If you’re a parent or a grandparent, chances are that at some point you’ve woken up in a cold sweat thinking about college tuition costs. College tuition is rising 6-7% every single year, and given the astronomical amount of student debt that current grads are facing, it’s enough to make you shiver.

As you may know, my wife and I now have a beautiful baby boy at home. As I write this he’s about six months old. And given that I’m a total financial nerd, I’ve been spending some time recently thinking about how best to save for his college tuition costs. Popular opinion will tell you that 529 plans are by default the best choice for this purpose. But since to date all my posts on college costs have to do with student loans, I figured it was high time to cover the “other” end of the equation: saving for college before incurring any debt.

So today we’ll review the most common types of college savings accounts, and try to determine whether 529 plans are really your best choice. As you compare and contrast college savings vehicles on your own, be sure to incorporate how financial aid plays into the equation. Financial aid is awarded based on both you and your kids’ income and assets. Savings in some types of the accounts we’ll cover are included on the FAFSA (Free Application for Federal Student Aid) form, while others are excluded.

Students that have more assets to their own name won’t end up receiving as much financial aid as those who don’t. Every school operates a little differently, but if they think your kid is independently wealthy rest assured they won’t receive any financial aid. Your income and assets count as well, just to a far lesser degree.

Here’s the rundown.

529 Plans

529 accounts have been around for quite a while, but became really popular after the Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA). The EGTRRA of 2001 expanded the tax benefits from the account, by exempting qualified distributions from income tax.

For tax purposes the accounts operate much like a Roth IRA. Your contributions to the account are made on an after tax basis, but any earnings or qualified withdrawals are tax free.

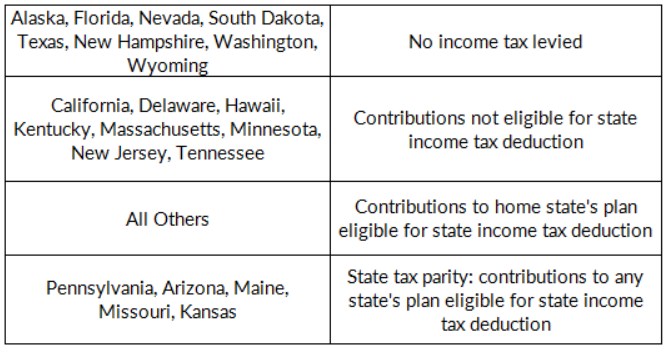

529 plans are operated by the individual states. This means that each state’s 529 plan will have its own custodian, its own investment menu, and its own fee schedule. While you can utilize the 529 plan of any state, some will offer state income tax deductions to its own residents:

Investment Options

Most 529 plans will offer a decent menu of investments to choose from, including a mix of stock and bond funds, composite funds with varying degrees of risk, and target date funds. Target date funds are tremendously popular in retirement plans, and are starting to gain traction in 529 plans too. Whereas composite funds typically use a consistent asset allocation over time, target date funds will reduce risk as the fund approaches its intended target date.

For example, new parents who wish to get an early start might choose a fund targeting a date 18 years in the future. Today that fund would likely by heavily invested in stocks. Over time, as their aspiring student approaches their first tuition payment, the fund would reduce its stock allocation in favor of bonds given the decreasing time horizon. This is a pretty convenient tool for parents who want to “set it and forget it” and not worry about rebalancing their accounts. Target date funds automatically decrease their risk profiles, aligning the fund’s risk with the student’s upcoming enrollment.

Contributions

Contributions to 529 plans are considered gifts according to the federal gift tax regulations. As such, any contributions over $14,000 per year ($28,000 for joint filers) counts against your lifetime gift exclusion. However – you can “front-load” your contribution if you wish, and deposit up to $70,000 (again, $140,000 for joint filers) into a 529 plan all at once. This would count as 5 years worth of contributions, meaning any additional contributions over the next 5 years would work against your lifetime exclusion. Additionally most states also have aggregate limits for how much can accrue in an account. They’re very high and rarely a problem though (over $300,000 in many states).

Beyond the contribution limits, 529 plans can be helpful for estate planning purposes too. Any amount contributed to a 529 plan isn’t included in the donor’s estate for estate tax purposes.

Qualified Education Expenses

Anything you take out of a 529 account is withdrawn tax-free as long as it’s considered a qualified withdrawal. Withdrawals are considered qualified if they’re used to pay for any of the following at an accredited school:

- Tuition

- Books

- Fees

- Supplies

- Required equipment

- Room & board, as long as the student is enrolled at least half-time

Additionally, beneficiaries can withdraw funds penalty-free if they receive:

- A scholarship

- Veterans’ educational assistance

- Employer-provided educational assistance

- Other non-taxable payments received for education expenses

Transferability

Any amount in a 529 plan that goes unused by one beneficiary can be transferred to other members of the family without penalty. This is considered a rollover for tax purposes. Members must be qualified though, and include:

- Spouse

- Son, daughter, stepchild, etc.

- Sibling or step-sibling

- Parent or step-parent

- Niece or nephew

- Aunt or uncle

- In-law

- Cousin

- The spouse of anyone listed above

Disadvantages

529 plans are not free from disadvantages. While they’re great for paying for qualified educational expenses, if you need to take funds our for any other reason, your withdrawals will be subject to income tax and a 10% penalty.

The fees in some state’s 529 plans are also pretty high. Whereas in an IRA you can invest your contributions in anything you wish, a 529 plan is more like a 401(k). Each state offers only a limited menu of investment options. If the fees are high or the options are poor, you have limited options. Plus, the IRS only allows you to change the investments in your account twice each year.

Prepaid Tuition Plans

Come to find out, there are actually two types of 529 plans. And while contributing & investing in a traditional 529 plan can work just fine, you’re still subject to what’s going on in the capital markets. If the markets tank or the cost of tuition & fees rises faster than expected, your out of pocket cost may be far higher than you expect.

An alternative here is a prepaid tuition plan. Rather than making contributions now and buying tuition credits in the future, you can purchase tuition credits with your contributions in a prepaid tuition plan now. This lets you lock in tuition at current rates, rather than risking a 6-7% increase every year between now and when your child enrolls.

Right now prepaid tuition plans are operated by state governments, and tuition rates are based on a weighted-average of the public colleges in your state. If your child decides to attend an in-state school, bingo! Some or all of their tuition is paid for. In instead they decide to attend a private or out-of-state school, most plans will pay the average of in-state public tuition on behalf of the student. The family is then responsible for anything in excess of this amount.

Some colleges and universities (and groups of them) offer their own prepaid tuition plans as well. Privatecollege529.com is a good example.

Obviously the ability to purchase tuition credits at today’s prices is a pretty nifty feature since they’re increasing at about 7% every single year. Prepaid tuition plans can be a nice hedge to your aggregate portfolio too, though. State governments tend to reduce support for higher education when the economy tanks. That means that the cost of education to you and your family usually goes up during the same periods the your investment accounts go down. Prepaid tuition programs can be a nice hedge against this risk.

Coverdell Education Savings Accounts (ESAs)

Just like in a 529 plan, a Coverdell ESA allows any funds you contribute to grow tax deferred. Then, as long as they’re used for qualified educational expenses, you can withdraw them tax free later on.

However, with Coverdell ESAs qualified educational expenses includes both primary and secondary education. This is very appealing for anyone considering private elementary, middle, or high school. 529 plans only count expenses from secondary education as qualified.

Also, while 529 plans allow you choose from a set menu of investments offered by the state, you can put pretty much anything into a Coverdell ESA. Coverdell ESAs can be opened at nearly any brokerage firm, just like you would a traditional or Roth IRA.

Low contribution limits are the main disadvantage of Coverdell ESAs, as you’re limited to $2,000 of contributions per year. Your modified adjusted gross income (MAGI) must also be below $110,000 in order to contribute (or $220,000 for joint filers). That said, anyone can contribute to a Coverdell ESA – including corporations and trusts. The only limitations are that contributions must:

- Be in cash

- Not be made after the beneficiary turns 18, unless they have special needs

- Be made by the due date of the contributor’s tax return (like an IRA)

Just like 529 plans, when a student is the beneficiary of an account, the assets are not considered theirs for financial aid purposes. If you decide to contribute to one, just keep in mind that any funds in the account must be distributed by the time the beneficiary turns 30. You can always change beneficiaries penalty-free to comply with this rule.

UGMA & UTMA Accounts

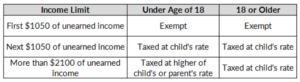

The Uniform Gifts to Minors Act (UGMA) & Uniform Transfer to Minors Act (UTMA) have been passed in most states, allowing parents, family members, or friends to irrevocably transfer assets to kids and take advantage of their lower tax rate. While they used to be convenient for tax purposes, tax law changes in 1986, 2006, and 2007 (which incorporated the kiddie tax) have substantially reduced their appeal.

While not specifically designed for educational expenses, many people use the accounts for college savings since it helps parents avoid the cost involved in drafting & maintaining a trust. Parents can then control the funds on behalf of their children until they reach the age of majority (18-21 depending on the state).

In some regards this is a nice feature, since the funds can be used for anything if the child decides not to go to college or gets a scholarship. But, since the child gains total control of the funds at the age of majority, there’s no legal way to prevent them from using the money to buy a house or backpack through Europe.

UGMA & UTMA accounts are often lumped together, but there are some subtle differences. UTMA accounts allow virtually any type of asset to be transferred – including real estate. UGMA accounts are limited to bank deposits, securities, or insurance policies.

Finally, funds in UGMA & UTMA accounts are technically included in the child’s assets, which will reduce eligibility for financial aid. Typically aid is reduced by 20-25% of a child’s UGMA/UTMA balance.

Roth IRA

You might already know that the Roth IRA is an awesome tool to save for your own retirement (and that I’m a huge fan of it). But on top of being a great vehicle for retirement savings, it can also be used for education savings.

Typically you can’t take the earnings out of a Roth IRA (free of penalty at least) before you turn 59 1/2. There is an exception though, that allows early withdrawals for hardships like disability, purchasing a first home, or for qualified education expenses.

Here’s what the IRS considers a qualified education expense:

- Tuition

- Fees

- Books

- Supplies

- Equipment

- Room and board (if the student is enrolled at least half time in a degree program)

Any time your child has earned income, they can technically contribute to a Roth IRA. And before they reach 18, you can control the account for them. That means that if your kid earns $1,000 one summer working as a lifeguard, you could match their earnings with a $1,000 contribute to a Roth IRA in their name. If you were feeling generous.

You can also pull from your own Roth or traditional IRA to help pay for your kids’ education expenses. Technically, the expenses must be for you, your spouse, your kids, or your grandkids. Common sense tells us that this should be a very last resort, since we never want to sacrifice our own retirement to pay for our kids’ college costs. But it remains an option.

If you do decide take withdrawals from your own Roth IRAs, try limit your withdrawals to only the amount you contributed to the account. That way you’ll avoid any income tax on the distribution. Also, keep in mind that this type of withdrawal is considered “untaxed income” on the FAFSA form, and will reduce your kids’ eligibility for need-based aid.

Even though a Roth IRA is an option, it’s usually better to leave your retirement accounts for your own retirement.

Summary

For most people a traditional, low cost 529 plan will usually be the best choice. But it’s important to weigh your options. Purchasing tuition credits at today’s rates sounds mighty attractive, and a Coverdell ESA would be a good fit if you’re considering private primary school. Any way you cut it, college costs and student debt are on the rise. The earlier you start putting money away for tuition the better off your kids will be.