One of the murkier areas of student loans is the various ways you can get rid of them without actually paying them back. As you might know, there are pretty helpful forgiveness options in the federal student loan system. But what about getting your loans discharged in other extenuating circumstances? Can you shed your loans by declaring bankruptcy? What if you become disabled?

This post will cover the lesser known “out-clauses” (also known as dischargeability) for both federal and private student loans.

Federal Student Loans

You may have heard before that the federal student loan system is actually quite accommodative to borrowers. This is true. The federal student loan system has several different repayment options to make life easier on borrowers, like extended repayment periods and income driven repayment schemes. But on top of the various repayment options, the federal system gives borrowers a good number of “outs” where your debts will be erased under certain conditions. This includes both forgiveness, like PSLF, and dischargeability, if you were to become disabled or die.

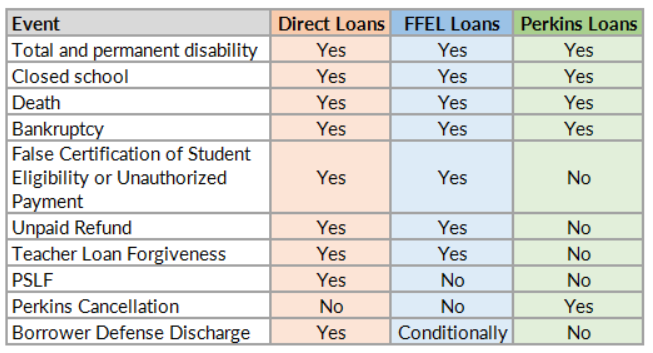

Here’s the breakdown:

Total and Permanent Disability

If become totally and permanently disabled, you may be able to have your federal student loans forgiven. You’ll need to prove your disability in one of three ways:

- If you’re a veteran, you can submit documentation that the VA has determined you’re unemployable due to a service-connected disability.

- If you’re receiving Social Security Disability Insurance or Supplemental Security Income benefits, you can submit a notice of award. The notice must state that your next scheduled disability review will be within 5-7 years from the most recent determination.

- You can submit certification from a physician that you’re totally and permanently disabled. Your physician must claim that you’re not able to engage in any substantial activity due to a physical or mental impairment that:

- Can be expected to result in death;

- Has lasted at least 60 consecutive months, or;

- Is expected to last for at least 60 months.

If you think you qualify, you’ll need to gather the supporting documentation that proves your condition. You can gather & attach this documentation to your application if you claim either of the first two scenarios. But if you’re relying on a physician’s opinion, they’ll need to complete a portion of the application for you.

You can also have a representative fill out the application for you, after you’ve both completed and signed an Applicant Representative Designation form. Also – keep in mind that any loans that are successfully discharged are counted as taxable income.

Closed School

If your school closes while you’re enrolled, you also have an opportunity to have your loans discharged. The closure must interfere with your completion of a specific degree program though. You won’t be eligible if:

- You withdraw more than 120 days before the school closes

- You’re completing a comparable educational program at another school. This can occur:

- Through a teach-out agreement, where the closed school reaches an agreement with another school to ensure that their students are able to finish their program of study;

- By transferring academic credits or hours earned at the closed school to another school;

- Or by another, comparable means

- You’ve completed all the coursework for the program, even if you haven’t received a diploma or certificate

What you can do is transfer your existing credits to a new school, and use them toward a completely new program to maintain eligibility. Your service can provide more details if you need them.

Death

Federal student loans are discharged when you die. To process the discharge, a family member or representative will need to provide a certified copy of the death certificate to:

- Your loan servicer for Direct or FFEL loans

- Your school for Perkins loans

Additionally, Parent PLUS loans are discharged if either the parent cosigning the loan dies, or the student on whose behalf the funds were borrowed dies.

Bankruptcy

You may have heard that student loans are not discharged when you declare bankruptcy – they stick with you no matter what. That’s not exactly true. It is possible to have your student loans discharged in bankruptcy, but it’s very difficult. In fact, according to a 2011 paper by Jason Iuliano 99.9% of people declaring bankruptcy don’t even attempt to have their loans discharged. And of those who do, only 40% are successful.

Basically, if you file for Chapters 7 or 13, the bankruptcy court needs to find that repayment of your loans would impose an undue hardship on you and your dependents. The court uses a three-part test to determine hardship:

- If you’re forced to repay the loan, you wouldn’t be able to maintain a minimal standard of living

- There is evidence that this hardship will continue for a significant portion of the loan repayment period

- You made good-faith efforts to repay the loan before filing for bankruptcy. Usually this means that you’ve been in repayment for at least five years.

You’ll need to pass all three of these tests in order to have your loans discharged. Plus, this decision is made in an “adversary proceeding” in bankruptcy court, where your creditors can be present to challenge your request.

Long story short, it’s possible to have your loans discharged in bankruptcy, but very difficult.

False Certification of Student Eligibility or Unauthorized Payment

If your school declared you eligible to receive a loan based they inappropriately claimed you’d benefit from their program, you can also have your loans discharged. You have to prove that you didn’t meet the student eligibility requirements in the first place though, which can be tricky.

Beyond that, you can have your loans discharged if:

- Your school signed your name on a promissory note without your authorization, or endorsed your loan check without your knowledge

- Your loan was falsely certified because you were a victim of identity theft

- Your school certified your eligibility, but you’re disqualified from employment in the occupation the program trains you for due to physical or mental condition, age, criminal record, or any other reason

Unpaid Refund

If you withdraw from your school, your school may be obligated to refund some of your loans back to the U.S. Department of Education or your lender. This depends on the time of your withdrawal, of course. Refund policies differ from school to school as well, so you’ll want to check into yours if this is an issue.

Teacher Loan Forgiveness

There are two avenues to getting your loans discharged if you’re a teacher: the teacher forgiveness program and teacher cancellation of Perkins loans.

In the forgiveness program, you can have up to $17,500 of your Direct or Stafford loans forgiven in exchange for teaching five consecutive years (full-time) at low-income schools. A low-income school is one that:

- Qualifies for Title 1 funds;

- Has more than 30% of its enrollment made up of children who qualify for Title 1 services; and

- Is listed in the U.S. government’s annual directory of low-income schools

To receive forgiveness you’ll need to print and complete the application here. Also keep in mind that the chief administrative officer at your school will need to complete the certification section.

If you have Perkins loans, you might be eligible for cancellation if you teach full-time at a low-income school or teach certain subjects:

- Math

- Science

- Foreign Languages

- Bilingual Education

- Any other field that your state determines has a shortage of qualified teachers

You can also qualify if you’re a special education teacher, including infants, toddlers, children, or youth with disabilities.

The helpful part about the Perkins cancellation program is that some of your loans can be cancelled after teaching only one year full-time, and all Perkins loans can be cancelled after only five years. Cancellation works on a tiered schedule:

- 15% of Perkins loans are cancelled for the first and second years of service

- 20% are cancelled for the third and fourth years

- 30% is cancelled for the fifth year

To apply, contact the school that holds your loans. They make the decision over whether you qualify for cancellation, which cannot be appealed to the Dept. of Education, by the way.

Public Service Loan Forgiveness

Although there’s some risk that the current laws might change, PSLF might be the best way to extinguish your loans. I’ve written about PSLF quite a bit on the blog (here, and here) so I won’t spend time re-hashing the finer points. Basically, if you go to work for the government or a non-profit for 10 years you can get all your federal loans forgiven….tax free.

Perkins Cancellation

In addition to teaching, other work in public service is eligible for cancellation of Perkins loans too. For each year of service a certain percentage of your loans are canceled, depending on the type of service performed. The following can qualify:

- Volunteer in the Peace Corps or ACTION program (including VISTA)

- Member of the U.S armed forces serving in a hostile area

- Nurse or medical technician

- Law enforcement or corrections officer

- Head Start worker

- Child or family services worker

- Professional provider of early intervention services

Like Perkins cancellation for teachers, you’ll need to contact the school holding your loan.

Borrower Defense Discharge

Finally, you might be eligible to have your loans discharged if your school misled you or engaged in violation of certain state laws. More specifically, you have to prove that the school violated state law directly related to your federal student loans. Claims like personal injury or harassment won’t work, since they’re not directly related to your loans.

For example, if you attended any of the Corinthian for-profit schools (WyoTech, Heald, or Everest) you may have a case to make. The Department of Education found that these colleges misrepresented their placement rates between 2010 and 2014 for many of their programs. This was a violation of state law and obviously misleading, and in fact the DoE has an expedited process for ex-students of these schools to make their claims.

Private Student Loans

If you’re familiar with the student loan “landscape” at all, or if you’re read a few of the student loan posts on this blog, you’ll know that the federal system is pretty accommodative for borrowers. There are a good number of avenues for having your loans forgiven altogether, borrower friendly income driven repayment schemes, not to mention all the “out-clauses” for having your loans discharged that we discussed above.

So what’s the deal with private loans? If you refinanced with private lenders like Wells Fargo, Sofi, Earnest, or DRB, what are your options?

Basically….none. While every lender will have different terms, when you refinance privately you basically forfeit any of the options we listed above. It’s my understanding that private loans usually are discharged upon death, but disability is not. That means that your lender won’t give you and lee-way if you became disabled and couldn’t work. It also means that if you do decide to refinance privately you’ll want to make sure you understand your long term disability insurance coverage.

As for bankruptcy, the same legal framework applies to both federal and private loans. It’s not easy to have student loans discharged through bankruptcy, regardless of whether they’re federal or private.

All in all, the issues surrounding student loan dischargeability are another good reason to think twice before refinancing privately. The federal government wants to make life easier on borrowers however it can. On the other hand, private lenders are for profit businesses, and believe me – they want their money.

If you have other questions surrounding dischargeability of loans feel free to reach out to me or to your servicer!