Happy holidays!

It’s now December, and if you blink hard enough (or drink enough egg nog) you’ll wake up & find yourself in January of a new year. For many people, holiday office parties & Christmas shopping comes hand in hand with a few year end financial chores.

There are plenty of these financial “chores” you could occupy yourself with if you chose. But since December 31st coincides with the end of the tax year, today’s post will cover my 5 favorite year end tax planning tips. These are five of the most common year-end opportunities I see to reduce your long term tax liability.

1) Harvest Capital Losses

My first tax planning suggestion has to do with capital gains and losses. As you probably know, any capital gains or dividends you receive in a taxable investment account are included on your taxable income on a year to year basis. So are capital losses.

Let’s say you invested $1,000 in a random stock earlier in the year. If the value of that position has fallen to $600, you have a $400 unrealized capital loss. If you decided to sell the shares, you realize the loss. Which, of course, is a taxable event.

This can be helpful from a tax perspective for two reasons. First, capital losses offset capital gains. Using the same example, let’s say that you the random stock now worth $600 was not your only investment on the year. If you’d purchased $1,000 worth of Amazon shares that are now worth $2,000, you’d have one position at a gain, and another at a loss. Selling the Amazon stock means you’d be realizing a $1,000 capital gain.

The key here is that capital gains and losses are netted against each other every year. By selling both positions, your net taxable capital gain would not be $1,000. It’d be $1,000 (from the Amazon shares) – $400 (from the loss) = $600.

Secondly, if you have a net capital loss on the year, up to $3,000 can be netted against your earned income. This is what would happen if you realized the $400 loss, but decided not to realize the $1,000 gain. You’d hang on to the Amazon shares, and the $400 loss would work as a deduction & reduce your taxable income. If you have net losses beyond the $3,000 annual limit, they are “rolled” into subsequent years.

Keep in mind that this only works in taxable accounts. Any tax deferred account, like an IRA, 401(k), etc. isn’t taxed until funds are withdrawn from the account. So there’s no benefit of harvesting losses.

Long story short, harvesting your losses can reduce your tax bill for the year. Looking through the positions in your taxable account every December could be a fruitful exercise and uncover a few opportunities.

2) Strategic Roth IRA Conversions

If you’ve read the blog for long, you probably know I’m a fan of strategic Roth IRA conversions. I won’t rehash the entire concept in this post, but the basic premise is that you want to use our progressive tax system to your benefit.

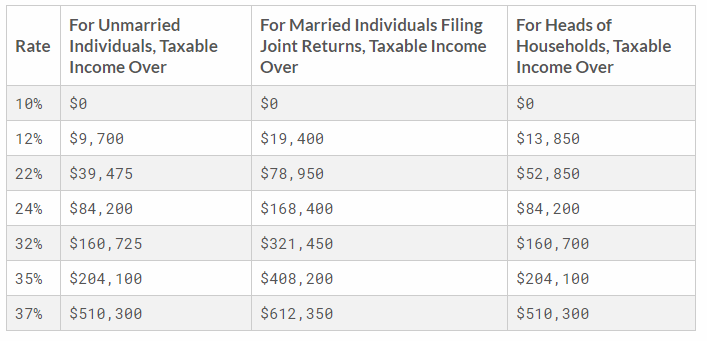

Take a look at our current marginal tax brackets 2019:

As you already know, the higher your income, the higher rate of tax you pay on it. The opportunity here appears if/when your income fluctuates from year to year.

Let’s say, for example, that you’re married, you file taxes jointly, and your combined taxable income this year will be $300,000. Using the table above, you’d find yourself in the 24% (which applies between $168,400 and $321,450 in taxable income).

If you expect your income to rise substantially next year, there’s a pretty decent chance you’d find yourself in the 32% bracket. You’d only need to make an additional $321,450 – $300,000 = $21,450 for this to happen.

The opportunity here is the $21,450 of “room” you have left in the 32% bracket this year. If your income has been climbing steadily, this may be the last year you ever find yourself in the 24% bracket. If your growing income continues, you may never even see the 24% bracket again!

This being the case, you may want to convert funds in a traditional IRA to a Roth IRA in a “strategic” Roth IRA conversion. Any funds you convert will be added to your taxable income for the year. But, the funds in your Roth IRA will never be taxed again. Since you have $21,450 of “room” until you hit the 32% bracket, it could make sense to convert exactly that amount of traditional IRA funds. You’d be paying tax on that amount at 24%, instead of 32% or more in the future. Plus, Roth IRA funds are not subject to mandatory distributions once you turn 70.5. You never need to pull the funds from the account if you don’t want to.

There are many circumstances where you’d want to avoid this strategy, of course. Even if you expect to jump into a higher bracket next year, your current bracket may still be higher than the bracket you expect to be in your 60’s and 70’s. If that’s the case it usually makes sense to continue deferring taxes until that point. The key is forecasting your tax bracket now and comparing it where you think you’ll be in the future. If you’re in a lower bracket now, consider the conversion.

3) Accelerate Expenses / Defer Income

It’s not uncommon for business owners to have some discretion surrounding when exactly their clients pay them. Same goes for deductible business expenses. If this is the case for you, it’s another opportunity to put your tax planning & forecasting skills to use. Just like with strategic Roth IRA conversions, having a loose idea of which tax bracket you’ll be in this year & which you expect to be in next year can pay dividends.

Let’s say you have a big contract that’s coming due, and you have a choice of claiming $10,000 in revenue this year or next year. If you know you have $20,000 of “room” until you hit the next tax bracket, it probably makes sense to get paid this year. Waiting until January could mean you’d pay a higher tax rate on the same amount of revenue, if you expect your income to climb.

Same goes for deductions, such as equipment purchases. If you think you’ll be in a higher bracket next year, you may want to wait on a big purchase until the calendar ticks over. The higher your tax bracket, the greater the value of the deduction.

4) Triple Check Your RMDs

This isn’t a tax planning strategy so much as it is a “penalty avoidance” strategy. As I mentioned above, you’re required to start pulling money out of your IRA or 401(k) once you turn 70.5. The penalties are severe if you fail to do so: the IRS dings you 50% of what you should have taken out, plus tax.

Even though required minimum distributions won’t necessarily save you money on taxes, I always like to triple check to make sure my clients have taken them. A 50% penalty would be such an easily avoidable shame.

**While I mention here that you run into mandatory distributions once you turn 70.5, you typically need to take them at younger ages too if you’ve inherited an IRA or a Roth IRA. The 50% penalty applies here too, so make sure you don’t miss an annual withdrawal.

5) Top Off the Retirement Accounts & HSA

Finally, make sure you’re taking advantage of your tax deferred retirement savings. This may sound like a no-brainer to the financially savvy, but you’d be surprised how many people fail to max out their 401k or make IRA contributions.

Even if you make too much money to deduct your contributions to a traditional IRA, I typically suggest that people still do so if they have the cash available. Making non-deductible contributions opens the possibility of back door Roth IRA conversions in the future. And even if you don’t pursue one, your holdings still grow tax deferred.

Alongside your 401k & IRA contributions, if you’re eligible to contribute to a health savings account, DO IT. There’s a good argument to be made that your HSA should be funded even before your 401k and IRA. The catch here is that you need to be enrolled in a high deductible health plan in order to contribute to one. But if you have the option, it’s the best tax deal available. You get to deduct your contributions. You get to invest those contributions (still tax free). And you get to pull out those funds later for eligible medical expenses. You guessed it. Tax free.

What do you think?

What year end tax planning strategies did I miss?