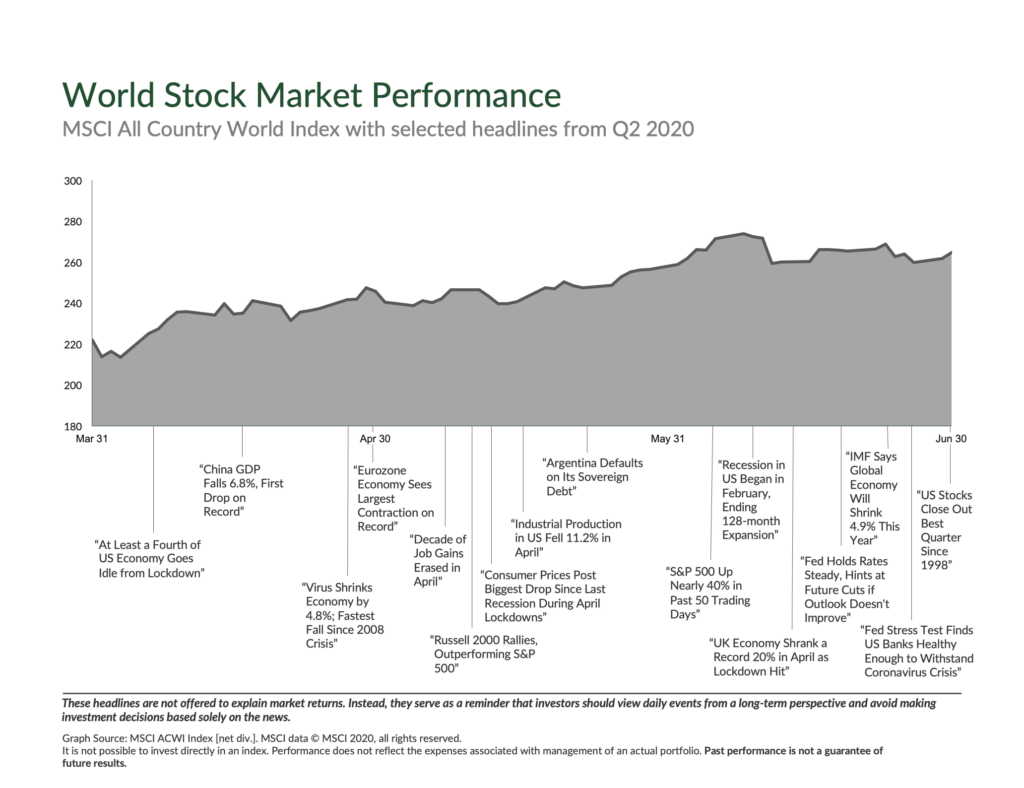

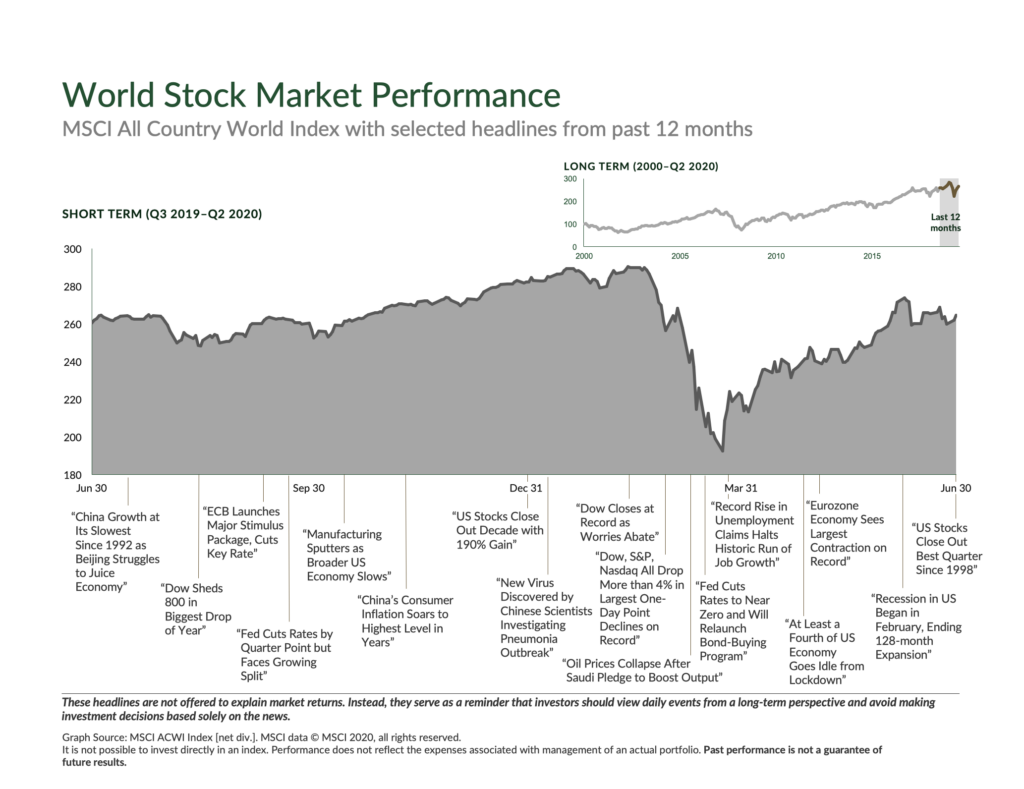

Well that was an interesting quarter. The second quarter of 2020 brought us the fastest selloff into a bear market in history, which subsequently turned out to be one of the shortest in history. Equities around the world continue to whipsaw investors amid COVID-19 and the resulting fiscal and monetary stimulus packages from governments around the world. In short, the markets seem to be at odds with the economy.

Interest rates have fallen in lockstep and show few signs of rising any time soon. This makes for great refinancing opportunities for borrowers, but poor bond yields for long term investors. These are interesting and precarious times.

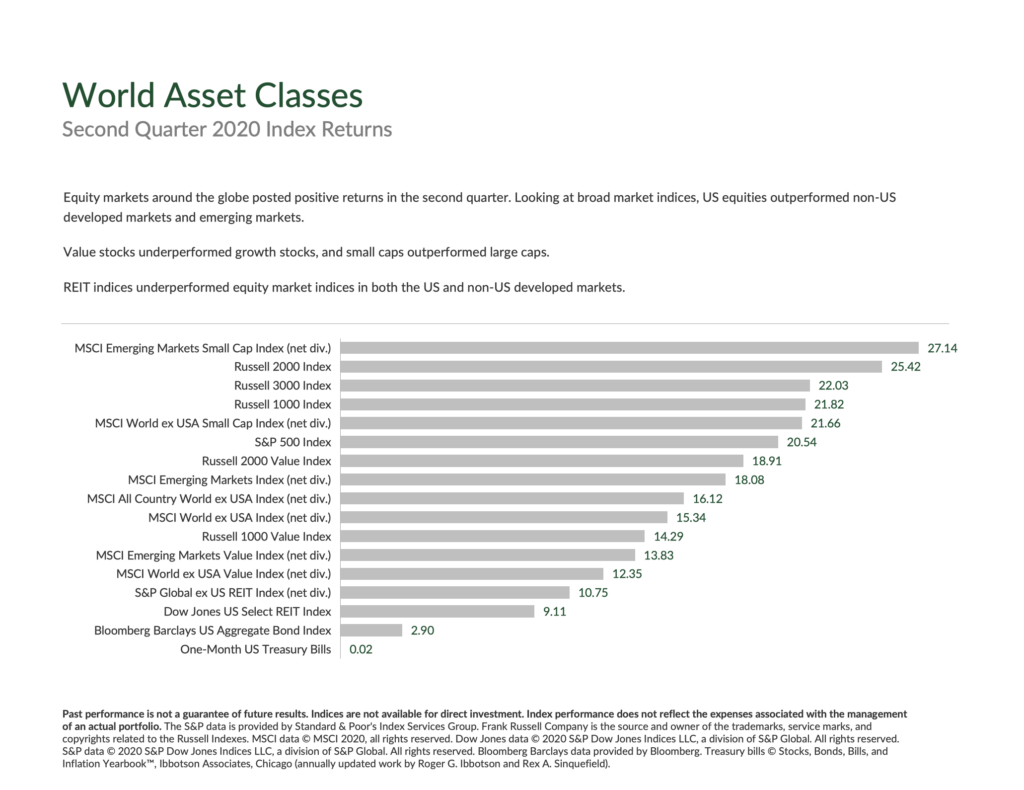

Here is this quarter’s market update.

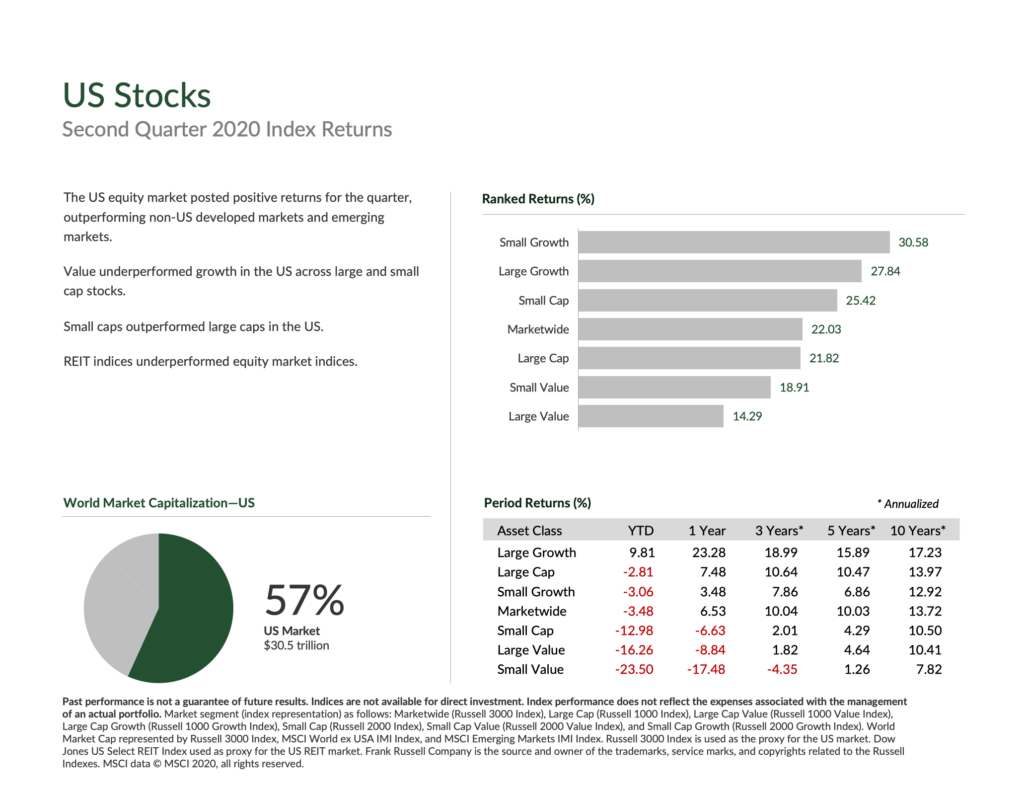

US Stocks

Many of the headlines you’ll read these days about the US equity markets comment on the strange juxtaposition of current equity values and the economy. On the one hand we are in the middle of a pandemic. Unemployment is still around 14% nationally, and we are still knee deep in the first wave of the virus.

And yet…..the markets are approaching record highs again! The tech sector continues to boom, money continues to pour into equities, and here we are, looking back on a Q2 that brought a 20% gain to the S&P 500.

I chimed in on this topic in a recent blog post [The Economy is Not the Stock Market], and tried to explain my take about how this could be. I’ll summarize that post with two thoughts:

- The economy is not the stock market (bet you could have guessed that one from the title).

- There is a massive amount of fiscal and monetary stimulus in the system.

Between Congress and the Federal Reserve, total relief measures sum to about 30% of the Congressional Budget Office’s 2020 estimate U.S. GDP. This is a mind bending amount of support. The Fed’s balance sheet has expanded to $7.2 trillion now that it’s again buying up corporate bonds, and The CARES Act and subsequent legislation have been a bazooka of economic stimulus. Stocks like stimulus.

Looking ahead, the road looks tougher. The Fed and our national legislators seem to have used their best & biggest bullets already, and if additional rounds of stimulus are needed and/or passed, they are unlikely to be as effective as the first round.

On top of that, the market looks vulnerable to bad news right now. The Coronavirus pandemic is nowhere remotely close to over, and we’re on the precipice of a very unpredictable Q2 earnings season.

We are not out of the woods yet. For anyone out there who was terribly panicked by the rough patch at the end of March, now would be the time to taper back on your equity exposure. It’s just as likely that we see another sell off as it is we see another 10% rally.

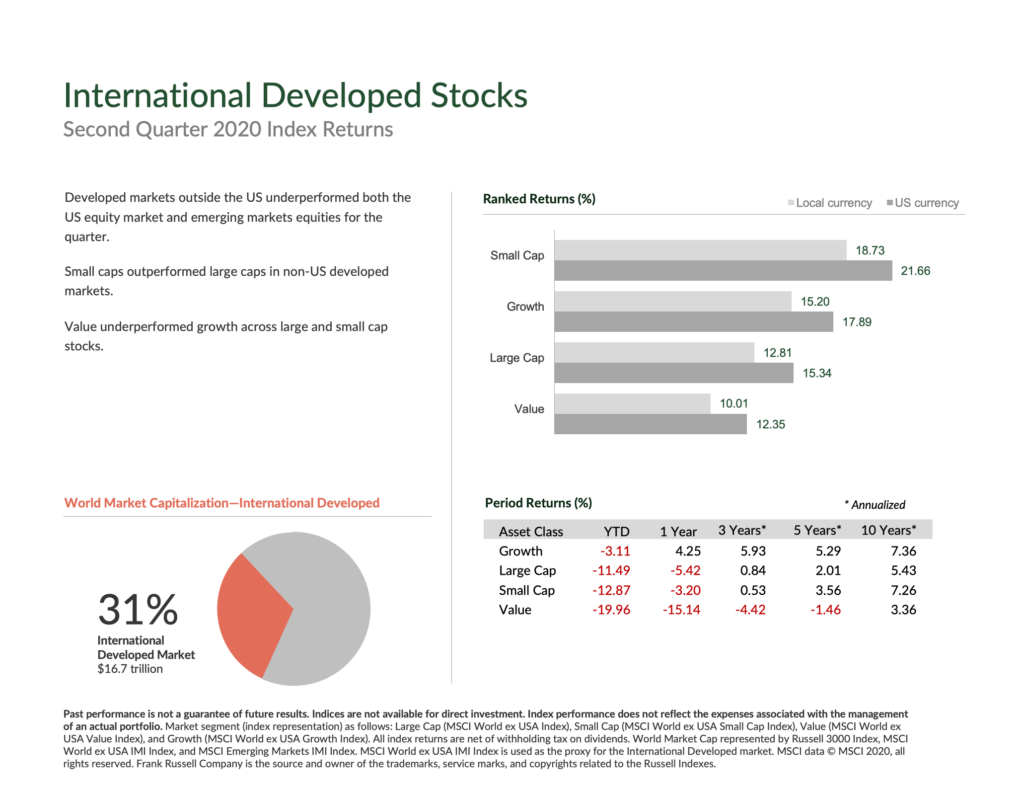

International Developed Stocks

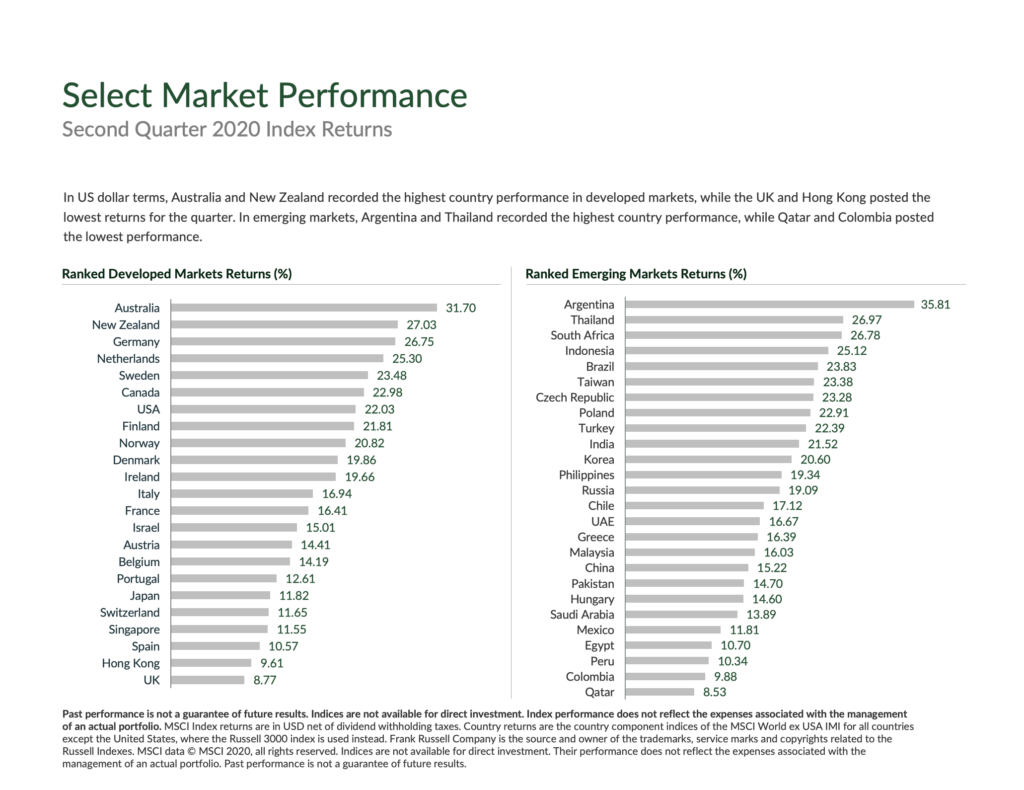

Outside the US, equity returns in the developed countries in Q2 seemed to closely resemble that country’s success at handling COVID-19. Much has been written about how successful New Zealand and Germany were at restricting spread. Those two countries had two of the strongest equity returns on the quarter.

Like in the US, developed economies have mostly adopted substantial economic stimulus packages too. The European Central Bank plans to buy corporate bonds for at least the next 12 months, in a widespread effort to prop up bond markets and inject money into its monetary system.

So far the stimulus has been effective. But again, just like here in the US, equity markets in other countries remain vulnerable. If we’re unable to quell the spread of the virus around the globe further, stimulus packages will not be as effective in subsequent rounds.

It may well come to fruition though. Inflation forecasts from the European Central Bank are coming in below 2% per year all the way through 2022. And in today’s “printing happy world”, that’s a green light for central bankers to put the foot on the gas. Even if additional stimulus is less effective, it would likely provide some type of floor to market wide equity values. Or at least a cushion, perhaps.

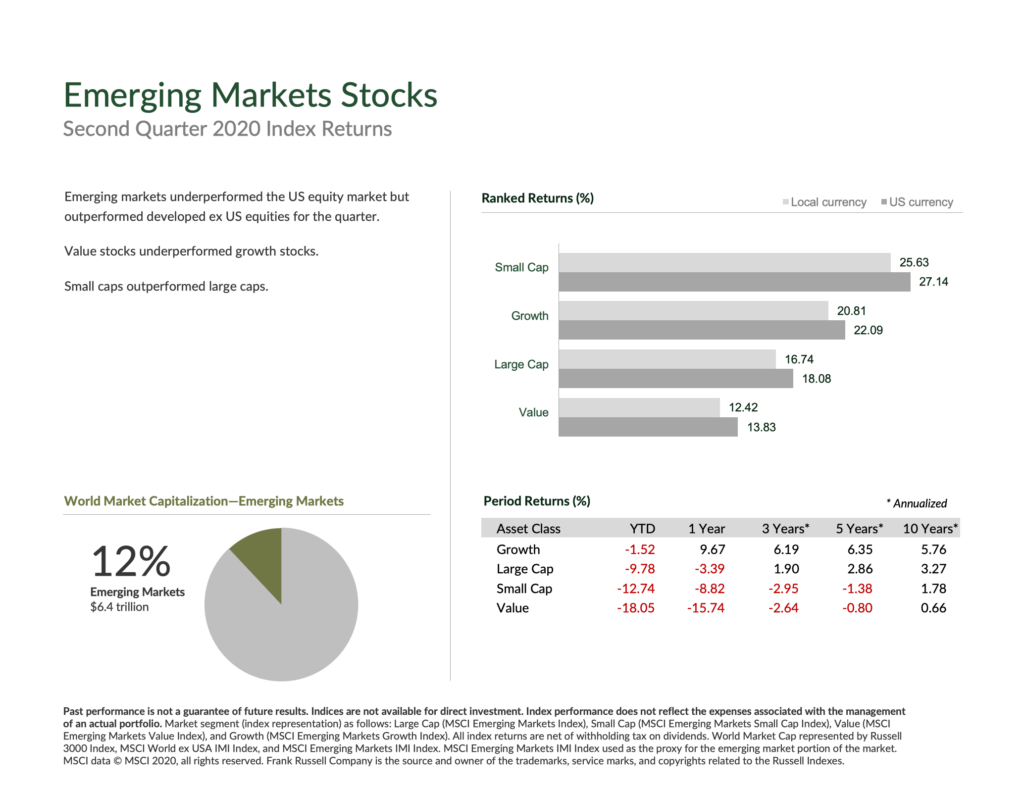

Emerging Markets Stocks

The emerging markets posted exceptionally strong returns in Q2, and that trend has continued thus far into Q3. While many different countries across the emerging markets saw a strong rebound, much of the focus has been on China.

For one, China strong armed Hong Kong with a new security law late on June 30th – just an hour before the 23rd anniversary of the hand off from China to Britain. The law essentially gives Beijing the power to shape life in Hong Kong. “National security” provisions allow China the ability to curtail freedom of speech and protests. Under the guise of community stability, of course.

There hasn’t been as strong a response from the White House as we might expect under the current administration. At least not yet. There is legitimate risk that trade tensions could escalate with any sort of retaliation, putting unneeded pressure on an already fragile economy. Perhaps that’s why the President hasn’t taken action.

Regardless, China appears to be in the middle of a strong V-shaped recovery. The country’s purchasing manager’s index from June came in at 51.2, compared to a consensus estimate of 50.5. While it’s hard to trust the data, it’s still looking positive.

As always, emerging markets equities are an exceptionally volatile asset class. They can bring outsized returns over the long run, but only if you can maintain a steady allocation. If 2020 has taught us anything, this is easier said than done.

Fixed Income

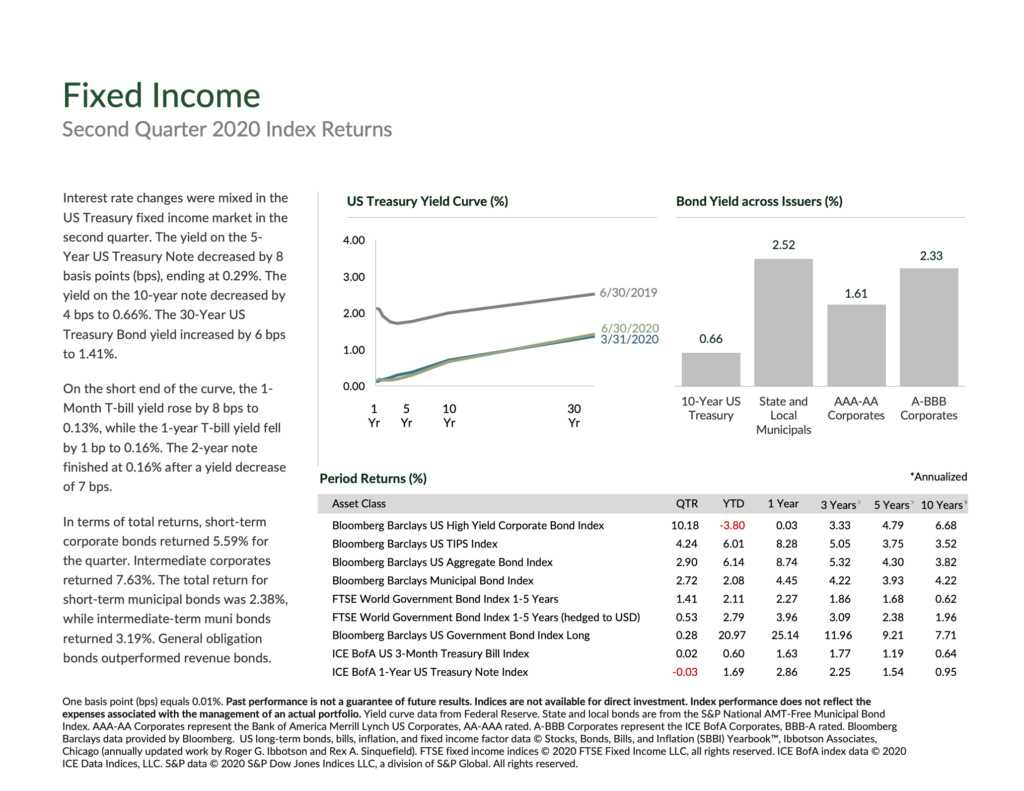

The second quarter was strong for bonds across the board, just as it was for stocks. As the Coronavirus pandemic began to spread across the world toward the end of Q1, corporate bond prices plunged. Fears about revenue drying up and the possibility that large, otherwise stable corporations might have trouble making debt payments caused the asset class to falter across nearly all maturities and credit qualities.

Then the Fed stepped in. As you may have heard, the Federal Reserve announced in late March that it was launching both the “Primary Corporate Credit Facility” and “Secondary Corporate Credit Facility”, allowing the central bank to purchase up to $750 billion of corporate bonds and related ETFs.

The move was successful in shoring up the bond market. The Fed officially started buying ETFs on May 12th, individual corporate issues on June 16th, and since then prices have rebounded.

Going forward, there is still genuine concern that a prolonged “pandemic restricted” economy could seriously hurt certain areas of the bond market. While the Fed’s primary and secondary lending facilities provide support for investment grade corporate bonds, they do not allow for purchases of high yield bonds, preferred stocks, or bank loans. And if the economy struggles further, these would likely be some of the most “at risk” debt securities.

Meanwhile, U.S. government issues have surged this year amid the flight to quality. As you can see below, the Bloomberg Barclays Long Term U.S. Government Bond Index is up 20.97% on the year. This coincides with a massive drop across all terms of the yield curve over the last 12 months, which you can also see in the chart below. With short and long term yields so low, fixed income investors should not expect much return without moving into securities with greater duration and/or credit risk.

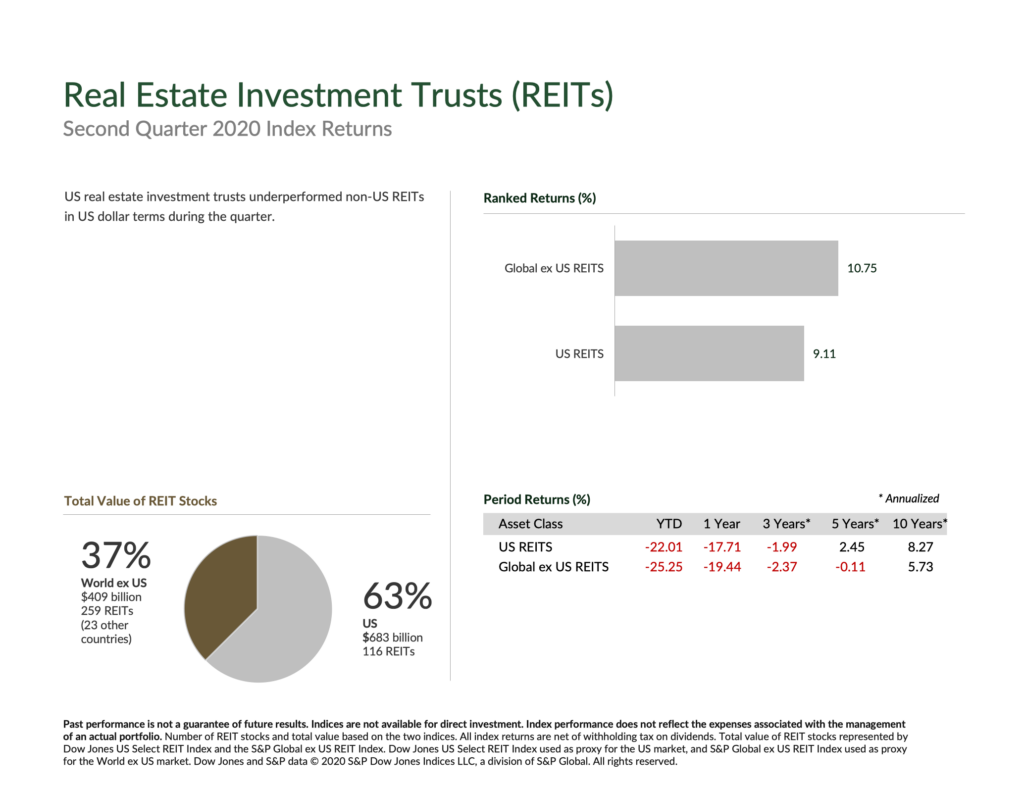

Real Estate Investment Trusts (REITs)

REITs recovered handily in Q2 as well. REITs are an interesting animal, and an asset class that’s seen very strong growth and returns over the last decade. (8.27% annualized in the US over the last decade, in fact). It’s also an asset class that’s particularly susceptible to COVID-19.

REITs come in all shapes and sizes. But for those of you broad based indexers with a wide exposure to all the REITs, your REIT allocation will have holdings in shopping malls, corporate office buildings, hospitals, residential homes, and perhaps mortgages financing of all of them. Some hospitals might do OK throughout the pandemic (arguable), but there will undoubtedly be pressure on shopping malls and office buildings.

Think about how many times you’ve had to listen to someone on a Zoom call drone on about how the entire work environment is going to change. About how corporations will no longer need massive physical presences, and how it’s actually more efficient to have staff work from home. It’s a cliche I’m rapidly growing tired of, but also a valid point.

REIT income is supported by mortgages paid by owners, and lease agreements paid by tenants. While we may not see REITs plummet because of large numbers of businesses going belly up, there will be a lot of pressure on corporate real estate owners when leases are up for renewal. When you know how to have staff work from home, you’re not forced to pay up for A+ office space. This will take a couple years to play out (office leases are typically 3-10 years in duration), but is growing increasingly likely.

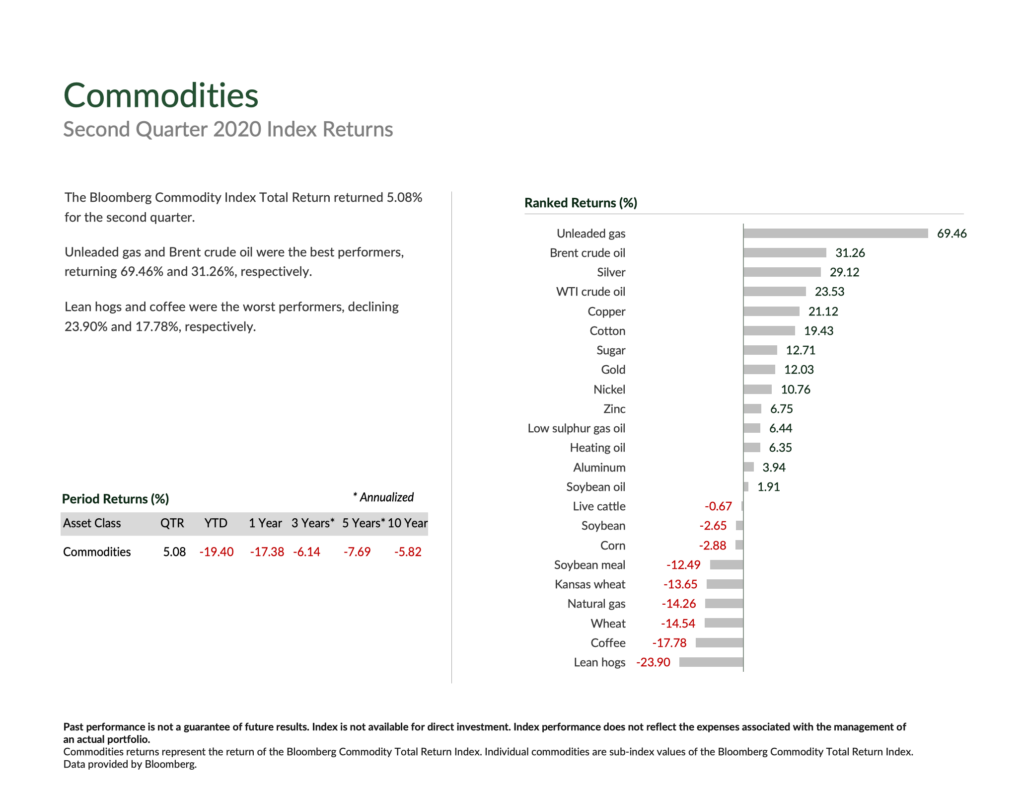

Commodities

Take a look at the chart below, but try not to jump out of your seat. Unleaded gas was up 69.46% in Q2, while brent crude rose 31.26%. These are astounding numbers for a three month period, but remember the market dynamics at the end of March. Oil futures were trading at negative $40 per barrel just before contract expiration, thanks to demand falling off a cliff and a glut of supply. This was temporary, of course, but a definite “history maker”.

So commodities in general started the quarter at quite a low point. Fast forward three months and they’ve begun to normalize. Brent crude now trades at around $42 per barrel, and unleaded gas is back to between $2 and $3 per gallon around the U.S. That may not last though, as many parts of the country are experiencing rising COVID cases again. The possibility of more “stay at home” orders would put another damper on oil and gas both, and likely drive prices back down. Commodities are a volatile asset class, which this pandemic has been quick to highlight. I wouldn’t expect that to change.