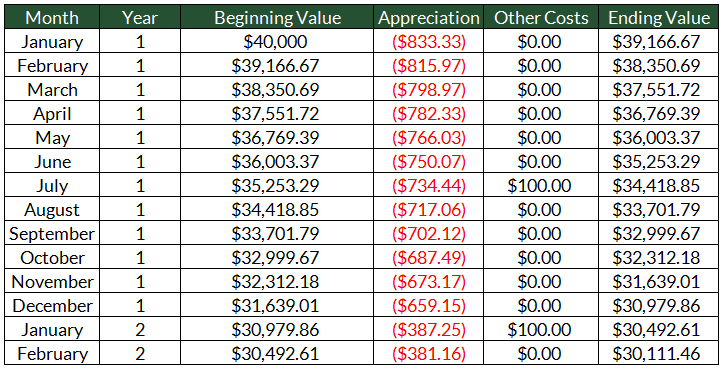

As you already know, the car’s value would plummet as soon as you drove it off the lot. And while the annual amount your car depreciates will depend on make and model, several sources I looked at believe 25% in first year depreciation is reasonable. To model this out, I chopped the 25% annual depreciation in year one into 2.08% monthly increments. Based on the same sources, I assumed depreciation in all future months would be 1.25% (15% per year).

I also included $100 of maintenance every six months, since oil changes and other basic maintenance are usually included in an auto lease. Rather than summing these additional costs separately, I added them to the depreciation of the car. Realistically you’re probably not using your car as collateral to finance an oil change, but this still gives us a decent apples to apples comparison. Here’s what the numbers look like over the first few months:

And here’s where you’d net out after 5, 10, 15, and 20 years:

Pretty straightforward. You pay $40,000 for a new car. The car’s value falls every year thereafter.

Financing a New Car

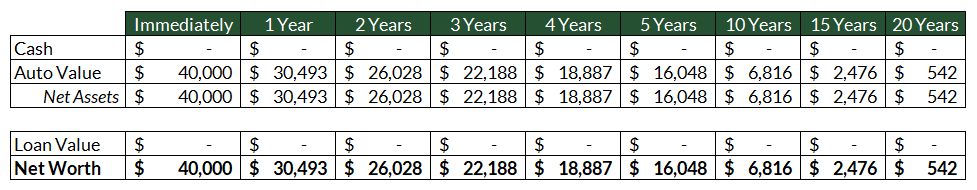

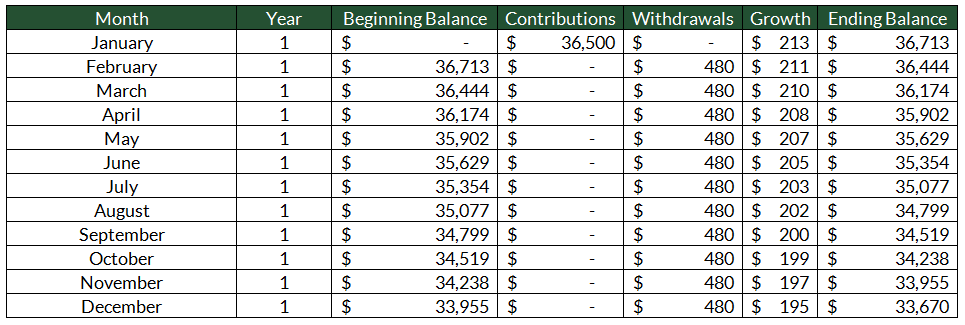

If you decided to finance the new car purchase rather than paying cash, the picture would be different. I assumed here that we put down $10,000 of the $40,000 purchase, financing the other $30,000 at 3% over five years. Borrowers with decent credit can probably find financing these days for less than 3%, to be honest. But 3% is reasonable, and a nice, round number.

Financing the car enables you to free up $30,000 worth of cash in the purchase. (Or, it enables you to afford a $40,000 car if you only have $10,000 to put down in the first place). Here, let’s assume you have the $40,000 purchase price available. With the financing, you get to keep $30,000 free for other purposes – presumably for investment elsewhere.

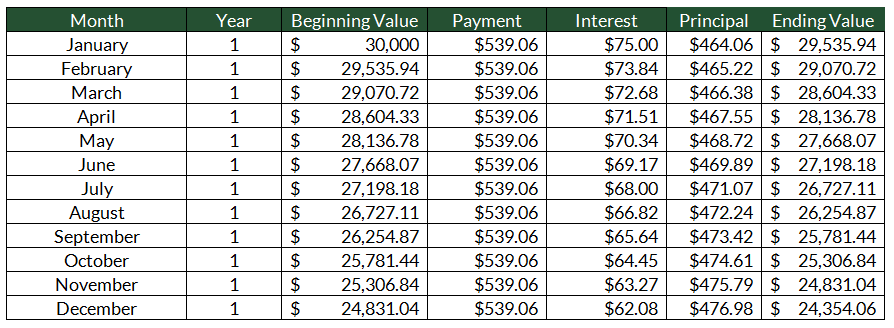

The monthly payment on a $30,000, 3% loan amortized over five years works out to be $539.06. Here’s the amortization schedule over the first 12 months:

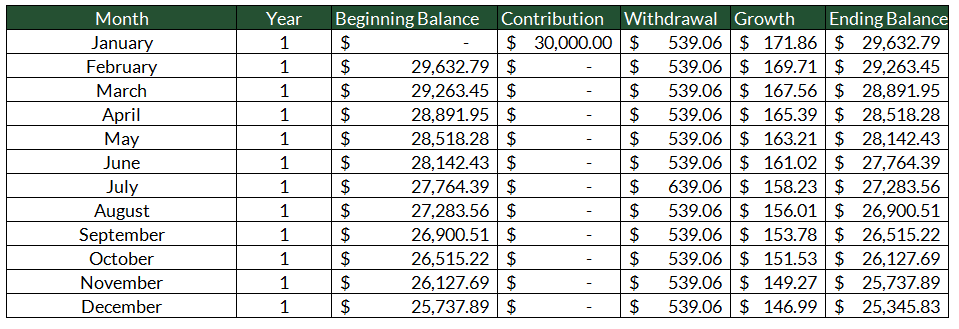

By financing, you’d have $30,000 left in your bank account. $539.06 would need to be withdrawn each month for payments, on top of the $100 every six months for maintenance. If the remaining cash grew at 7% per year in a balanced investment portfolio, here’s what the first 12 months of cash flow would look like:

And, here’s what your assets, liabilities, and net worth would look like over 3, 5, 10, 15, and 20 year intervals:

Notice that the cash available falls rapidly over the first five years as you pay off the loan, but levels out thereafter.

Leasing a New Car

And what about the lease? Leasing a car is quite a bit different than purchasing one. There is typically a down payment involved, a monthly payment for the term of the lease, and a restocking fee once the lease has concluded.

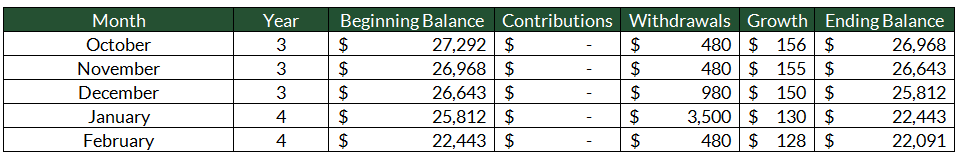

Here, I looked up lease terms on a few different new cars with MSRPs around $40,000. For a 36 month lease, the average down payment was close to $3,500. The average monthly payment was about $480. Note that the monthly rates advertised on leases are not actually what you end up paying. Other fees, like acquisition fees, are incurred at inception but spread out over the term of the lease in your monthly payment. I also included a restocking fee of $500.

By putting down only $3,500, you’d have $36,500 left in the bank to play with. Here’s what the first year of cash flows would look like:

While this situation looks pretty favorable in year one, it ends up being costly over longer periods of time. When the lease concludes you’re dinged with the $500 restocking fee AND you’re without a car. You could purchase another car, of course, or find another lease. Here’s what the cash flows look like at the end of lease #1 and the beginning of lease #2:

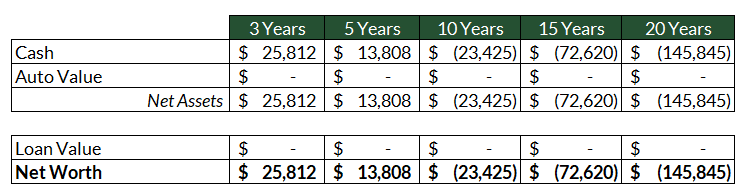

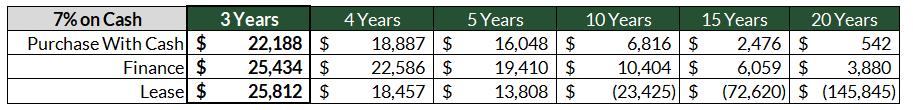

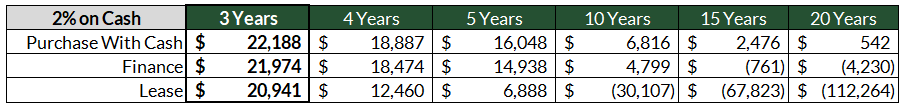

The costs stack up quickly, and there’s no residual auto value to offset them with. Here’s what the net effect looks like over the same time intervals, assuming that you began a new 36 month lease with the same terms every three years:

The Verdict

So what’s the best option? At the end of year three leasing the car leaves you in the strongest position financially. This option give you a nice set of wheels with the least amount down and relatively little out of pocket each month. Plus all your maintenance is taken care of by the dealership.

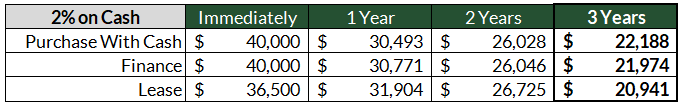

That said, 7% return on the cash you’d be saving is a pretty big assumption. It assumes that you’d be taking every penny of extra cash and using it to buy stocks and bonds in a diversified portfolio. A more likely scenario for many people is that it doesn’t get invested, but sits in the bank instead. So, I ran the numbers again using a 2% return on cash instead of 7%.

In this scenario you’re best off paying for the car with cash. This makes sense when you compare the 100% down option to the financing option: the rate you’d be earning on your bank deposits is actually less than the rate you’d be paying on an auto loan.

It makes sense when compared to the lease, as well. Since you’d be putting substantially more money in the bank with a lease thanks to the lower down payment, the lower interest rate impacts the 3-year value quite a bit more.

But look what happens when we stretch the time horizon our further. As soon as the lease renews after the first three years, purchasing the car becomes the better option. At a 7% return on cash financing is the better option, as it’s a great rate than the 3% you’d be paying on the loan. But at 2%, again, paying cash is better.

So what does all this mean? To me it comes down to timeline: you’re better off buying the car if you think you’ll hang onto it for more than three years. If you think you’ll trade the car in after 36 months, then go ahead with the lease.

These numbers also tell me that there’s a TON of value in the latter years of a car’s useful life. If you can squeeze an extra 2-3 years out of an auto before swapping it for something fresh, you’re instantly saving yourself thousands of dollars. Driving the same car for 20 years as the model shows might be aggressive. Nevertheless, going into a purchase expecting to drive the car for 10-15 years is a great way to approach the transaction.

But not everyone is comfortable with that idea. Many people in sales roles, for example, feel the need to drive around a fresh set of wheels every few years to produce a successful image. There’s nothing wrong with that. Just know that lease renewals are expensive, and there’s a much less costly way to get on the road.

Pros & Cons of Leasing vs. Buying

Summing all this up, you’re probably better off buying a new car than you are leasing one. Unless you plan on swapping the car out for something else in three years or less:

Pros of Leasing:

- Potential for lower monthly payments

- No maintenance costs

- No selling hassle

- New cars every few years

Cons of Leasing:

- Insurance is more expensive

- Miles are limited

- No customization

- More expensive long term

What do you think?

Has leasing cars worked out in your favor?