Today’s post is going to fall a little more on the abstract side of the spectrum. To date, most of the posts you’ll find on Above the Canopy are somewhat technical, and oriented toward achieving financial independence.

But for many thousands of people in America, the traditional career trajectory (working for 30-40 years until fully retiring around age 65) is a poor fit for their values. The pursuit of financial independence often compromises the important parts of our lives, leaving us overworked and unhappy.

So in today’s post I’ll examine the difference between money-centered and happiness-centered living. We’ll cover what we actually need to be happy, and the role money plays in fostering a happy life. Finally, we’ll cover how you can arrange your finances to support a life focused on happiness & fulfillment. If you’re up for a “deeper” post and don’t mind me waxing philosophical, read on!

Traditional Financial Independence

Usually when we hear about financial independence, it’s used in the context of having enough assets to live off of comfortably. Whether they produce enough income to fully cover our living expenses, or the withdrawals from principal are small enough that we’re confident we’ll never run out of money, the idea is the same. Financial independence means we’re no longer beholden to employment, since we could live off our own assets if we wanted to.

This idea of financial independence also fits pretty nicely with our traditional view of retirement here in America, where there’s a stark contrast between “working” and “being retired”. Our working years start when we first enter adulthood. While we usually don’t have much to our name, we do have (hopefully) some ambition and a few skills we can use to earn a living. We go out and market these skills to potential employers and eventually get a job. If we’re lucky, it’s work that’s interesting to us and pays a decent wage.

Once we start our working years we begin to collect paychecks every other week, which we use to pay taxes, rent, and other living expenses. After the bills are paid we use anything left over to pad our retirement accounts, bank accounts or both.

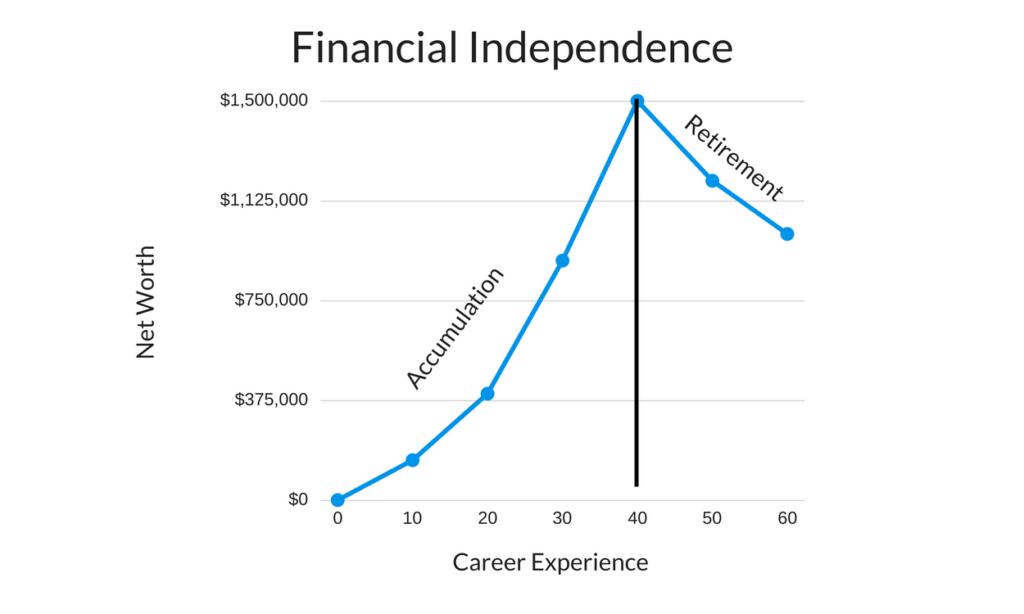

At this point we’re in the phase of life affectionately known as the accumulation phase. We earn an income, use it to pay our living expenses, and save whatever is left over. Our savings grow with each paycheck, and our net worth accumulates over time.

We invest our savings in order to accelerate growth, and sooner or later we reach the holy grail – financial independence. If we wanted to, we could discontinue our employment and use income and withdrawals from our savings to pay our living expenses. We’re no longer reliant on our job for income. We can do whatever we want. We’re financially independent.

The amount of wealth it takes to reach financial independence depends on few factors personal to you:

- What’s your lifestyle like? How much do you expect to spend once you become financially independent?

- What will your investment returns be? How much risk are you comfortable taking?

- How long will you live? For how many years will you be withdrawing from your savings?

If you’re to enjoy financial independence, you’ll need a very clear understanding of these factors. A few incorrect assumptions, like overestimating your investment return, underestimating living expenses, or underestimating your lifespan can jeopardize your independence.

Traditional Retirement

This fits pretty neatly with our traditional view of retirement. The typical career path has you go out and find a job, and then pound rocks for 30-40 years until you have enough money to retire. Along the way you’ll probably get promoted a few times, maybe make a few career changes, but the idea is the same. You’re fully employed for 30-40 years, in pursuit of building your net worth until you don’t have to work any longer.

This type of career trajectory works pretty well for many, many people. Even now, some of you reading this are probably jumping up and down screaming “Yes! That sounds great! I LOVE my job, I’m fulfilled in my career, and I couldn’t imagine it any other way!” Well, kudos to you. You’re in the minority. Most Americans struggle to find a fulfilling career that makes them happy. It’s very common to dislike going to work every day, but we do so anyway because:

- We have a financial obligation to provide for our family

- We see the light of financial independence at the end of the tunnel

- Big life changes are scary and hard

My point here is that our traditional mindset is built on the idea that we work hard now in exchange for gratification later. Even if we despise our job, we think that if we “grind it out” for long enough we’ll eventually be free to ride off into the sunset and spend our days however we like. We’re dealing with unpleasantness now for happiness later.

Problems With the Traditional Mindset

You can see where I’m going here. While it’s admirable to show grit when times get tough, this whole paradigm can make for some pretty unpleasant times if you’re stuck in a career you dislike. We keep telling ourselves that even if we hate our jobs, we should “stick it out for a few more years”. There are numerous ways to justify the decision:

- “The pay is too good to walk away from.”

- “If I keep this up I can retire early. Then my whole life will be a vacation.”

The idea is that there’s a light at the end of the tunnel, and that financial independence will bring us to the pinnacle of happiness. The things we need to be happy now, like maintaining relationships with family & friends, pursuing personal interests, etc., are too often pushed aside by our careers. But we put up with it for the promise of freedom at some point down the road.

Again, this doesn’t apply to everyone. There are plenty of people out there who are invigorated by their work and are able to live a balanced and fulfilling life. My point is that for those who’s career path doesn’t foster happiness and personal fulfillment, why should you wait to be happy until you’re financially independent? You may not even live that long!

What Do We Need to Be Happy?

What I’ve described above is a money-centered existence. Your focus is on financial independence, and you’re willing to compromise your own happiness to get there. If this is you, I’d like to propose a different mindset based on a concept called lifestyle design.

Ditch the money-centered life. Try a happiness-centered life instead. Why live your life in pursuit of money if the journey doesn’t bring happiness? That’s the ultimate goal, right….to live a happy & fulfilling life?

Money Doesn’t Buy Happiness

So if our objective is to transition from a money-centered existence to a happiness-centered existence, it’d probably make sense to examine exactly what we need to be happy. (I told you this post was philosophical).

Psychologists have done quite a bit of work in this area. As my wife will tell you I’m definitely no psychologist, but I did take a gander at some of the collective wisdom.

What most psychologists seem to agree on is that happiness can be achieved by “having” a mix of external and internal things.

Externally, we need to have:

- Sufficient material resources. We all need food, clothing, shelter, and our health in order to be happy. No surprise here. Not only do we need these things to be happy, we need these things to simply live.

- Sufficient social resources. This can be family, friends, or anyone with whom we share a close personal relationship. It sounds pretty logical to me – we need other human beings who understand us and who we understand.

- A stable environment. We also have an innate need to make sense of the world and our place in it. We need to have a sense of how our life fits into the “grand scheme of things”. Religion fills this need for many people.

Internally, we need to have:

- A good attitude. How many happy, perpetually grumpy people do you know? Psychologists pretty much agree that attitude is very controllable, and happiness requires a positive outlook on life.

- Believing that you’re living a meaningful life. This sort of ties into the external need of understanding the world and our place in it, but it basically means that we happiness requires living life with a purpose. This could be having a family, leaving a legacy, or maybe improving the world in some way, shape, or form.

Living a Meaningful Life

Of these five components, it seems to me that living a meaningful life is by far the most subjective. We all see the world a little bit differently. If we’re to shift our focus toward living a life focused on happiness and fulfillment, we’ll need to dive into this component a little further.

When I talk to my clients about their biggest fears, many share that they’re afraid they’ll wake up one day and realize that they’d wasted much of their time here on earth. And even though they try to live a meaningful life now, what they currently find meaningful may not even be relevant to them once they’re older.

This is an important obstacle for anyone attempting to live a happiness-centered & fulfilling life. What if what you think is meaningful now is no longer meaningful later on in life? How can you be sure you won’t regret your decisions?

Regrets of the Dying

This is where some context can be helpful. Bronnie Ware is a writer and former worker in palliative care, where she spent a lot of time with people who didn’t have long to live. A few years back, Ware shared here unique times with terminal people in her best-selling memoir: The Top Five Regrets of the Dying – A Life Transformed by the Dearly Departing.

The book was hugely successful. It’s been released in 29 countries, and since then she’s traveled the world giving Ted talks and readings.

If we want to live a happiness-centered & fulfilling life, it seems to me that living regret-free would go hand in hand. What better context is there than the collective wisdom of people who don’t have long to live?

Without diving into too much detail, here’s a summary of the top 5 regrets her patients had when reflecting on their own lives:

- I wish I’d had the courage to live a life true to myself, not the life others expected of me

- I wish I didn’t work so hard

- I wish I’d had the courage to express my feelings

- I wish I had stayed in touch with my friends

- I wish that I’d let myself be happier

I see many of the fundamentals of happiness reflected in this list. I can also easily see how a money-centered life could cause some of these regrets.

Happiness-Centered Living: A New Paradigm

If our focus is to live a happy, meaningful life free of regret, we need to stop trying to fit the fundamentals of happiness into our work schedule. Instead we should focus our existence on being happy in the first place, and find employment that fits into this lifestyle.

Going further, the five fundamentals of happiness should be the foundation of our existence. We should identify exactly what we need in order to be happy, and be uncompromising when making decisions about how to spend our time & resources. Sometimes this may align well with a highly demanding, 80+ hour per week job. But other times it won’t.

In a money-centered existence we might be enticed by the dollar signs in front of a new job opportunity. Even though the job might require travel and put stress on our most important relationships, we think the extra money will make us happier. Better lifestyle, faster path to financial independence, it all sounds great.

But in a happiness-centered life, we’d view a new opportunity in the context of the five fundamentals of happiness. We’d recognize that our most important relationships must not be compromised. Even though the extra cash looks nice, the additional travel could easily be a deal-breaker.

The Role of Money in our Lives

So where does money fit into all this? This is a financial blog, right?

From all this, it’s probably obvious that I don’t think money buys happiness. But to be happy we do need some money. Recall the first fundamental: sufficient material resources. We need to have enough to afford the basic necessities of life like food, shelter, clothing, and healthcare.

That said, all the money in the world won’t make us happy if we don’t have the other components in place: social resources, a stable environment, positive attitude, and a meaningful life.

Now, if we do have those other components in place, more cash in the bank can go a long way. Who wouldn’t love to trade in their 10 year old Hyundai for a brand new Mercedes, or take an additional two vacations every year? The point is that while more money can make us happier, it won’t without the other fundamentals in place too.

Financial Freedom

Living a happiness-centered lifestyle is a pretty dramatic shift from the current mindset of accumulating wealth until you’re financially independent. Rather than focusing your efforts on achieving financial independence and hoping you’ll be happy along the way, a happiness-centered lifestyle requires you to put you & your family’s happiness first. Financial independence may indeed come later, but not at the expense of your lifestyle.

This isn’t an entirely new idea. Tim Ferriss wrote about the concept of lifestyle design in his hugely successful book the Four-Hour Work Week, and since then it’s become an increasingly popular notion. And for the followers of Mr. Ferriss and lifestyle design, integrating your finances in a way that supports this philosophy becomes a pretty big issue. This is an objective I like to call financial freedom. It’s the idea that your finances are completely aligned with your focus on living a happiness-centered life.

Achieving financial freedom requires a few steps. You must first, of course, have your financial “house in order”. You must be organized. You must know have and adhere to a monthly budget, and have a clear picture of where your assets, liabilities, and net worth fall. Most importantly, you must have a clear vision of what happiness looks like to you, and what you’d like to do with your life. How can you align your finances with a happiness-centered life if you don’t know what you need to be happy?

Financial freedom has tremendous benefits. Having your financial life organized and in place immediately gives you the confidence to take bigger risks. You have the latitude and flexibility to take your life in whatever direction you want, as opposed to being tied to a career because you need the money (or think you need the money).

Finding Your Own Financial Freedom

Achieving financial freedom takes some soul searching. Remember, the idea is to structure your finances in a way that gives you the flexibility to focus your life on you & your family’s happiness. This may indeed include financial independence, but that’s not a requirement.

Once you nail down exactly what your happiness-centered life looks like, the steps it will take to achieve financial freedom start to flow logically. Of course there are a ton of nuances, technicalities, & small decisions to make, but once the big picture is complete the rest will start to fall into place.

For many people out there the traditional mindset of financial independence and retirement fits just fine. These will be the people that have flexibility both financially and in their careers to find a work/life balance that makes them happy. But for anyone out there struggling with these issues, a happiness-centered mindset focused on lifestyle design might be a welcome change of pace.