Stock and bond markets around the world had a rough year in 2022. Most of the financial headlines you’ll see these days focus on whether the Fed will be able to tame inflation without pushing us into a recession. While they certainly have a tightrope to walk, I’d like to highlight a different theme in today’s post. We are amid a change in the business cycle, and are entering a phase newer investors haven’t seen before. Here’s a review of how markets tend to react to business cycle changes and a few things to look for in 2023.

The Typical Business Cycle

Business cycles consist of four phases: expansions, peaks, contractions, and troughs – in that order. The economy expands when times are good, then hits its peak as some impediment to future growth emerges. That could be a market bubble (like 2001), banking or debt crisis (like 2008 and the great depression), inflation (like we’re seeing now), or another random reason. The stock market senses the economic headwinds ahead and sells off. Sometimes by a lot.

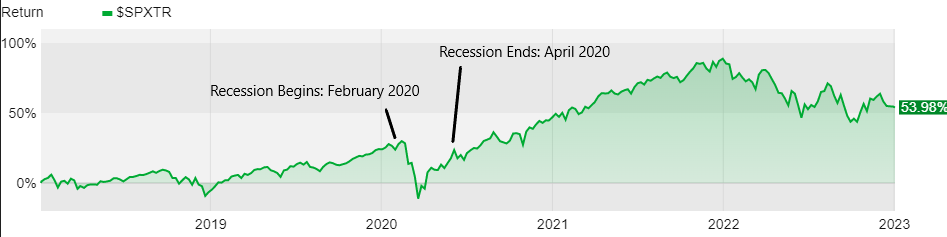

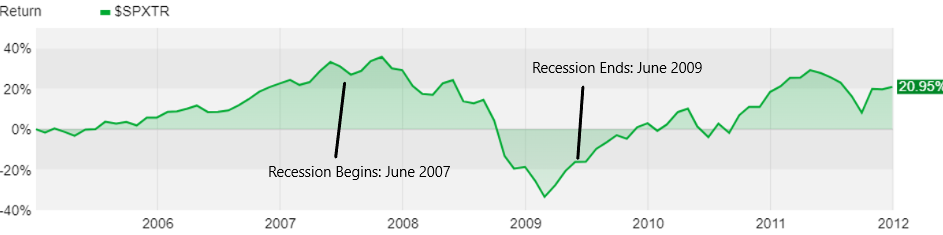

But markets usually hit their bottom far before economic headwinds go away. Remember – a stock’s value is based on the market’s expectation of its future earnings. Not what it reported last quarter (though last quarter’s earnings do have bearing on future expectations). Look at the last two recessions, in 2020 and 2007-2009.

The charts show the S&P 500 total return index, and in both circumstances they bottom out before the economy does.

Contractions are followed by a trough. Here again we see that markets value our investments using future expectations. Economic activity bottoms out as the U.S. and rest of the world sort out the bubble/debt/inflation/problem du jour. Seeing brighter skies ahead, this is where markets tend to rebound.

Growth Stocks Trade on the Story

2022 was a lousy year for investors all the way around, with a typical 60/40 portfolio down around 20%. Which actually makes for the 2nd or 3rd worst year ever for the 60/40 portfolio depending on how you measure it.

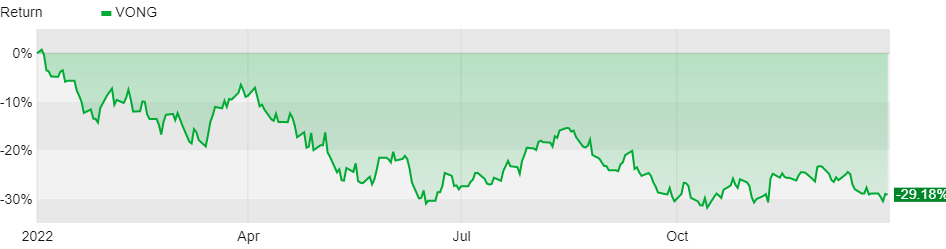

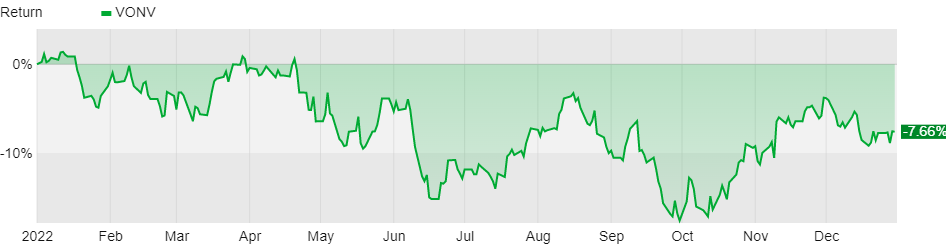

Even so, growth stocks – tech in particular – took it on the chin especially badly. VONG, Vanguard’s ETF that tracks the Russell 1000 growth index was down over 29% on the year. VONG’s counterpart VONV, which tracks the Russell 1000 value index, was only down a little over 7.5% in 2022.

So why did growth stocks get hammered so badly last year? The reason has to do with the business & economic cycle. While all stocks trade based on the market’s expectations of future earnings, growth stocks are especially susceptible to bad news.

Remember what a “growth” stock is in the first place. Growth stocks have rapidly growing revenues and operating cash. They have new, innovative products and services and are growing market share. They reinvest profits aggressively back into their companies rather than distribute them to shareholders through a dividend. Think Tesla. Think Amazon. Think Netflix.

When you buy a growth stock you’re not doing so because it’s cheap. You’re buying it because you think all this growth and market share capture will continue. You think the march will go on. You think management will execute and reach the vision they’ve communicated to investors. You buy their story.

Value Stocks Trade on the Fundamentals

Value stocks fall on the other end of the spectrum. They’re not as shiny or flashy. They’re not growing as fast. They’re not innovating the same way. But they’ve usually been around for a while, have weathered one or more downturns, and are stable. They’re a cash cow. Maybe they pay a dividend back to shareholders. Think IBM. Think Coca-Cola. Think Procter & Gamble.

The investment thesis is completely different for value stocks too. You don’t buy a value stock because you think the company will roll out some completely disruptive technology, or suddenly double revenues thanks to a new marketing program. You buy them because you think the shares are inexpensive compared to the company’s earnings and cash flow. You don’t need to believe some magnificent story about how a random tech company will make the world a better place. You’re buying the fundamentals. You’re buying what’s already there.

The Story From 2022

For me the disparity between growth and value is really the investing story of the year. Yes we can argue all day about inflation, the economy, and whether the Fed will successfully avoid a hard landing. But even if inflation fell tomorrow back to the Fed’s 2% annual target and the economy suddenly corrected itself, some other catalyst would come along sooner or later and turn the business cycle over. Whether it be inflation, a bubble, a debt crisis, a housing crisis, or an alien invasion, the business cycle will always turn over. It’s simply what markets and economies do.

Looking back on 2022, the stories growth investors kept buying into simply evaporated once rates started rising. Tesla investors thought the company could make all the deliveries it promised. Amazon investors watched AWS grow market share and revenues unabated over the previous decade. Netflix hadn’t had a single quarter with a net negative subscriber count. Then the Fed tightens and wham, down 65%, 50%, and 51% on the year, respectively.

I’m simplifying a bit here. The Fed raised rates for a reason, and for the first time in over a decade. And clearly, when the Fed tightens money is siphoned out of the financial system, which is a drag on risk assets. Especially growth stocks.

What to Look For in 2023

It’s been over a decade since we’ve been in a truly contractionary cycle. One where money is coming out of the system as the Fed raises interest rates. Growth stocks have trounced value over this period because when times are good it’s easier to believe the stories. High flying tech companies have had a hell of a run, but it’s easy to forget that this is only one phase of the cycle.

When money starts coming out of the system investor sentiment turns almost immediately. All of a sudden it’s harder to believe the growth story. Investors begin to turn back to the fundamentals and ask questions like “what am I really buying here?” There is a stark turn away from growth companies and toward value companies. This is what we started to see in 2022, and what I think will continue throughout 2023.

This is Why Investing Is So Hard

We have an entire generation of investors who’ve never seen this part of the cycle. During the pandemic everyone on your block was trading crypto and options contracts on tech stocks instead of tending to their remote work. They bought growth stories hook, line, and sinker because it was the only part of the cycle they’d ever known.

My sincere hope is that 2022 didn’t turn new investors off entirely. The capital markets are truly the best way for most people to build and sustain wealth over multiple decades. But navigating them effectively takes patience and consistency. Plus an ability to stomach uncomfortable times like we saw last year.

Index investing can help, but doesn’t solve the problem entirely. Yes you can simply buy everything in the investible universe. But what are the best portions? An S&P 500 index fund will naturally skew toward growth and away from value. An equal weighted fund might make sense, but could build too much exposure to small cap names.

Whatever your path, please remember that the best outcome will be achieved with consistent execution. As challenging as 2022 was for investors, better times are ahead of us both in the U.S. and abroad. The longer your focus, the better your results.