I’m a believer that the biggest factor contributing to the returns in your portfolio is asset allocation. The amount of your portfolio you choose to invest in stocks, bonds, real estate, or anything else will ultimately have the biggest effect on how your portfolio does over the long run.

In other words, the decision of whether to buy Lowe’s or Home Depot isn’t nearly as important than the decision to be in large cap stocks or international bonds.

If you’re being strategic about your saving, you’ll probably try to utilize tax advantaged accounts like IRAs, Roth IRAs, and 401(k)s as much as you can. If you’re using them (like most people), after a while your total portfolio will probably be spread across several different types of these accounts.

Today’s post covers asset location. Rather than replicate the exact same asset allocation in each of your individual accounts, placing your investments across them strategically can work to reduce your tax bill and enhance your after tax returns.

Since some asset classes are more likely to distribute taxable income & capital gains, parking them in the accounts you don’t pay tax on (like a Roth IRA), only seems logical. When done thoughtfully, asset location can as much as 0.25%-0.75% per year to your portfolio’s returns.

Read on to learn how it works.

What Is Strategic Asset Location?

At a high level, some asset classes are more likely to distribute taxable capital gains to investors than other. For example, growth stocks like Amazon and Netflix tend to reinvest their earnings, rather than distribute them back to shareholders. On the other hand, value stocks like Coca-Cola and GE tend to give back a steady portion of their earnings through dividends.

These dividends are taxable to investors. Capital gains (if the price of Amazon or Netflix rises) are only taxable once you sell your investment. Asset location is the concept of placing the asset classes in your portfolio strategically, based on the tax treatment of the accounts you’re using.

Asset Location Theory

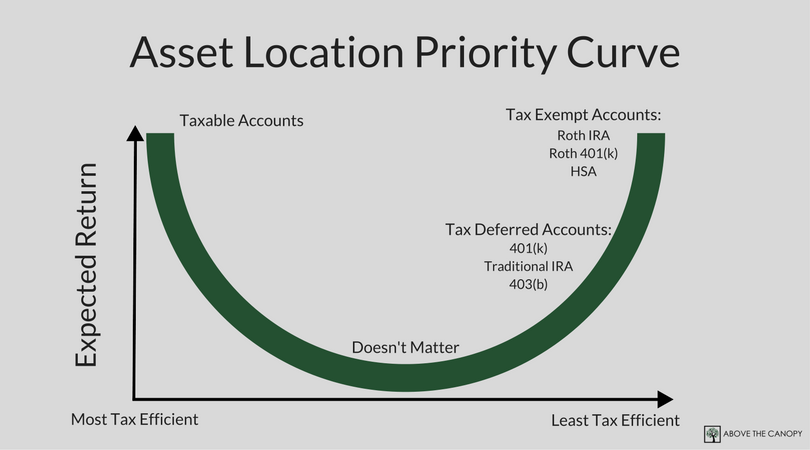

To use asset location effectively, you need to consider two different factors: tax efficiency and return.

Logically, the asset classes that are less tax efficient should sit in the accounts you pay less tax on. Tax deferred accounts like a traditional IRA or 401(k) work well, since you won’t pay taxes until you withdraw from the accounts in the future. Tax exempt accounts, like Roth IRAs and health savings accounts are even better since you’ll never pay taxes on the accounts again.

So what is tax efficiency? Different asset classes have different propensities to distribute taxable gains and income to their investors. For example, value stocks tend to distribute dividends to investors that qualify for favorable tax treatment. Commodities, on the other hand, are more likely to distribute capital gains that are taxable at higher rates.

The second factor is return. Very simply, the higher your income or gain from an investment, the more you’ll pay in taxes. The more taxes you’re subjected to, the more important it is to place it strategically in the right account. Asset classes with lower returns (think cash or U.S. government bonds) simply won’t matter as much since they don’t produce returns as high.

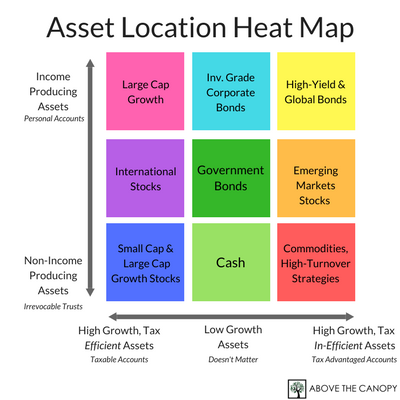

If you’re a visual person, here’s a graph to help explain things. You’ll notice that at the two ends of the spectrum we have taxable accounts, and tax deferred & exempt accounts. Asset classes with higher returns should be placed accordingly:

Lower return asset classes could go in either type of account. Lower returns means less tax impact, and strategic placement doesn’t matter as much.

That means that if you’re going to use strategic asset location, the first thing you should do is prioritize each asset class in your portfolio. Start with high return asset classes first, and rate their tax efficiency. High return asset classes that will cause a big tax bill should go in your tax advantaged accounts. High return asset classes with lower tax impact should go in your taxable accounts. Everything left over (lower return asset classes, i.e. bonds) can be used to “fill out” your unused account balances.

Example: Traditional IRA

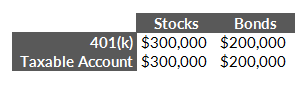

Let’s run through a simple example to help explain the concept. Let’s say that you’ve amassed $1,000,000 over the years, thanks to diligent saving in your company’s retirement plan and a taxable investment account. Your company offers a tax deferred 401(k) plan, which holds half of your $1,000,000 portfolio. The other $500,000 sits in a brokerage account that a professional manages for you.

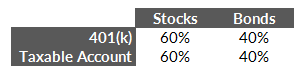

To keep things simple, let’s say that your portfolio consists of 60% stocks and 40% bonds. You use an S&P 500 index mutual fund for your stock allocation, and 10-year U.S. Government bonds for your bond allocation.

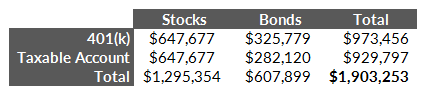

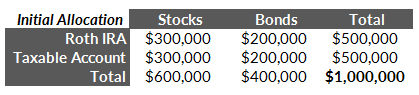

If you used the same asset allocation in both your accounts, you’d have $300,000 in stocks & $200,000 in bonds in each:

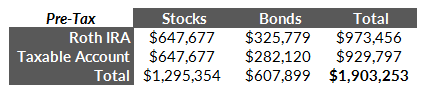

Let’s also assume that your stock allocation returns 8% per year on average, your bond allocation 5%, and you’re in the 30% tax bracket. These figures are pretty close to the long term averages for both the S&P 500 and 10-year U.S. Government Bonds. After ten years of growth, your account would be worth $1,903,253:

Notice that the bond allocation in your 401(k) is quite a bit higher than it is in your taxable account. That’s because you’re paying taxes on interest income in your taxable account each year. (We’re assuming here that you don’t receive taxable distributions on stocks, and 100% of your bond returns come from coupon payments).

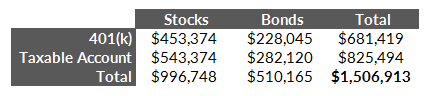

Your 401(k) plan won’t be taxed until you withdraw from it, though. If we viewed this account on an after-tax basis, your portfolio’s value would be $1,506,913. This takes into account the capital gains you’d pay after selling stocks in your taxable account, and taking withdrawals from your 401(k):

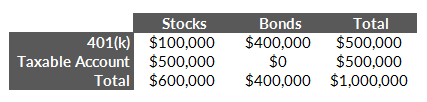

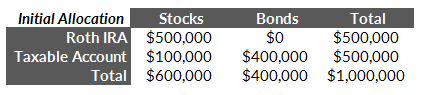

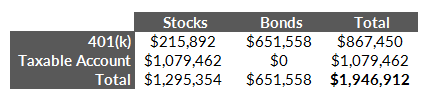

But what if we were more strategic with your asset placement? Let’s say you place 100% of your stocks in your taxable account, since they’re more tax efficient (that is, you don’t pay tax on the gains until you sell the investment). You’d end up with $500,000 in stocks in your taxable account, and $400,000 in bonds and $100,000 in stocks in your 401(k):

After 10 years, the pre-tax value of your portfolio would be $1,946,912:

Since you’re not paying tax on interest income each year (since the bonds are sitting in your 401(k)), the returns accumulate and compound faster.

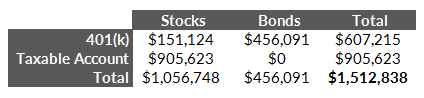

And it’s after-tax value would be $1,512,838:

That’s a difference of $5,925. This isn’t really that much over a ten year period, but remember this is a pretty simple example. What if you had $500,000 in a tax exempt Roth IRA instead of a tax deferred 401(k)? You could park your high growth asset class (stocks) in the Roth IRA that you’ll never pay tax on again.

Example: Roth IRA

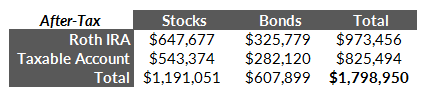

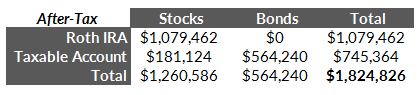

Instead of using the tax deferred 401(k) or traditional IRA from our previous example, let’s say half your portfolio is held in a Roth IRA. Here’s what your portfolio would look like after ten years of growth (8% for stocks and 5% for bonds) without locating your investments strategically:

By using strategic asset allocation, you could boost the after tax value of your portfolio over $25,000. The placement strategy is slightly different though, since you’ll never pay tax in a Roth IRA. Rather than using your taxable account solely for stocks, you’ll want to use your Roth IRA solely for stocks. Since you’re expecting to have more taxable gains in your stock allocation, it makes more sense to put them in the account you’ll never owe taxes on again:

By being thoughtful about how and where you place investments across your accounts, you could add $25,877 to a $1,000,000 over a ten year period. This works out to about 0.25% in extra returns every single year.

How to Use Strategic Asset Location

Asset location strategy will vary quite a bit, based on the types of investments you own and the types of accounts they’re sitting in. As we covered above, the first step is to rank each asset class in your portfolio from highest to lowest expected returns. Emerging markets & small cap stocks should be at the top, with bonds at the bottom.

The next step is to rate each in terms of tax efficiency. The least tax efficient asset classes should sit in your tax deferred & tax exempt accounts. The most tax efficient should sit in your taxable accounts. The lower return asset classes don’t matter as much, and can be used as “filler” to round out your portfolio. And, of course, the aggregate asset allocation across all your accounts should match your portfolio objective.

The Best Situations to Employ Strategic Asset Location

Just like strategy, the benefits of strategic asset location will vary, depending on the types of accounts you own and asset classes you’re invested in. In general, the more of your wealth that sits in tax deferred & exempt accounts, the greater the opportunity. If 90% of your assets live in a taxable investment account you could still benefit from asset location, but you wouldn’t have as much room to “play with.” The more you can stash in tax advantaged accounts, the more you can reduce your long term tax burden.

Where Strategic Asset Location Gets Complicated

Often times, the greater the opportunity, the more complicated the strategy becomes. Having both tax deferred and tax exempt accounts does give you more opportunity to boost returns, but figuring out how will probably take some work. And when it comes to time to rebalance your accounts down the road, things can get downright hairy.

If that wasn’t bad enough, the picture gets exponentially more complicated when there are irrevocable trusts in the picture. Revocable trusts flow right back to your personal tax return. But irrevocable trusts are considered a distinct, separate entity for tax purposes. While they’re subject to the same tax rates, their marginal brackets are very compressed. For example, married couples won’t be subject to the top tax rate of 39.6% until they reach $470,701 of annual income. Trusts reach this bracket after producing only $12,500.

That means that for asset location purposes, not only must you divvy up your portfolio based on each asset class’s growth rates & tax efficiency, but income vs. non-income producing asset classes come into play as well.

For that reason, if you’re both the trustee and beneficiary of an irrevocable trust, income producing assets should be placed in accounts titled to you as an individual. The trust should hold non-income producing assets, like growth stocks. This way your income producing assets will be taxed under your personal income brackets – and not subject to the top tax rate unless you make over $470,701 per year. (Or $418,401 if you’re single).

When You Shouldn’t Use Strategic Asset Location

If you’re saving for a shorter term goal in a separate account, it’s probably best to omit that account from your asset location strategy. 529 college savings accounts are a good example here.

If you’re saving for your kids’ first year of college tuition, a 529 account would offer tax free growth. But that doesn’t mean you should invest the entire account in small growth stocks for asset location reasons. You’d be taking too much risk in an account you’re preparing to withdraw from in a few years. Yes, you might be diversified in terms of your total wealth. But if the market crashed, you’d need to withdraw tuition money from another (less tax friendly) account.

This concept really applies to anything you have earmarked for specific short term goals. Rather than using strategic asset location within these accounts, you should use a diversified portfolio with a risk profile commensurate with your time horizon.

How Much Can You Actually Save Using Strategic Asset Location?

This is a subject of some debate. Again, your personal results from thoughtful asset location will depend on the types of accounts you own, and what you’re investing in. Michael Kitces is a financial researcher I think highly of, and thinks that 0.25% per year is a reasonable average figure, which could range all the way up to 0.75% per year.

0.25% per year might seem small, but it can really add up over time. If you have a $1,000,000 portfolio, that’s $2,500 just in year 1. If you have an account of $1,000,000 that grows at 8% per year after taxes, you’d have $4,315,701 after 20 years. But if you employed strategic asset location to boost your return to 8.25%, you’d end up with $4,509,519 after 20 years. That’s an extra $193,817 – earned just by being thoughtful about placing your investments in the right accounts.

What do you think about strategic asset location?

Is this something you think about with your own portfolio?