I’ve written and published quarterly market updates religiously since launching Three Oaks Capital Management back in 2014. At first I had physical newsletters printed out on six thick pages of card stock, and mailed them out to clients and other contacts. Shortly afterward I began adding the commentary to www.3oakscapital.com, and started calling the distribution “Investment Insights”. A few years after that I abandoned the print version, and distributed the commentary solely through the blog.

Writing a market update at all is starting to become less common in the financial planning community. Many of my peers, colleagues, and friends prefer NOT to publish or distribute market updates at all, as they believe it diverts their clients’ attention away from long term & consistent strategies.

The market updates I’ve written have evolved quite a bit over the years, but they’ve received a good amount of positive feedback all along. Clients like to know my take on the markets, and feel comfortable knowing that I have my eye on them. Other readers and contacts seem to enjoy the content too.

This quarter I am making a minor change to the format of Investment Insights. While I plan to continue producing them, starting this quarter all new editions will live on Above the Canopy as opposed to Three Oaks Capital’s blog. We have other changes to the blog, format, and site forthcoming, and this change makes the most long term sense. (Hint: there is a podcast on the way). But from here on out, you’ll find market updates on this site as opposed to Three Oaks Capital’s.

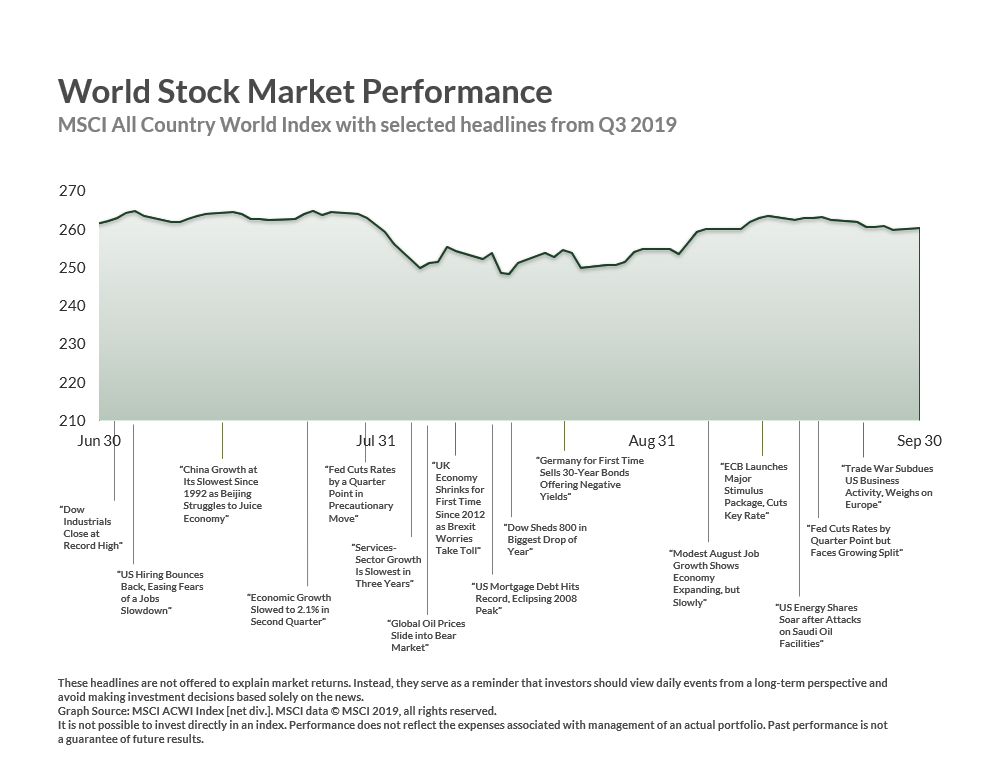

Speaking of this quarter’s edition, we have a number of items to touch on. First, the Federal Reserve reduced short term interest rates in both of their third quarter meetings. There continues to be a lot of trade uncertainty globally, inflation remains low, and there continues to be some weakness in global economic growth. This is the first time the fed’s reduced rates in ten years – the last time being December of 2008, when it cut rates from a range of 75 – 100 basis points to 0 – 25.

Elsewhere, US equities had another strong quarter, value shares outpaced growth in the small cap space, and the yield curve in US rates inverted for three days in August. Read on for more details.

**Source: Dimensional Fund Advisors

**Source: Dimensional Fund Advisors

U.S. Equities

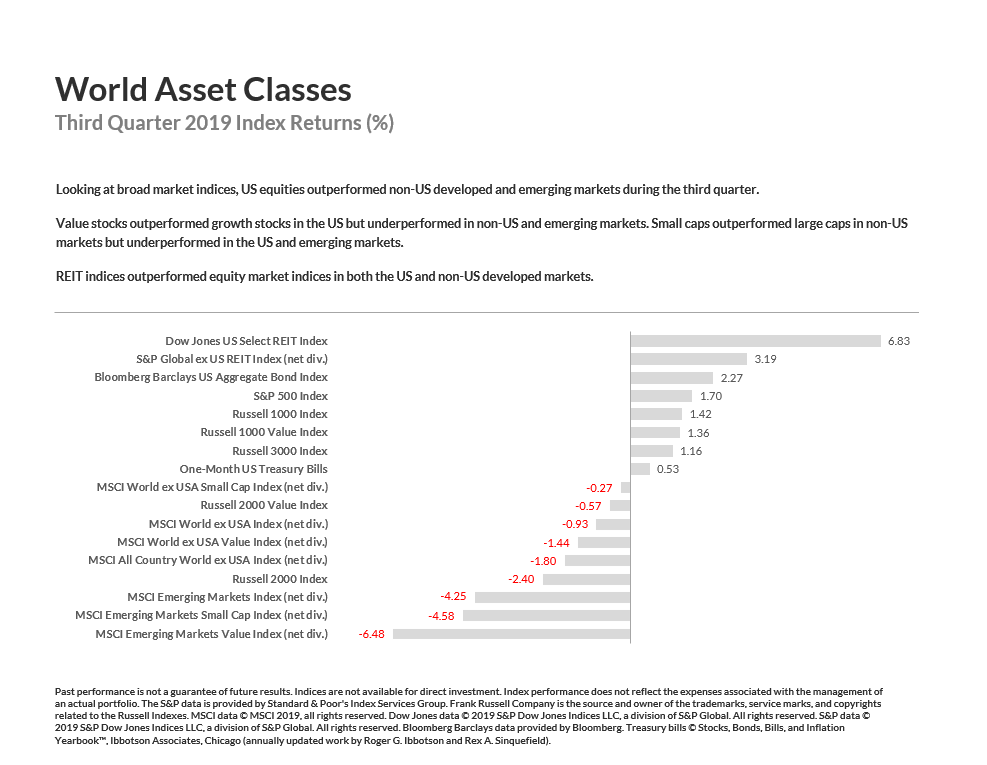

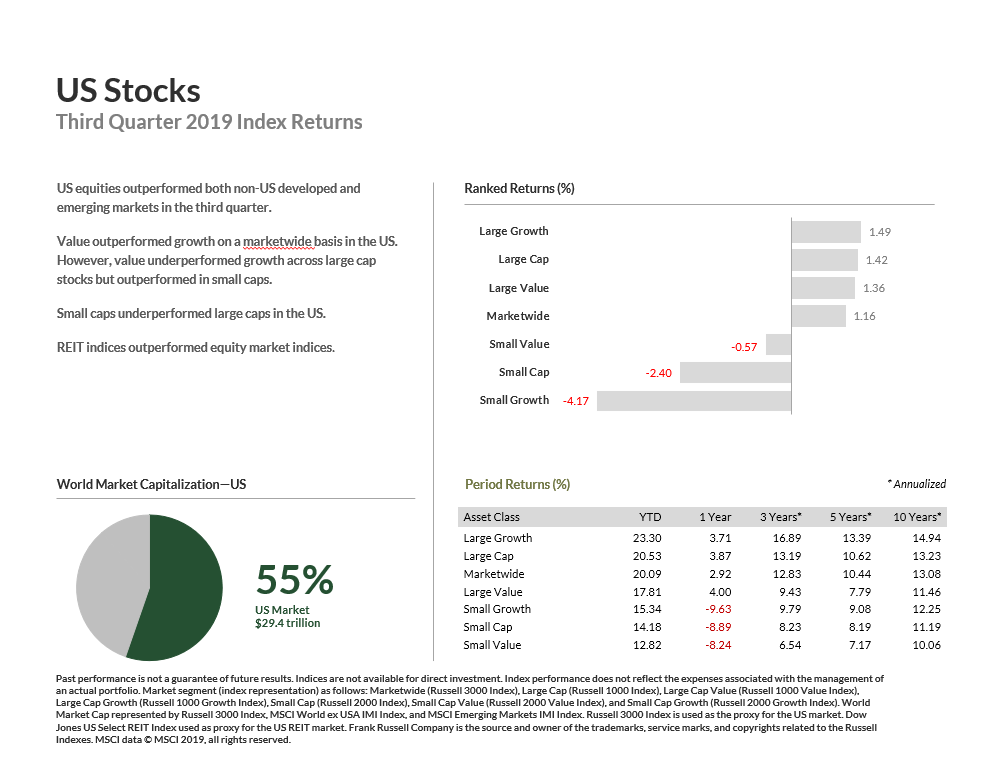

Continuing the recent trend, large cap stocks outperformed small cap shares in Q3. But in a reversal of what we’ve seen over the last decade or so, value stocks performed just as well as growth stocks in the large cap space, and much better in small caps. Small cap value shares lost 0.57% on the quarter, while small cap growth slid 4.17%.

Clients of Three Oaks may roll their eyes as they read this, as its a point I often make in our portfolio discussions. Over long periods of time small cap tends to outperform large cap, and value tends to outperform growth on a risk adjusted basis. Some of this is tied to the business cycle; growth shares tend to do very well when future economic growth looks strong. But when the “worm turns” and economic prospect dry up, value tends to catch up quickly.

This may be what we’re seeing here. When the global economy does eventually begin to slide, I’d expect value shares to catch up to and surpass growth stock performance rather quickly. As I’ve written about quite a bit recently, growth has been on a tear during this business cycle. That won’t continue forever.

**Source: Dimensional Fund Advisors

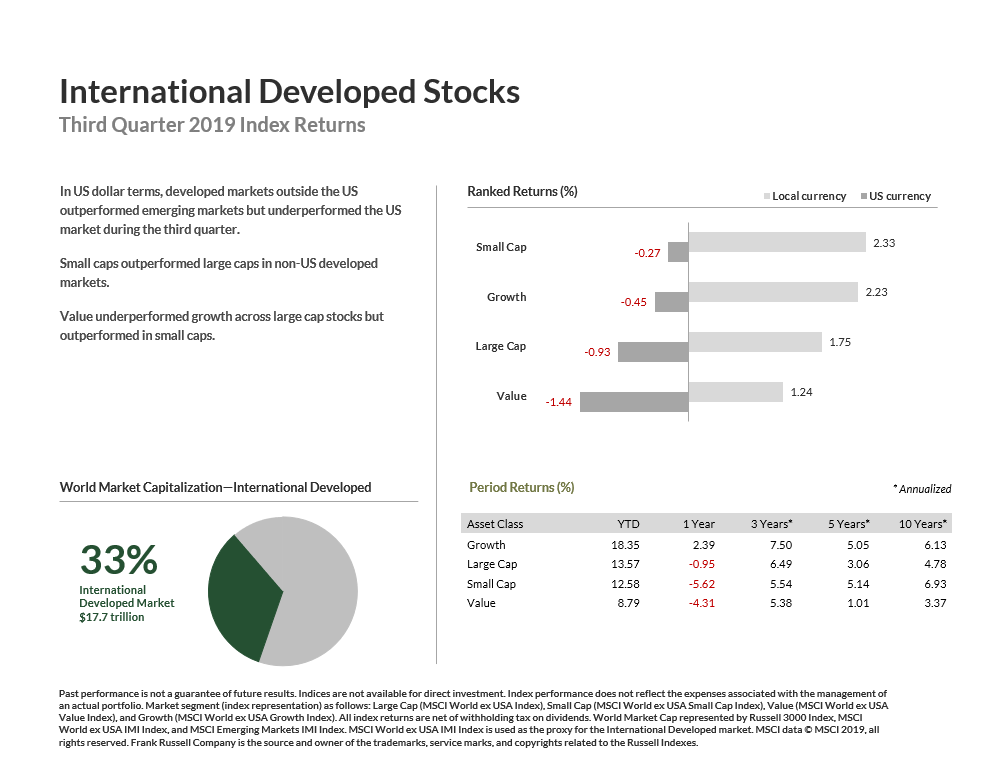

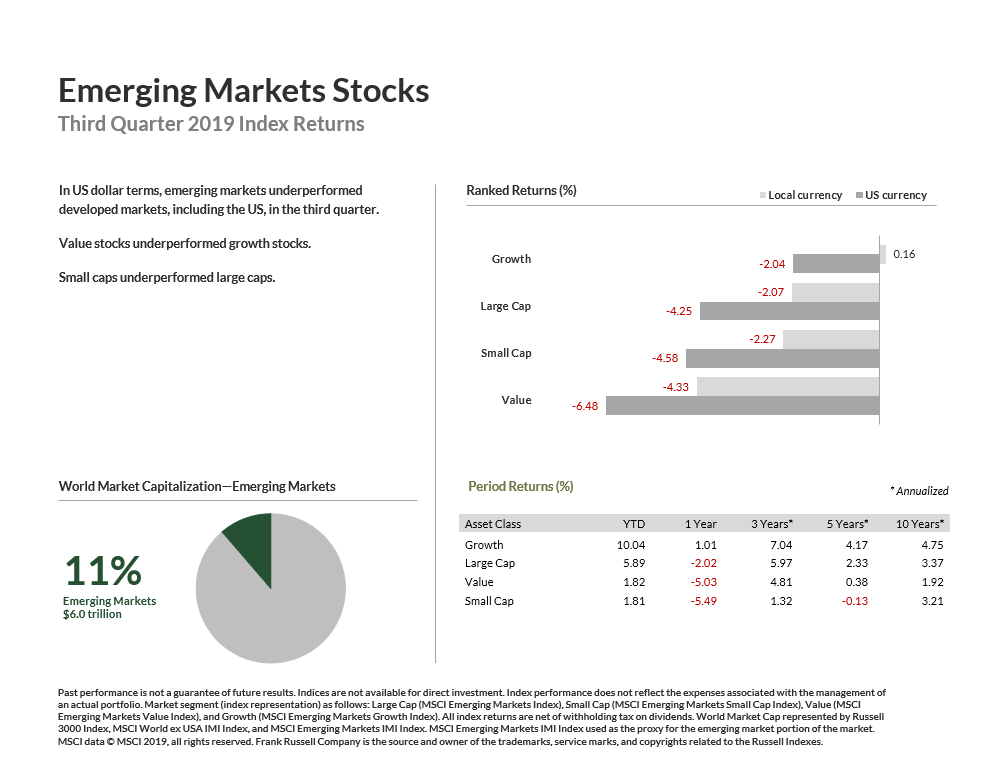

International & Emerging Markets Equities

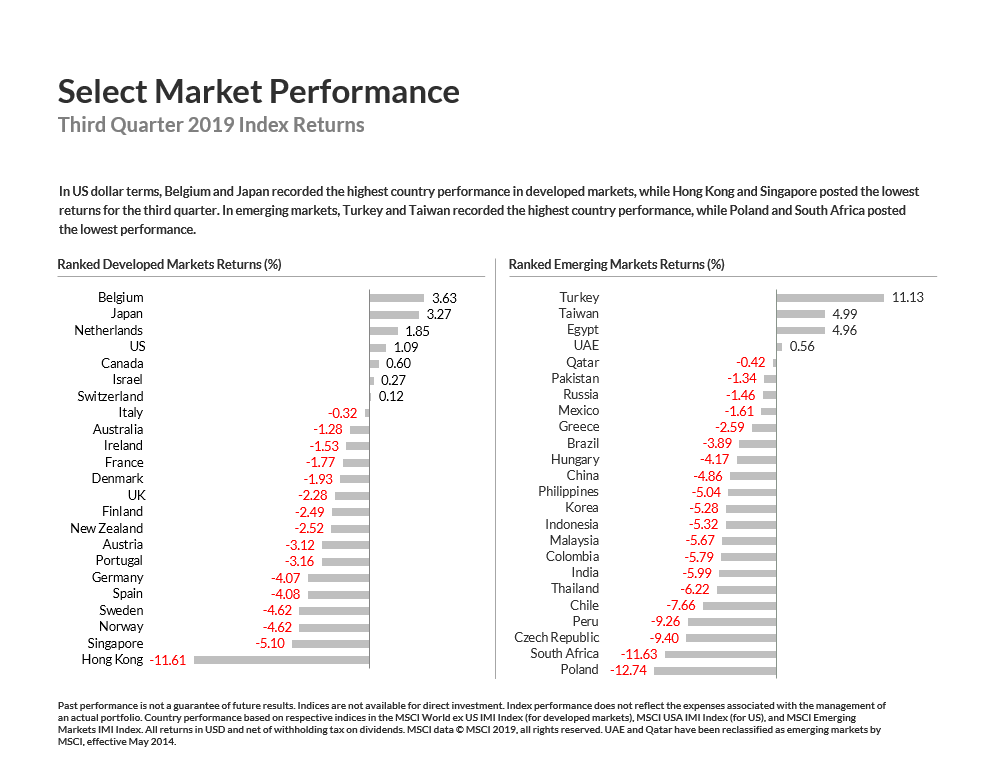

Stocks overseas lost ground in Q3, with the MSCI World ex USA index falling 0.93%. In developed economies, of the five highest weighted countries in the index three of them had negative returns: UK (-2.3%), France (-1.8%), and Germany (-4.1%). In the UK, a good portion of this slide is likely due to uncertainty surrounding Brexit. The Brits have zero idea of what comes next, and walking the tightrope toward economic stability may be out the window at this point. What that route actually looks like is above my pay grade. But from my casual observations, it doesn’t looks like either side has a cogent or well thought out plan.

The emerging markets were hit particularly hard in Q3, falling 4.2%. Emerging markets are usually very dependent on foreign trade, and escalating tensions between the U.S. and China muddy their economic outlook. China stocks fell 4.9%, South Korean shares fell 5.3%, and Indian equities lost 6%. Remember here that China comprises the lion’s share of the emerging markets equities indices. The MSCI Emerging Markets Index has roughly a 32% weight in Chinese shares, meaning that economic ping pong between Xi Jingping and Donald Trump weighs heavily on the asset class.

Beyond Chinese shares themselves, the trade war will have downstream ramifications for other developing countries too. The supply chains controlled by the US and China represent a huge portion of global trade, although I don’t have the figures in front of me. Tariff wars and other disruptions would like crimp growth in the US and China, but also all the countries expecting them to purchase local goods and services.

**Source: Dimensional Fund Advisors

**Source: Dimensional Fund Advisors

**Source: Dimensional Fund Advisors

U.S. Fixed Income

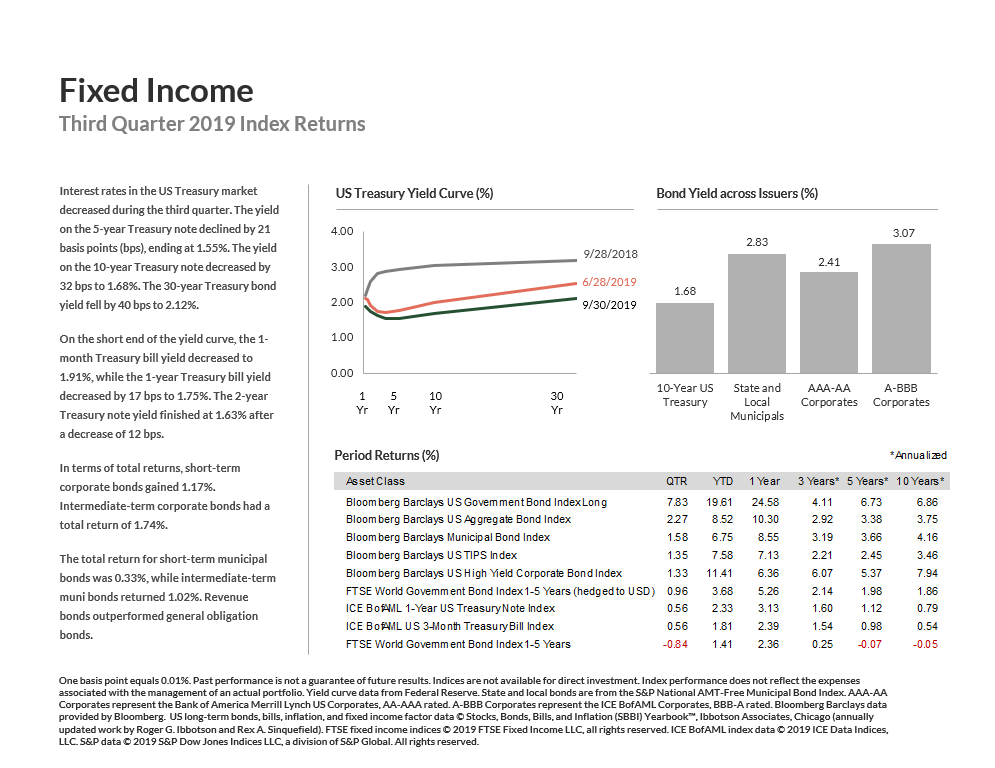

One of the main headlines coming out of the fixed income world in Q3 may ring a bell: the inverted yield curve. The yield curve is a chart that displays interest rates across various maturity levels. We one displayed in the image below. Typically yields on shorter term bonds are lower than longer term bonds, meaning the yield curve trends upward from left to right. As an investor, you can command more interest on bond investments by locking up funds over a longer period of time in this environment.

“Inverted” yield curves exist when the rates on longer term bonds are actually lower than shorter term bonds. Whereas short term interest rates are set by the fed, long term interest rates are market based. They reflect long term growth expectations, meaning an inverted yield curve is usually not a good omen for the economy. They’re not perfect, but are often a decent predictor of recessions.

In August the yield curve inverted. Rates on 10-year U.S. treasuries fell below 2-year U.S. treasuries, sounding the alarm for some in the financial media. (Image in my head: newscasters on CNBC jumping up and down pulling out their delicately manicured hair, bells going off, papers flying in the air).

But while this is often a good predictor of recessions, the inverted yield curve in this circumstance only lasted for three days. Since then long term yields bounced & leveled out a bit. And with the fed reducing short term rates again in September, we’ve been in an upward sloping environment since.

What’s interesting about the September rate cut is the different growth expectations from FOMC members. Remember – the federal open markets committee (FOMC) is the rotating group of 17 regional bank central bank presidents to convene to determine short term interest rate policy. When asked about where rates will be through the end of next year there is no consensus whatsoever.

Of the 17 members, 5 think that rates will be higher by the end of 2019 after their December meeting. 7 think they’ll be lower, and 5 think they’ll remain the same. By the end of 2020, 8 think rates will be lower, 7 think they’ll be higher, and 2 expect no change.

As is often the case, this level of dissent tells me that no one, not even the most astute central bankers in the country, have any idea what will happen with the economy or interest rates. This is a good reminder that we shouldn’t adjust our portfolios based on economic or interest rate speculation.

**Source: Dimensional Fund Advisors

Real Estate

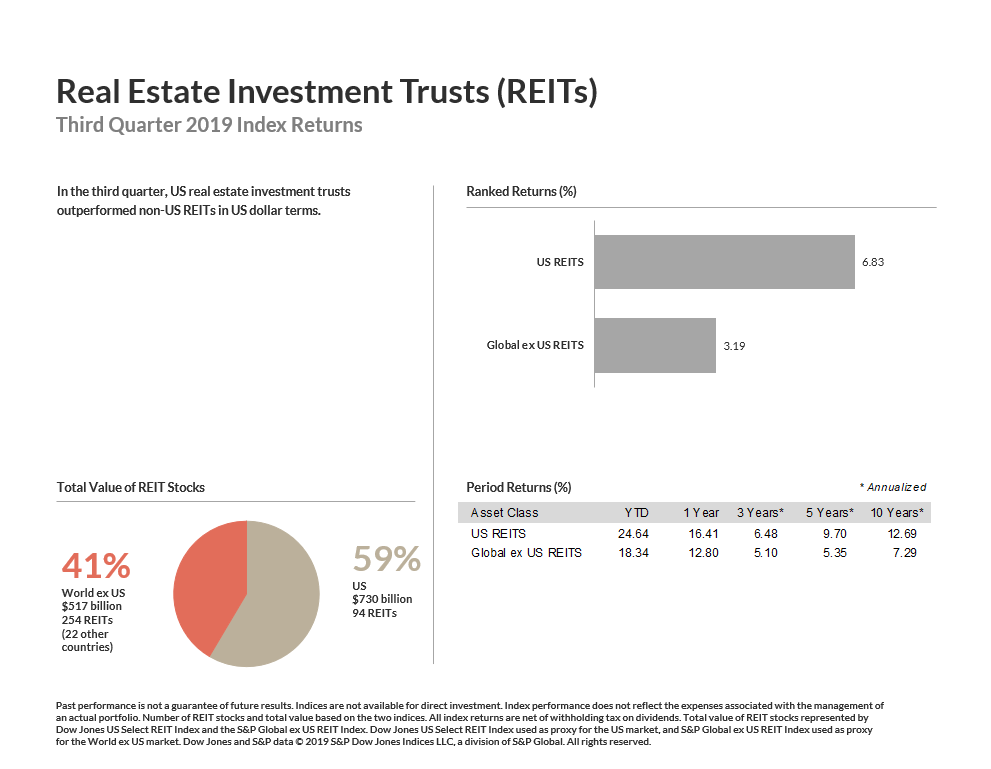

Real estate investment trusts (REITs) had a tremendous quarter both in the US and abroad. U.S. REITs gained 6.83% in Q3, while REITs overseas rose 3.19%. The cause here is mainly interest rates. Lower rates are typically a boost to real estate in two different ways.

First, if you’ve ever owned a house you’ll know that lower interest rates mean lower mortgage payments. For investment trusts, lower interest rates mean lower debt service payment, more cash flow, greater opportunity to undertake more deals, and ultimately better short term returns. And looking back at Q3, we had long term rates fall in August, producing an inverted yield curve for a few days. We then had the fed reduce short term rates the following month. Whatever financing period managers of REITs might consider when buying more property to add to their portfolio (1 year, 5 years, 10 years, or longer), it’s now less expensive for them to do so.

On top of this, many investors around the world have a need for yield and income. When bond rates fall, yield hungry investors often start to look around at other opportunities. This could be in dividend paying stocks, or in alternative asset classes like business development companies or peer to peer loans. It could also be in real estate. In low interest rate environments, REITs start to look more and more appealing comparatively. This is exactly what we saw in Q3 with the spike in REITs. It also follows the trend we’ve experienced amid the low rate environment of the last decade or so.

**Source: Dimensional Fund Advisors