What is REPAYE Student Loan Repayment?

After making the Pay As You Earn (PAYE) student loan repayment system available to borrowers in 2012, President Obama expanded the program by enacting the Revised Pay As You Earn (REPAYE) repayment plan in December of 2015.

While REPAYE has many of the same features as PAYE, the updated plan has several key improvements. Not the least of which is that it’s available to any borrower with qualifying loans – which opens the plan up to an estimated 5 million additional borrowers. This is a huge step up from PAYE, which is essentially only available to the class of 2012 and later.

How it Works:

Monthly payments under REPAYE work basically the same as Pay As You Earn and Income Based Repayment. Your monthly payments are 10% of your discretionary income, which is calculated using the difference between your AGI and 150% of the poverty line in your area. There are also a few key improvements and differences though.

Here’s an Example of REPAYE in Action:

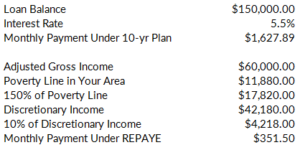

OK – let’s say you graduate from school with $150,000 in unsubsidized direct loans at 5.5% interest rates, and get a job that pays you $60,000. You enroll in REPAYE and start making minimum payments of 10% of your discretionary income: $351.50. Life is good:

Interest Subsidy

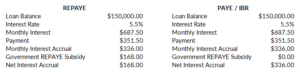

The interest subsidy under REPAYE is an improvement over PAYE and IBR. Like PAYE and IBR, the government will pay accrued interest on subsidized loans for your first three years in the program.

Unlike PAYE and IBR, the government will continue to pay 50% of accrued interest on subsidized loans after the first three years. They’ll also pay 50% of the accrued interest on unsubsidized loans your entire time in the program.

Your monthly payment is the same under REPAYE as it would be under PAYE and IBR (if you’re a new borrower). But, with the boosted interest subsidy, you don’t rack up accrued interest as fast:

Spouses

Another major difference between REPAYE and PAYE/IBR is the inclusion of spousal income and debt. Under PAYE and IBR, you can exclude your spouse’s income and debt by filing your taxes separately. REPAYE includes your spouse’s debt and income regardless of how you file.

Back to Our Example:

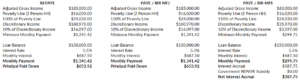

Let’s say two years later you marry your college sweetheart, who makes $125,000 and doesn’t have any debt. This would cause your discretionary income and monthly payment to rise. Under PAYE & IBR, you could always file your taxes separately to keep your payments down if you’re OK with the other tax ramifications. This isn’t an option under REPAYE:

Granted, paying $1,341.42 per month is still better than the initial $1,627.89. But if your objective is to keep your payments as low as possible (perhaps you’re seeking PSLF forgiveness), filing separately via PAYE or IBR might be a better option.

Payment Cap

The third big difference between REPAYE and PAYE/IBR is the elimination of the payment cap. Under PAYE and IBR, if your income rises to the point where you no longer have a partial financial hardship, your payments will be capped at what they would have been under the standard 10-year plan when you entered the program.

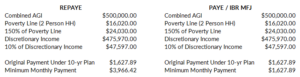

From our example, we assumed you made $60,000 and your spouse made $125,000. But what if you’re about to exit a medical residency, become an attending physician, and earn $200,000? What if your spouse made $300,000 instead of $125,000? These are two more circumstances where REPAYE might not be the most appealing option if your objective is to minimize monthly payments:

Forgiveness

Loan forgiveness under REPAYE is also slightly different than it is under the other programs. Your debt is forgiven after 20 years of qualifying payments if you’re only repaying undergraduate debt. If you’re repaying debt from grad school (or a mix of debt from graduate and your undergrad) the forgiveness period is 25 years.

Interest Capitalization

I won’t rehash what interest capitalization is in this post, but I will remind you that it’s important. For more information and a few thorough examples, check out the posts on other income driven options like PAYE and IBR.

Interest is capitalized in REPAYE when:

- You’re removed from the program. Since there’s no payment cap like PAYE or IBR, your accrued interest won’t capitalize if your income rises to where your payments under REPAYE are higher than they would have been under the 10 year repayment plan.

- You forget to recertify your income.

- You voluntarily leave the REPAYE plan.

Also, whereas PAYE limits interest capitalization to 10% of your original balance when you entered the program, there is no cap in REPAYE.

Who is Eligible

Anyone with eligible loans qualifies for REPAYE. You don’t need to have a partial financial hardship like you do under PAYE and IBR. This feature aligns with President Obama’s efforts to expand affordable repayment options beyond PAYE’s narrow qualification standards.

Loans Eligible for REPAYE:

- Direct Subsidized & Unsubsidized Loans

- Direct PLUS Loans made to graduate or professional students

- Direct Consolidation Loans that did not repay and PLUS loans made to parents

Loans Eligible for REPAYE if Consolidated:

- Subsidized & Unsubsidized Federal Stafford Loans from the FFEL program

- FFEL PLUS Loans made to graduate or professional students

- FFEL Consolidation Loans that did not repay any PLUS loans made to parents

- Federal Perkins Loans

Loans Ineligible for REPAYE:

- Direct PLUS Loans made to parents

- Direct Consolidation Loans that repaid PLUS loans made to parents

- FFEL PLUS Loans made to parents

- FFEL Consolidation Loans that repaid PLUS loans made to parents

When REPAYE is a Good Idea

REPAYE is a great fit in a lot of circumstances. That said, keep the payment cap and spousal income components in mind. If you’re shooting for PSLF forgiveness and expect to get married or for your income to jump in the future (like if you’re a medical resident), PAYE could be a better option.

It’s also a good option if you’re concerned about PSLF going away. The government will subsidize more of the accrued interest, and without the cap on payments you can repay(e) your loans in a way that’s more commensurate with your income.

If neither of those circumstances apply to you, REPAYE might just be the way to go:

- It offers low payments

- It has a better interest subsidy

- It includes forgiveness

How You Can Sign Up

Just like REPAYE’s income driven compatriots, you can apply online at studentloans.gov. You’ll be required to prove your income (the IRS retrieval tool comes in handy here if you filed a tax return in the last two year). You can also fill out a paper application if you’d rather. Just keep in mind that just like the other options, you need to recertify your income each year. Forgetting to recertify will mean that any accrued interest is capitalized and your monthly payment will jump. Student loan servicers tend to make a lot of mistakes, so make sure to keep copies of the paper trail.

Other Things to Consider

Some people have commented that the existence of REPAYE is a reflection of the government’s view that PSLF is not going away (Jan Miller has written about it here). This seems like a wise view to me. Rather than close some of the “loopholes” from PAYE and IBR, the government simply included spousal income in all forms and eliminated the payment cap. Instead of exploring the controversial topic of getting rid of PSLF, they fixed the problems with PAYE and made it available to everyone.