One thing all parents have in common is wanting what’s best for their kids. We all want to give our kids ample opportunities for success. We all want to keep them rooted in family values. And we all want them to have a fair shot at life.

When it comes to money, we typically want to give our kids ample support without spoiling them too much. Most of us don’t want our kids to win the lottery, though. We’d much rather our kids build some character through struggle and sweat equity. Nothing gives young people an appreciation for higher education than working a few arduous, low paying jobs.

From a financial perspective it’s difficult balancing these objectives. How do I help my kids financially without spoiling them? How do I teach them fiscal responsibility? How can I show them the power of long term tax advantaged compounding?

These a few questions our clients at the financial planning firm often ask. The answer is often the Roth IRA.

This post covers why that’s the case, how you can set one up for your kids, and when & how to contribute to one.

Friendly Reminder: Compounding Is Awesome

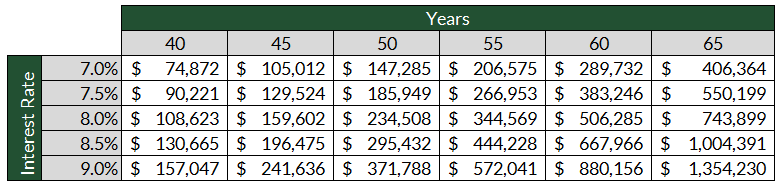

You’ve likely seen these charts before. But just for effect, here is a chart showing long term growth of $5,000 at a couple different average rates of return. This resembles what a 25 year old who’s just starting to invest might expect if they’re able to cobble together a few thousand dollars for long term growth:

I’ve looked at charts like this at least 1,000 times. But they still astound me. If you can scratch together $5,000 in your early 20s, you have a reasonable shot at growing it to over $1 million by investing it prudently into your 80s. That’s not annual contributions of $5,000, mind you. That’s one contribution of $5,000 at the age of 25.

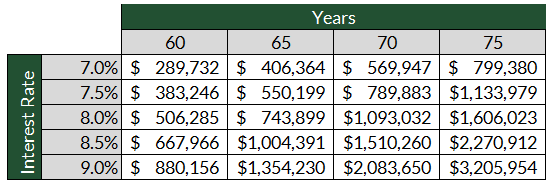

The math only gets better the longer your savings have to compound. Here’s what happens when we stretch the time horizon out another 10 years:

Now, most of us won’t live long enough to enjoy the fruits of 75 years of compounding. Not if we start funding the accounts at age 25 at least, as it means we’d need to live beyond age 100. But what if we had a 10 year head start, and began funding the account at age 15 instead? A 15 year old has a solid shot at giving their retirement savings 65 years to compound. They only need to live to 80.

Tax Benefits of Roth IRAs for Kids

As far as parking a few bucks in an account for our kids’ benefit, you can really use any type of investment account to take advantage of the long term compounding described above. But by using an ordinary brokerage account you (or your kid) will owe taxes on any gains & distributions on a year to year basis. And if that “unearned” income exceeds a certain threshold ($1,100 in 2020), your kid will owe tax based on your marginal bracket.

This is where the Roth IRA comes into play. As I’ve written about quite a bit on the site, the Roth IRA is my favorite retirement savings vehicle. Even though you don’t get an immediate tax deduction on your contributions, funds you put in are never taxed again. Plus, since you’ve already paid the IRS Roth IRAs aren’t subject to mandatory distributions once you’re in your 70s.

Putting all this together, if a 15 year old is able to contribute $5,000 to a Roth IRA, it can reasonably grow to over $1,000,000 of tax free money by the time they’re 80. Not bad. But here’s the icing on the cake: if your kid makes less than the standard deduction, their contribution won’t be taxed either.

The standard deduction for single filers in 2020 is $12,400, and will go up to $12,550 in 2021. If you make less than this amount you won’t owe any federal income tax, and in many cases don’t even need to file a return.

In other words, by timing this right you can help your kid turn $5,000 into $1,000,000 of retirement savings and NEVER pay tax on it.

Funding the Account: Earned Income Is the Key

Before I overstate the opportunity here, there is a pretty large caveat. As great as retirement accounts are (Roth IRAs included), not quite everyone is eligible to use them. While there are no age restrictions on Roth IRAs, you do need to have earned income. If you don’t, you can’t make any contributions for that year. Which means that you can’t fund a Roth IRA for your two year old. Unless they have legitimate earned income, perhaps through modeling or something.

The good news is that earned income can come from anywhere to make you eligible. Including self-employment. This is pretty easy to track if your kid has a part time job scooping ice cream or working at Old Navy. Those jobs will produce w-2 or 1099 income that’s reported to the IRS. Babysitting and lawn mowing jobs also work, but are considered self-employment. This means you’ll want to hang on to receipts and other records since there won’t be much of a paper trail to follow. Best practice here is to include a log of the type of work done, time it took, amount paid, and who the work was done for. Allowances don’t count, I’m afraid.

Once your kid has bona fide earned income, they’re free to open an account and make contributions at any brokerage firm. Even better, they don’t even need to make the contributions directly. You can fund the account for them, which helps if you’re trying to teach them the value of holding a job. Telling a 15 year old that they need to contribute their hard earned life guarding money to a retirement account is a tough sell. If you’re trying to give them a leg up, let them keep the money they made, but make a contribution to a Roth IRA in their name on their behalf.

Regardless of who contributes to the account, the annual limit is the lesser of $6,000 (for 2020-2021) or 100% of their earned income for the year. If your daughter pulls in $1,000 babysitting, that’s all you can put into a Roth IRA for her.

Custodial Roth IRAs

State and federal laws require the use of “custodial” Roth IRAs before children reach the age of majority. This differs by state, and ranges from 18 to 21. Custodial simply means that you’ll be the one directing the funds in the account for your kid until they’re old enough do so themselves. Once they reach the age of majority they’re free to take complete control.

That doesn’t mean that you can’t share the experience with them though. You’ll probably want contributions to the account 100% in equities, given the long time horizon of your kid. And if the intention is be collaborative, you may want to pick one or two stocks or stock funds together. Watching the positions grow over time could be a valuable exercise.

Other Benefits of Roth IRAs for Kids

Roth IRAs have other direct and indirect benefits for kids, aside from the power of long term tax exempt compounding. First, Roth IRAs have flexible options for taking withdrawals. Principal can often be withdrawn penalty free, as can distributions for the purchase of a house or higher education.

Plus, what a great way to teach your kids about the power of tax advantaged compounding! Having the funds in an account that they can track is a wonderful lesson in financial literacy. But even if they don’t pay much attention, getting them started early will be very helpful to them long term. If you can find a way to open a Roth IRA as soon as they have earned income, it will go a long way toward their financial independence.